Mining

Forests & Finance has a separate dataset which focuses solely on hard commodities (mining). This research assesses the finance received by mining companies that explore for, and extract, metals such as iron, copper and nickel, and whose operations may impact tropical forests and the communities that rely on them in Southeast Asia, Central and West Africa, and parts of South America.

Mining is a significant driver of deforestation in several regions. Analysis by the World Bank found that the five key countries with large-scale mining in forests, based on the area, economic importance and forest cover, are Brazil, the Democratic Republic of Congo (DRC), Zambia, Ghana, and Zimbabwe.

Although the impacts can vary based on the type of mine and the context for its operation, there are substantial adverse Environmental and Social impacts related to the sector. The direct impacts of mining include the impact of the pit itself, the physical and chemical waste disposal, the social displacement, and the footprint of associated infrastructure (like roads and new settlements), depending on the type and context of the mine. But mining also affects wider forest landscapes by attracting new settlements and opening up forests to agricultural and other economic activities.

Brazil received the top ranking among countries with large-scale mining in forests by the World Bank based on factors like mine count, the national density of forest mines, the relative importance of mining to the national economy, the level of forest cover, and the importance of forests in national greenhouse gas (GHG) emissions.

In the Brazilian Amazon, mining caused 1.2 million hectares (12,000 square kilometers) of Amazon deforestation between 2005 and 2015, which represented around 9% of total Amazon forest loss during that period. Mines in the Amazon are often established in previously inaccessible forests in proximity to known deforestation frontiers, causing deforestation in surrounding areas by attracting people to new economic opportunities. Projects are accompanied by the construction of access roads and port terminals. Mining operations in the Amazon have been linked to the displacement of traditional communities and detrimental social and environmental impacts.

Considering only existing mining requests overlapping with Indigenous lands in the Amazon, 17.6 million hectares (176,000 square kilometers) or 15% of total Indigenous lands in the area could be directly affected by mining. The lands of 21 isolated groups concentrate 97% of all mining requests.

DRC’s rich mineral reserves are closely linked to decades of violent conflicts, severe human and labour rights breaches, and environmental and socio-economic impacts. DRC is the country with the second highest importance of mining in forests. DRC produces around 70% of the world’s cobalt. Out of this total, 15 – 30% is produced by artisanal and small-scale mining. DRC is also Africa’s biggest copper producer and has a significant mining output of diamonds, gold, oil, tin, tantalum, tungsten, and zinc.

In Ghana, cocoa cultivation is a leading cause of deforestation, however, mining forms a significant threat. Illicit small-scale mining, known locally as ‘galamsey’, causes significant environmental damage. There are also large open pit gold mines in Ghana which are operated by international mining companies.

According to World Bank analysis, Ghana is the country with the fourth-highest importance of mining in forests. Ghana is the sixth-largest gold producer globally and the largest producer in Africa.

Indonesia is a significant miner of coal, copper, gold, tin, bauxite, and nickel. Recent research has found that direct drivers of deforestation in Indonesia are spatially and temporally dynamic. While by far not as important a deforestation driver as agribusiness, mining activities are responsible for an increasing share in deforestation in recent years. This role is linked to the direct land use of the mining activities. Indirectly, mining activities facilitate new settlements and economic activities around large and small mining sites. These deforestation impacts are limited and isolated yet regionally significant.

Mining in Indonesia is also linked to widespread contamination of natural water systems. This has, for example, been observed in rivers around the giant Grasberg mine in Papua, one of the world’s largest gold and copper mines, and in relation to the ocean tailings disposal by the Batu Hijau gold and copper mine in West Nusa Tenggara. In early 2021, the Indonesian government halted the issuance of permits for deep-sea tailings disposal for new nickel smelters. However, the alternative on-land waste management options are linked to large-scale land use and connected conflicts, forest loss and the risks from being in areas prone to be affected by earthquakes, tsunamis, landslides and floods.

Interestingly, out of the top-10 largest oil palm plantation companies in Indonesia, at least six also have substantial mining operations. Next to the government-owned PTPN these are Sinar Mas (palm oil plantations under Golden Agri-Resources), Salim Group (Indofood Agri Resources), Jardine Matheson/Astra (Astra Agro Lestari), KPN Corp (KPN Plantation), and Harita Group (Bumitama Agri).

The dataset on finance for mining companies (which produce hard commodities) was separated from the data for soft commodity companies (which include palm oil, beef, soy and pulp and paper) for methodological and context reasons. Hard commodity companies and soft commodity companies operate differently, are financed in particular ways and result in distinct social and environmental impacts. As a result, we have developed distinct methodologies and recommendations.

For example, the mining dataset does not have the same granularity, and as such one cannot search by a specific mineral. In other words, the sectoral adjusters, as used for soft commodities, are generally not applied. For more detail on methodological differences, please refer to the methodology section.

Mining

Mining

Coalização internacional o movimento popular promovem evento online que traz discussões sobre a lógica da financeirização do capital no universo da MineraçãoPara debater aspectos sobre… Read More

Mining

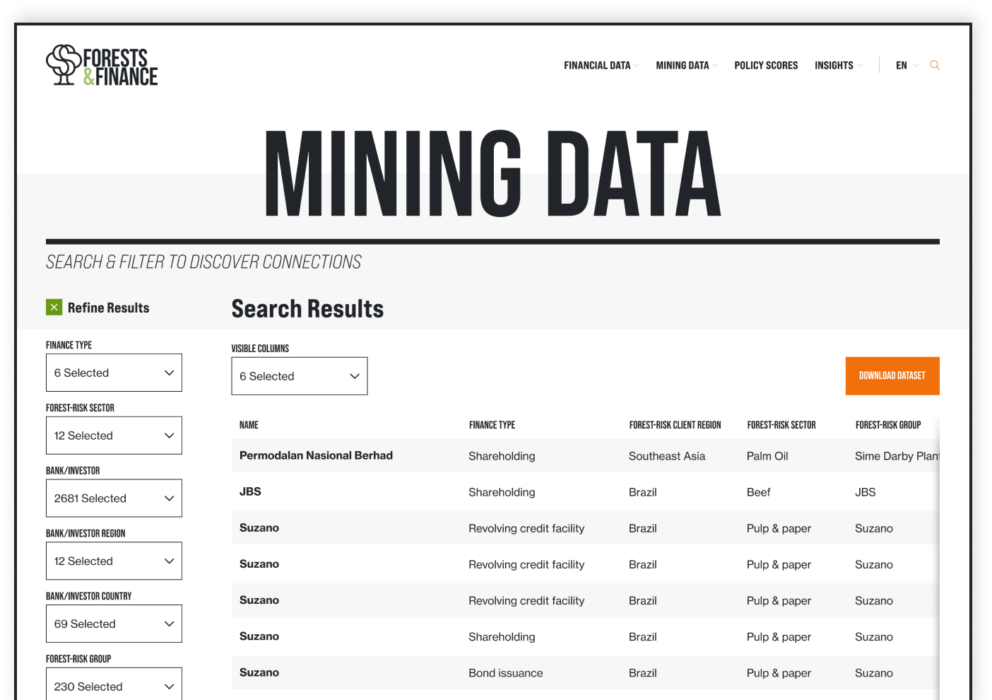

Find out who are the main financiers and investors in mining companies

Our Methodology

This project assesses the financial services received by 22 metal mining companies whose operations may impact natural tropical forests in Southeast Asia, Central and West Africa, and in parts of South America, between 2016 and 2021. It covers mining companies that explore metals, such as iron, copper and zinc. It does not cover coal.

We seek to improve financial sector transparency, policies, systems, and regulations to prevent financial institutions from facilitating systemic adverse Environmental, Social and Governance (ESG) impacts that are all too common in the operations of many forest-risk commodity sector companies.