News

Financial flows and policy assessments key findings

Since the Paris Agreement banks have provided USD 238 billion in credit to 186 of the largest forest-risk commodity companies in the world.

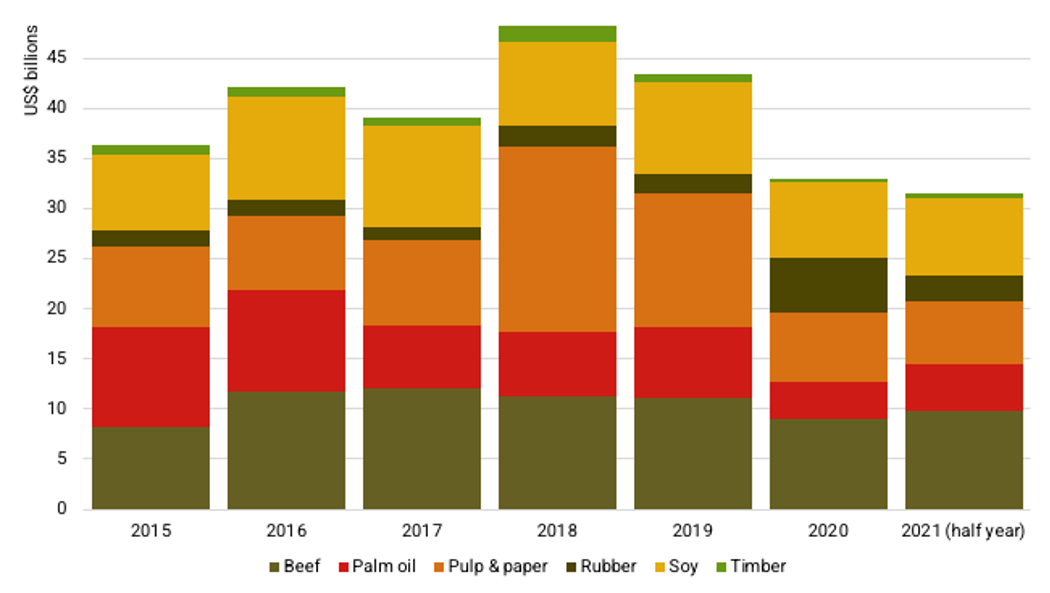

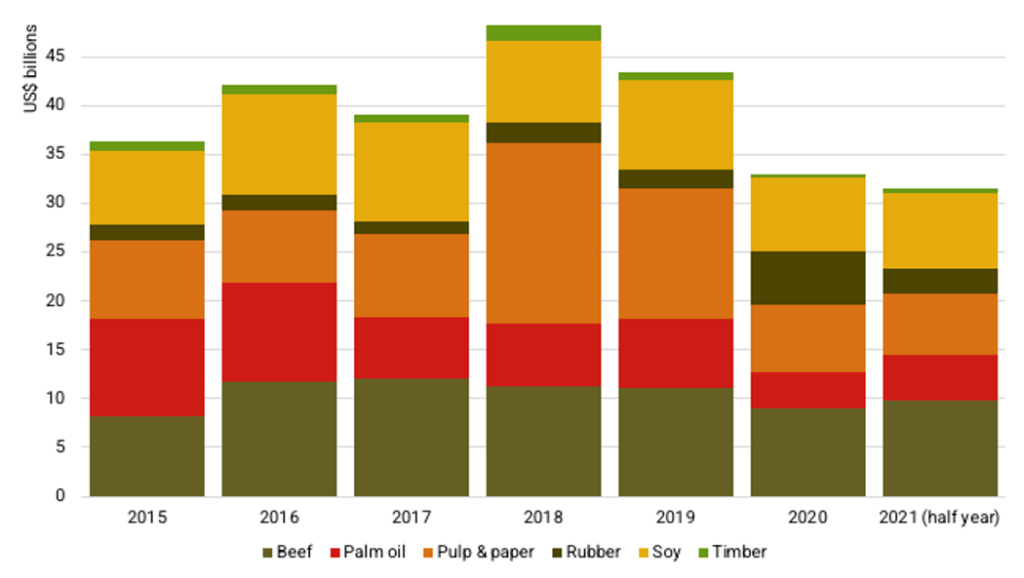

Emissions from Land Use Change and Forestry constitute around a quarter of human made Greenhouse Gas (GHG) emissisions. Commodities like palm oil, timber, soy, beef, pulp & paper and rubber – ‘forest-risk commodities’ – are driving deforestation. Despite global commitment to reduce GHG emissions to limit global warming well below 2℃, preferably 1.5℃ by 2050, our analysis shows that credit to forest-risk commodities have been increasing. Figure 1 shows the financial trend since 2015, with 2020 the first year to fall below 2015 levels (USD 36 billion) – from USD 43 billion in 2019 to USD 33 billion. However 2020 was no ordinary year, as the world ground to a halt to tackle the Covid-19 global pandemic. Although Figure 1 presents data only up to June 2021, financial institutions have already provided almost USD 31 billion in credit this year, setting the course to exceed 2015 levels yet again.

Figure 1. Credit trends by sector from 2015 to June 2021 (USD billion)

Over this period, beef has received the largest share of credit (USD 73.4 billion) followed by pulp & paper (USD 68.7 billion) and palm oil (USD 48.2 billion). Rubber, used in the manufacture of personal protective equipment, was the only sector to experience growth in the 2020 Covid-19 year, increasing from an average USD 2 billion per year (2015-2019) to USD 5.6 billion in 2020 and USD 2.6 billion in the first half of 2021. The palm oil and pulp & paper sectors have both recovered well securing USD 4.6 billion and USD 6.2 billion respectively in 2021 up to June.

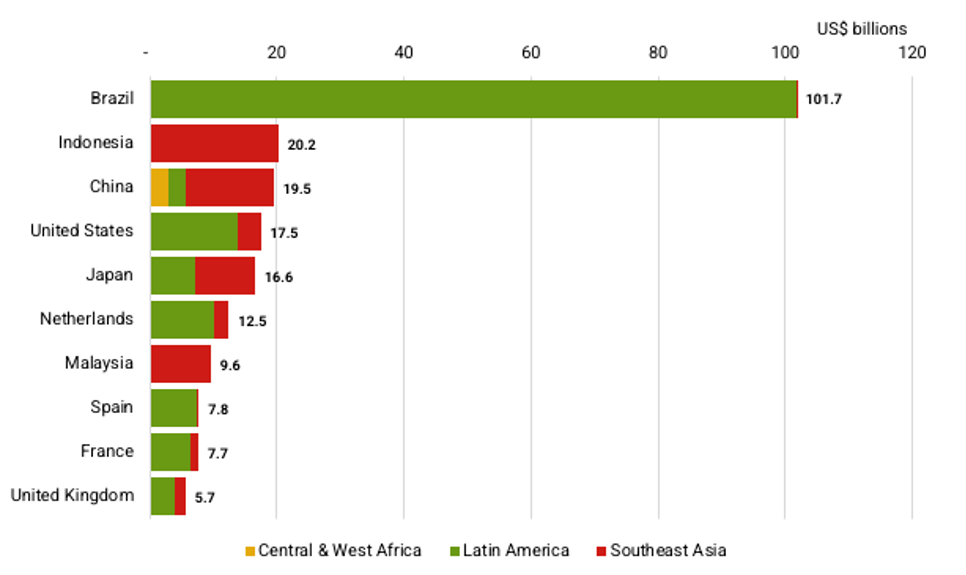

Figure 2. Largest 10 countries providing credit (2016-2021 June) by region

Forest-risk commodity sector financing since the Paris Agreement has been dominated by financial institutions from Brazil, followed by Indonesia, China, the United States and Japan. Brazil’s seemingly disproportionate representation is a reflection of its ‘Rural Credit’ programme. Analogous state-backed credit schemes from other countries are not captured in the Forest & Finance methodology due to a lack of transparency about them.

Overview of policy assessments

Forests & Finance assessed the publicly available policies of 200 financial institutions with the most significant financing of forest-risk sectors in Southeast Asia, Latin America and West & Central Africa. The assessment scored banks and investors against Environmental, Social and Governance (ESG) criteria based on international agreements, conventions and best practices with respect to deforestation, climate, human rights, labour rights, transparency and other criteria (see methodology).

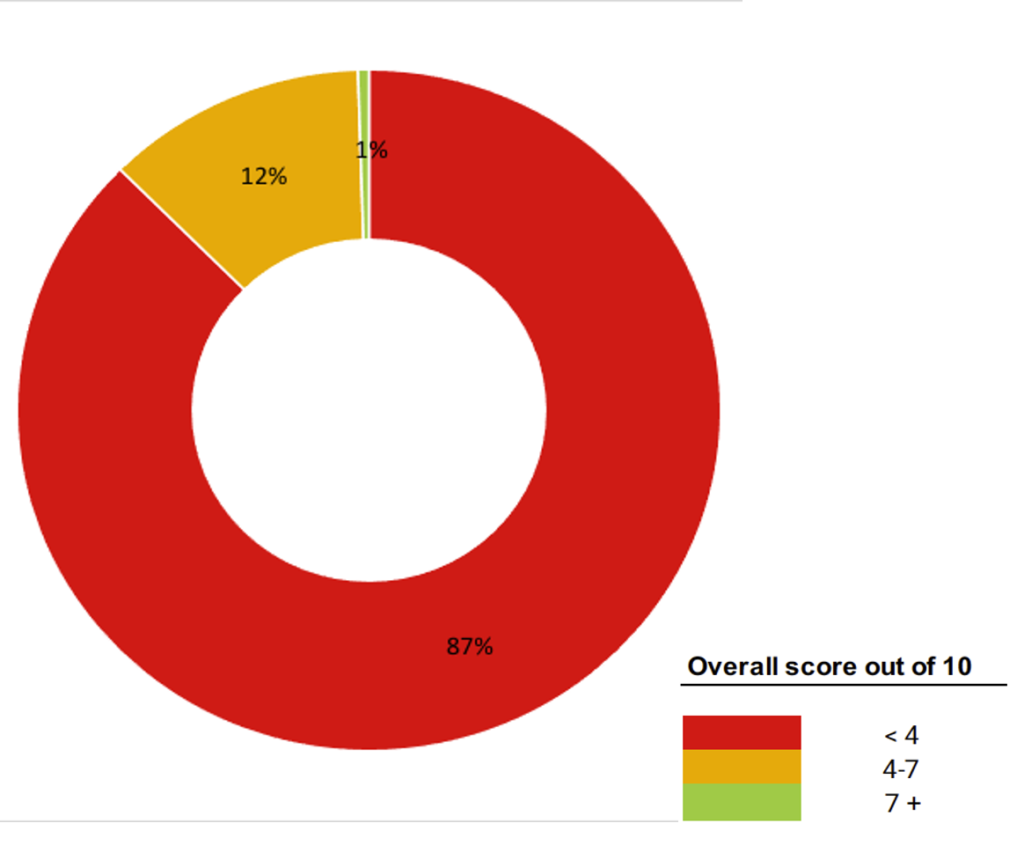

Figure 3. Proportion of overall scores for assessed financial institutions (%)

Despite the rise in commitments to mitigate ESG risks across bank and investor portfolios, our assessment indicates the majority of financial institutions are providing financial services to the forest-risk sectors seemingly without even desk-based checks or verification of client standards. This means that financial institutions are generally unable to identify, assess or manage ESG risks appropriately.

Several of the banks with the highest scores have seen financial flows to forest-risk sectors declining. However, many banks who are increasingly pumping money into forest-risk commodities have extremely low standards, magnifying the likelihood of exposure to ESG risks.

The highest scoring bank was the Dutch ABN Amro with an overall score of 7.2, followed by Rabobank, Norwegian Government Pension Fund Global, Standard Chartered and ING Group all scoring over 6. However the majority of banks and investors assessed scored below 1 (59%) and the average overall score was just 1.4. This demonstrates the scale of inadequate policies covering the forest-risk commodity sector which is driving deforestation and social impacts in tropical forest regions.

Figure 4. Policy assessment ranking showing the 20 highest scoring financial institutions. (points out of 10)

| Financial Institution | Beef | Palm oil | Pulp & paper | Rubber | Soy | Timber | Overall score |

| ABN Amro (Netherlands) | 5.7 | 7.2 | 7.7 | 5.7 | 5.5 | 7.7 | 7.2 |

| Rabobank (Netherlands) | 6.5 | 7.3 | 6.8 | 6.3 | 7.0 | 6.8 | 6.8 |

| Government Pension Fund Global (Norway) | 5.1 | 7.3 | 7.3 | 5.1 | 5.1 | 5.1 | 6.8 |

| Standard Chartered (United Kingdom) | 5.4 | 6.6 | 6.6 | 5.7 | 6.4 | 6.6 | 6.4 |

| ING Group (Netherlands) | 2.8 | 6.5 | 6.9 | 4.7 | 4.7 | 6.9 | 6.2 |

| Credit Suisse (Switzerland) | 4.1 | 7.0 | 4.8 | 4.7 | 4.7 | 5.0 | 5.9 |

| United International Enterprises (Bahamas) | 0.0 | 5.9 | 0.0 | 0.0 | 0.0 | 0.0 | 5.9 |

| United Overseas Bank (Singapore) | 3.8 | 6.9 | 3.5 | 1.9 | 3.8 | 0.5 | 5.8 |

| Banco Bilbao Vizcaya Argentaria (BBVA) (Spain) | 2.9 | 6.1 | 5.8 | 2.9 | 4.9 | 5.8 | 5.5 |

| Citigroup (United States) | 4.5 | 6.4 | 6.6 | 4.0 | 4.0 | 6.6 | 5.3 |

| Westpac (Australia) | 2.4 | 5.8 | 0.0 | 2.4 | 4.4 | 6.1 | 5.2 |

| HSBC (United Kingdom) | 3.9 | 6.9 | 6.4 | 3.9 | 3.9 | 6.5 | 5.2 |

| Mitsubishi UFJ Financial (Japan) | 2.2 | 6.2 | 5.1 | 1.6 | 2.1 | 3.9 | 5.1 |

| Goldman Sachs (United States) | 1.5 | 5.1 | 5.6 | 1.5 | 1.5 | 5.6 | 5.1 |

| Storebrand (Norway) | 0.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 |

| Standard Life Aberdeen (United Kingdom) | 2.9 | 5.8 | 2.9 | 2.9 | 2.9 | 2.9 | 5.0 |

| JPMorgan Chase (United States) | 2.4 | 2.3 | 5.7 | 1.3 | 4.5 | 3.5 | 4.9 |

| Deutsche Bank (Germany) | 3.6 | 4.8 | 3.3 | 4.6 | 5.7 | 5.4 | 4.8 |

| DBS (Singapore) | 2.4 | 5.4 | 1.5 | 3.2 | 3.2 | 1.7 | 4.5 |

| Finnvera (Finland) | 0.0 | 0.0 | 4.4 | 0.0 | 0.0 | 0.0 | 4.4 |