Mining

Mining dataset 2022: Key Findings

Launched in April 2022, the Forests & Finance mining dataset reveals the financial flows of credit and investment to 23 mining companies operating in the world’s three largest tropical forest regions. Industrial mining causes many adverse social and environmental impacts globally and is a significant driver of deforestation in tropical regions. The key findings below show that banks provided $37.7 billion in credit between 2016-2021 with 43% ($16 billion) going to companies in Southeast Asia. Investors held over $61 billion in bond and shareholdings in the mining companies assessed, with 55% ($39 billion) in companies operating in Latin America.

Credit and investment by forest-risk regions.

| Forest-risk region | Credit 2016-2021 | Investment 2022 |

| Central & West Africa | $ 10.8 bln | $ 11.4 bln |

| Latin America | $ 10.8 bln | $ 33.8 bln |

| Southeast Asia | $ 16.1 bln | $ 15.9 bln |

| Total | $ 37.7 bln | $ 61.1 bln |

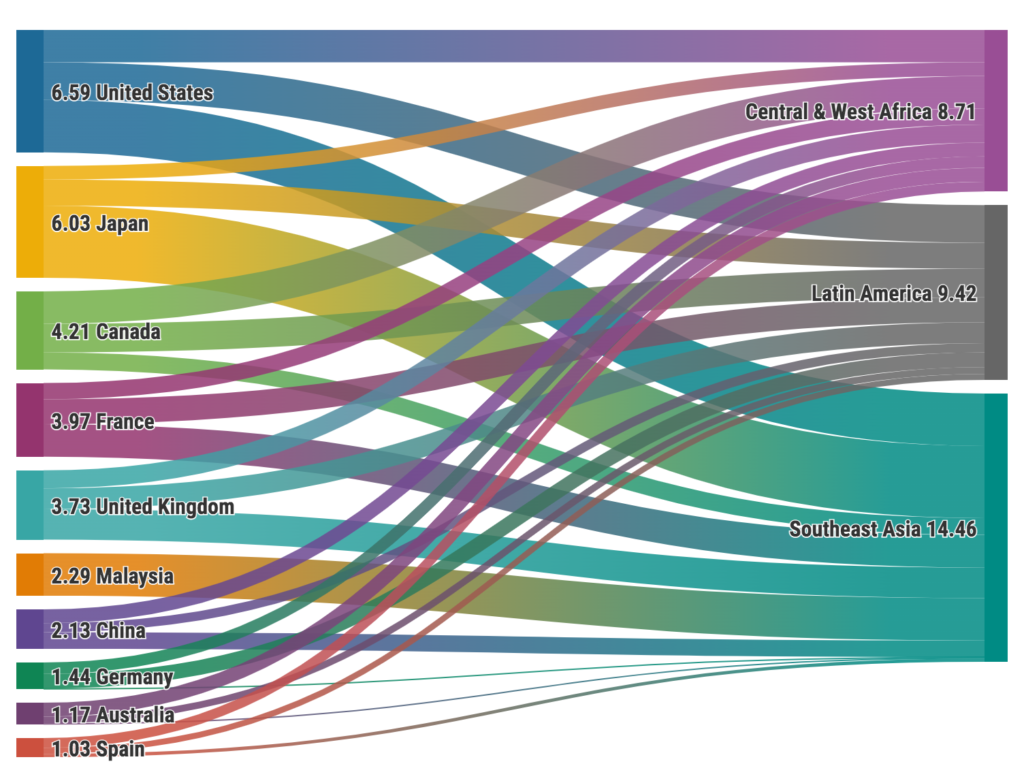

Financial institutions from the United States provided the most credit, $6.6 billion, in this period with the majority flowing to companies operating in Southeast Asia and Latin America. Followed by Japan, with $6 billion to companies in Southeast Asia, then Canada with $4 billion mainly to companies in Latin America and Central & West Africa.

Largest 10 creditor countries by forest-risk region 2016-2021 (USD billion)

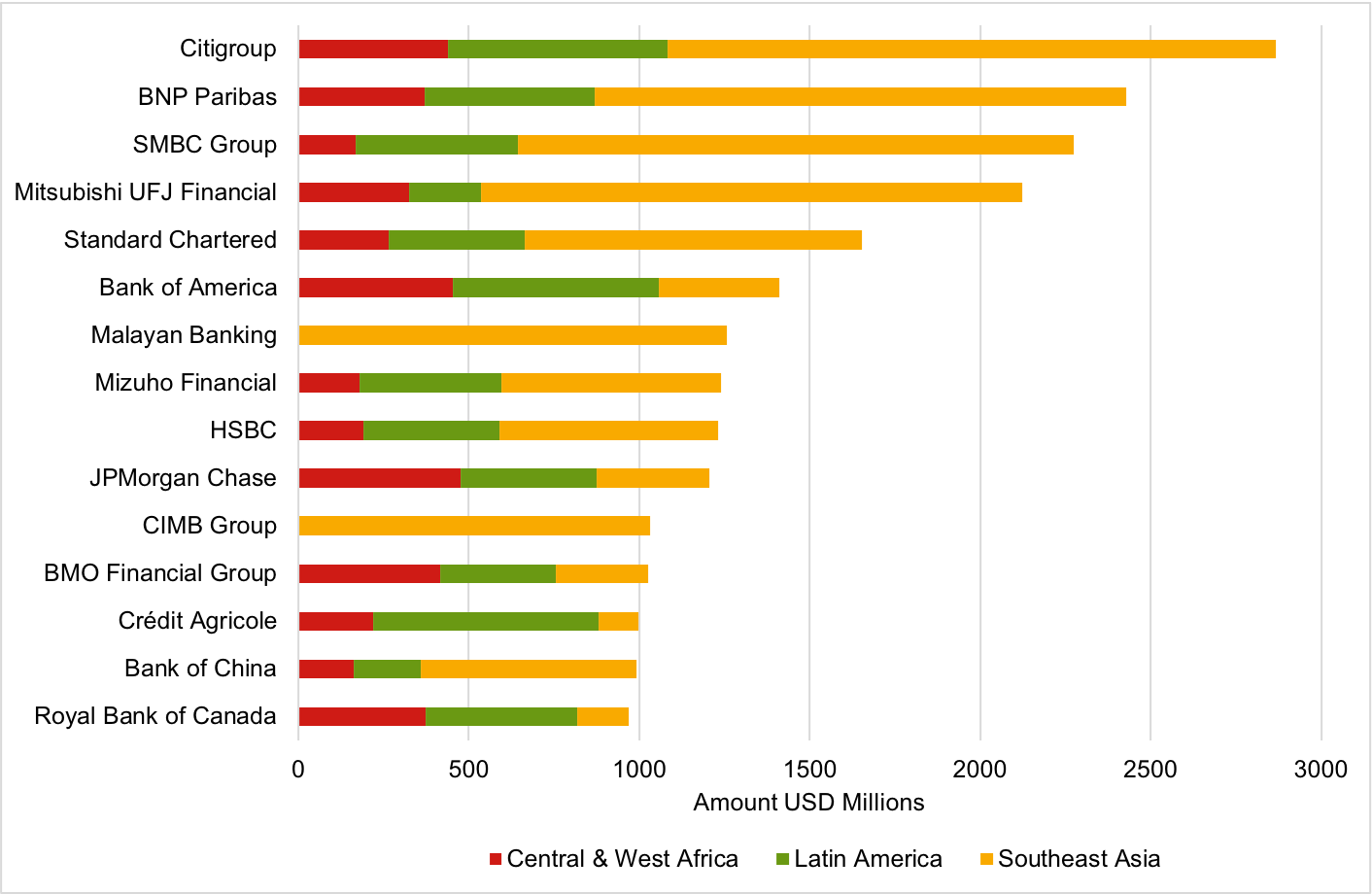

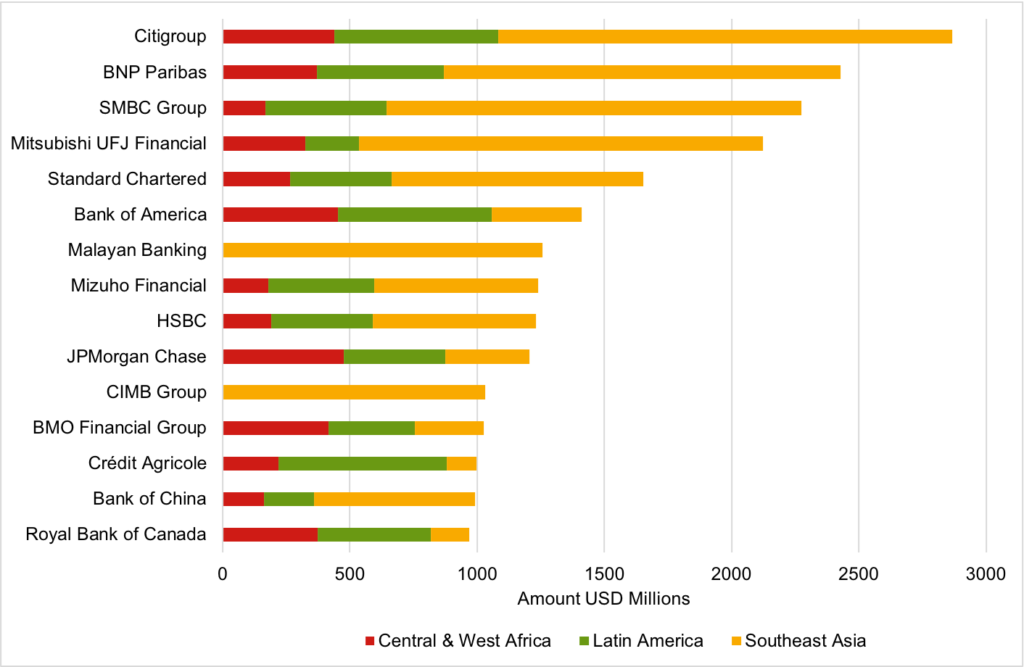

The largest 15 creditors include North American banks: Citigroup ($2.9 bln), BoA ($1.4), JPMorgan Chase ($1.2), BMO ($1), Royal Bank of Canada ($1); European banks, BNP Paribas ($2.4), Standard Chartered ($1.7), HSBC ($1.2), Crédit Agricole ($1); and East Asian banks, SMBC ($2.3), Maybank ($1.2), Mizuho ($1.2), CIMB ($1), Bank of China ($1).

Largest 15 creditors by forest-risk region 2016-2021 (USD million)

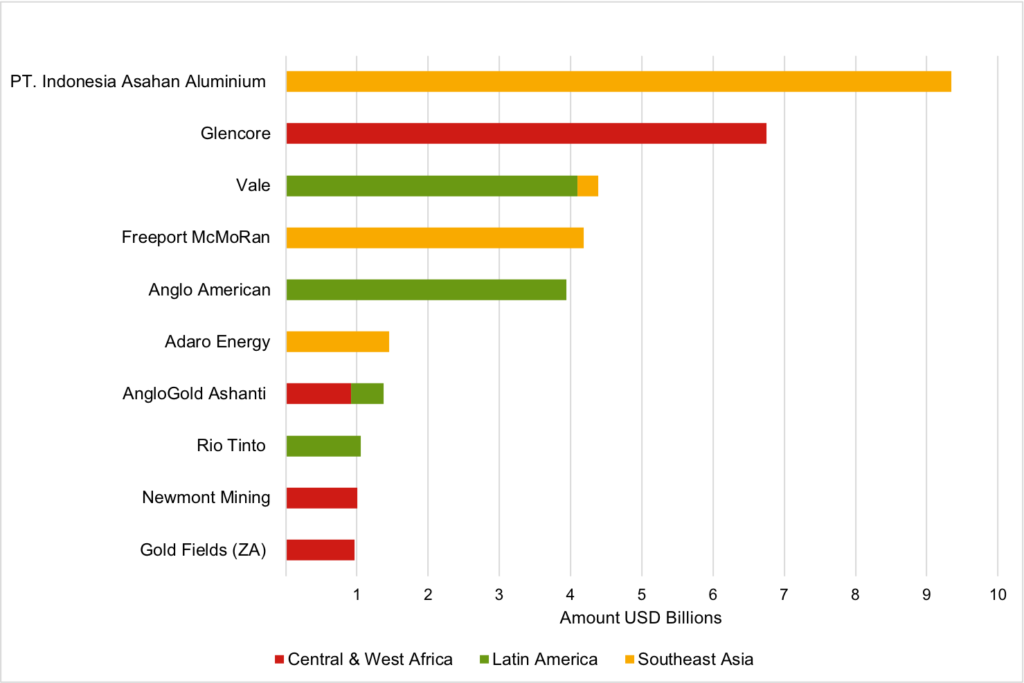

The largest 10 groups receiving credit include: Glencore, which has been linked to poor working conditions and environmental pollution in DR Congo; Vale, which is involved in conflicts with indigenous peoples and traditional communities in Brazil; and Freeport McMoRan, which has contaminated waterways and been criticized from fueling armed conflicts in Papua.

Largest 10 groups receiving credit 2016-2021

Investment

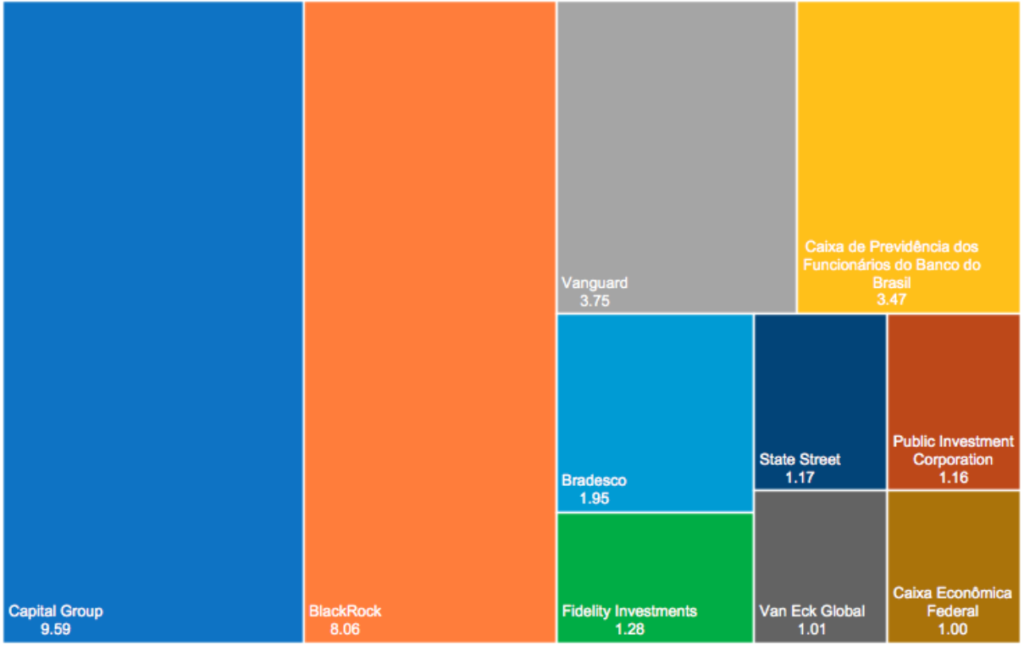

The countries with financial institutions investing the most in these mining companies were: the US ($37.8 bln); Brazil ($9.2 bln); UK ($2.4 bln); South Africa ($2.2 bln); Canada ($1.7 bln). Again, the companies receiving the lion’s share of investment were: Vale ($24.7 bln); Freeport McMoRan ($12.5); Anglo American ($5 bln); Glencore ($3.7bln); and Rio Tinto ($3.1 bln). Capital Group and Blackrock were the two largest investors by a huge margin holding $9.6 billion and $8.1 billion respectively in bonds and shares as of February 2022.

Largest 10 Investors 2022 (USD Million)

Methodology

Forests & Finance analyzed the financial flows to 24 small to large forest-risk mining companies with operations in South America, in Central and West Africa and in Southeast Asia. The credit data covers the period of 2016 to 2021 (April, July & November depending upon data availability for each company) and the investor data is per January 2022.

Financial databases Bloomberg, Refinitiv TradeFinanceAnalytics, and IJGlobal, company reports (annual, interim, quarterly) and other company publications, company register filings, as well as media and analyst reports were used to identify corporate loans and underwriting facilities provided to the selected companies.

Investments in bonds and shares of the selected companies were identified through Refinitiv, EMAXX and Bloomberg at the most recently available filing dates at the end of January 2022. Regional adjusters were applied to the data.

Companies with business activities outside of the forest-risk sector had recorded amounts reduced to more accurately present the proportion of financing that can be reasonably attributed to the forest-risk sector operations of the selected company. Further adjusters were calculated for companies operating in multiple geographies within the scope of this research.