News

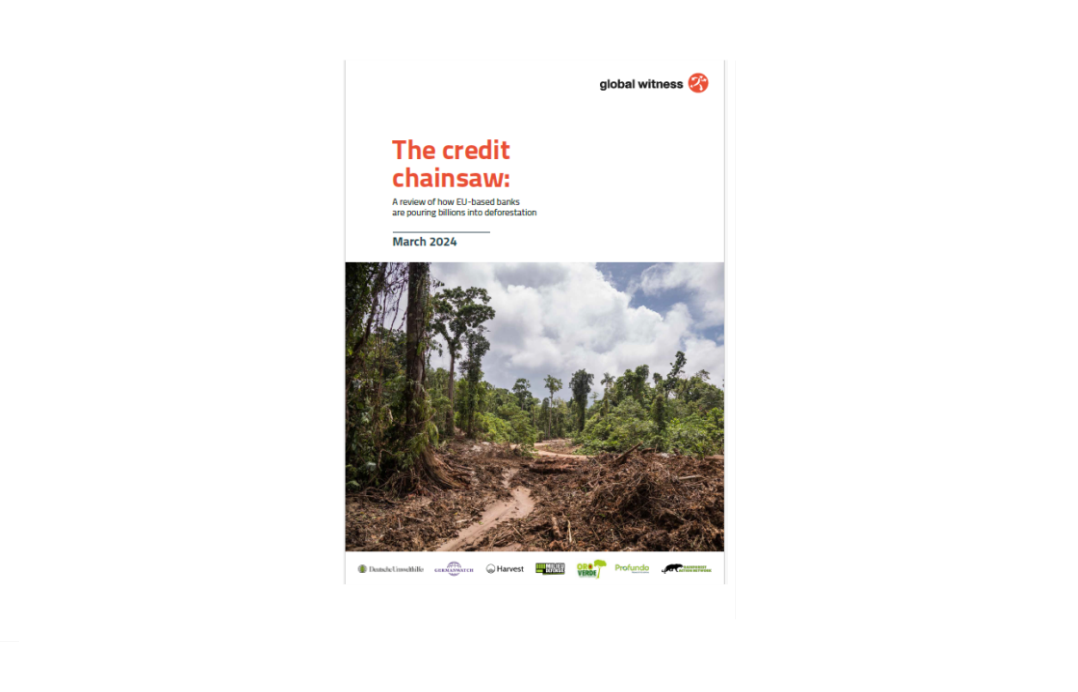

The credit chainsaw

This blog and report was originally posted by Global Witness

Last year the European Union (EU) introduced a groundbreaking anti-deforestation law (the EU deforestation-free products Regulation, EUDR), prohibiting imports of timber, beef and other products linked to deforestation.

It was a huge step forward to protect the world’s remaining forests but left one big loophole open: there’s nothing to stop banks from financing forest destruction.

And according to a new literature review we’ve published today, there is overwhelming evidence that it’s time to close this loophole: billions and billions of dollars have been channelled from the EU’s biggest banks to forest-risk companies over the last few years. Global Witness is therefore calling on the EU to introduce specific obligations for EU-based financial institutions to stop financial flows bankrolling deforestation.

Bewani SABL, West Sepik Province, PNG © Global Witness

The literature review, published by Global Witness with the support of Deutsche Umwelthilfe -Environmental Action Germany, Germanwatch, Harvest, Milieudefensie, OroVerde – Tropical Forest Foundation, Profundo and Rainforest Action Network, shows how EU-headquartered financiers have funnelled large amounts of capital into deforestation-risk companies between 2016 and September 2023. [1]

Read the full review here.

It looks at the 20 largest banks by assets in the EU and assesses them against the 2023 Forest 500 scores and 2023 Forest & Finance data. It also brings together key NGO reports that have found evidence of deforestation in climate-critical areas linked to companies’ activities, identifying the major financial actors funding them.

For example, BNP Paribas – the EU’s largest bank – alone provided over $10 billion in credit to forest risk clients between 2020-2023, including big agribusiness companies like Cargill. And it is not alone. Major banks from Spain, Germany, Italy, the Netherlands, Finland, Belgium, and Denmark continue to provide significant amounts of credit to, or hold major investments in, forest risk companies.

Forest cleared for rubber plantation, New Hanover SABL © Global Witness

And the European Commission will soon have to figure out what to do about this.

Under the terms of the EUDR, the European Commission has committed [2] to undertake an impact assessment to evaluate the role of financial institutions in preventing financial flows that contribute directly or indirectly to deforestation and forest degradation by no later than June 30th, 2025.

The EUDR obliges operators and traders putting commodities like soy, beef, palm oil, wood, cocoa, coffee, rubber, and some of their derived products, such as leather, chocolate, tyres, or furniture onto the EU market to undertake rigorous checks and be able to prove that those products do not originate from deforested land or have contributed to forest degradation after 31 December 2020. Operators and traders will also have to demonstrate that their operations are in compliance with local environmental and human rights laws. [3]

Global Witness has been at the forefront of investigating the drivers of deforestation and its impact on local communities and indigenous groups for many years. We have been exposing the role of the livestock industry in destroying swathes of the Amazon rainforest and the Grand Chaco for beef exported into the EU, China and US; how the palm oil industry originating from Papua New Guinea was involved in human rights abuses and selling to world famous brands; or how European rubber imports have driven the destruction of climate-critical forests in West and Central Africa. What is also apparent is the role of the financial sector in supporting the wider deforestation activities of these companies, many of them being EU-based iconic banks and investors.

In the run up to the adoption of the EUDR, the European Parliament, businesses, NGOs, and parts of the financial sector itself urged the European Commission and Member States to also expand obligations to banks and investors. The planned review of the financial sector’s role in deforestation is a crucial opportunity to close the loophole, and push the EU towards a financial market that stops investing in forest destruction.

The evidence is clear: voluntary guidelines and individual committments by financial institutions will not be enough to stop banks funding deforestation. It is time for the EU to put an end to this for good.

[1] In some cases, the timeframe goes back to 2013.

[2] EUDR, Chapter 8, Review – Article 34, paragraph 4.

[3] EUDR, Chapter 1, Article 3, point b. See definition of ‘relevant legislation of the country of production’ in Article 2, point 40.