Notícias

Banks are fueling deadly fires, Covid-19 threatens to compound the risks

The world is rolling into another season of cataclysmic fires, already raging in tropical forests in Indonesia, Brazil and the Central African region, as well as the boreal forests in Russian Siberia and the temperate rainforests of California. The fires are devastating forest ecosystems and turbocharging climate change. Fortunately a growing number of banks and investors now understand that they have substantial leverage over culpable companies and national governments, and can pressure them to tackle the fire crises, but are they doing enough?

In Brazil, fires are strongly linked to land speculation and the expansion of the agricultural frontier into forest areas. Fires are often used to clear land for pastures or soy plantations. A significant part of these fires happen on unregistered lands, often as part of landgrabs, making it harder to identify culprits. However, a study found that in 2019, almost 50% of the total fires in Brazil were found in the potential buying zones of the meatpackers JBS, Minerva and Marfrig. Santander and HSBC are among the top financiers of these three meatpackers. The fires have recently intensified.

Meeting between Vice President Hamilton Mourão and members of the Committee and the Board of Directors of Santander Brasil Bank in Brasília. July 23, 2020. Image by Romério Cunha/VPR (Vice Presidency of the Republic of Brazil).

Following the dramatic increase in fires across the Brazilian Amazon in 2019, a group of international investors with $16 trillion in assets pressured the government of President Bolsanaro to address the issue. While statements alone are an inadequate response, it indicates an increased expectation on the financial sector to acknowledge and address its own role in perpetuating environmental and social harms.

There was, unfortunately, no comparable investor intervention for the fires in Indonesia, caused by the expansion of oil palm and pulpwood plantations. Plantation companies use fire as an illegal, cheap method to prepare land ahead of planting, by cutting the cost of clearing debris, fertilizing the land and killing weeds and pests. When combined with the unsustainable development of plantations on carbon-rich peatlands, fires often spread out of control and cannot be extinguished, sometimes for weeks. In terms of climate impacts, the Indonesia fires that have produced significantly more greenhouse gas emissions than the Amazon fires.

Fires & COVID-19: A Deadly Combination

The resultant toxic haze from these fires blows across national boundaries with serious public health and economic impacts. This year it will likely exacerbate the fall out from COVID-19. Several studies already suggest that even small increases in fine particulate air pollution (of the sort produced by the fires) significantly increases COVID-19 mortality rates. For Indonesia and its neighbors, the yearly haze already has profound public health impacts. A widely cited 2016 study estimated that the 2015 haze caused over 100,000 premature deaths across Indonesia, Malaysia and Singapore. During the haze of 2019, more than one million suffered from respiratory infection.

Recent years have demonstrated the potential for transboundary haze to bring normal life to a halt, so this year has the potential to deliver a major blow to economies and government finances already buckling under the stresses of the pandemic. In 2019, the fires are estimated to have cost Indonesia USD 5.2 billion in economic loss and damage, and $16 billion in 2015.

Banks are fueling the fires in Indonesia

Following the fires of 2015, President Jokowi described the crisis as organized environmental crime and promised tough measures against the corporate actors responsible. In 2019, the Ministry of Environment and Forestry (KLHK) sealed off 90 palm oil, pulpwood and rubber companies because of fires, with 24 reported to be facing civil or criminal sanction (the names have not yet been made public). Partial lists of the companies sealed have been made public or leaked, and from these 37 corporates have been identified as parent groups.

Despite increased government efforts to act on companies causing the fires, very few investigations have resulted in meaningful sanctions, and even fewer sanctions issued have actually been enforced by the courts, with hundreds of millions of dollars in fines unpaid.

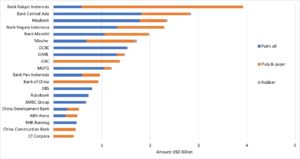

In the absence of risk management regulations or financial sector due diligence, the problem has been largely ignored by banks, who continue to extend huge lines of credit to companies developing areas of flammable peatland or with a history of fires in their concessions. Of the 37 identified corporate groups, Forestandfinance.org has identified financing for 19 of them, and shows that between 2015 and April 2020, these groups received at least USD 37.4 billion in loans and underwriting. These figures are adjusted to only capture financing to their palm oil, pulp & paper and rubber divisions. The fire-linked corporate groups include many of the biggest palm oil and pulp & paper groups in Indonesia.

Top 20 Creditors to corporate groups implicated in 2019 fires (2015-Q1 2020)

Despite the enormous costs of fires to the Indonesian economy and public finances, three of the top five creditors to fire-linked operations are majority state owned banks: Bank Rakyat Indonesia (BRI), Bank Negara Indonesia (BNI) and Bank Mandiri. Together, the three banks provided 8.2 billion in loans and underwriting. None of these banks have public policies on fire prevention, or prohibitions on clients expanding into new areas of flammable peatland.

It is also clear that Malaysian and Singapore banks are also major financiers of the fire-linked groups, despite their countries and economies also being severely impacted by transboundary haze. Several of the groups implicated in the fires including Kuala Lumpur Kepong/Batu Kawan Group, IOI Group, Genting Group, NPC Resources and TDM Group are publicly listed plantation companies. Singapore, meanwhile, is the offshore destination where many of Indonesia’s oligarchs have listed or headquartered their businesses including Royal Golden Eagle and Sinar Mas Group.

Many of these banks are also signatories to the UN Principles for Responsible Banking, under which banks have pledged to align their business strategies with the Paris Climate Agreement and the Sustainable Development Goals (SDGs). Their financing of fires is clearly not aligned with the goals of the PRB. Such banks include Mizuho Financial Group (Mizuho), CIMB Group, Industrial and Commercial Bank of China (ICBC), Mitsubishi UFJ Financial Group (MUFG), Rabobank, SMBC Group, and ABN AMRO. Rabobank, SMBC, and ABN AMRO also have explicit policies prohibiting clients from using fire to clear land.

Above the law?

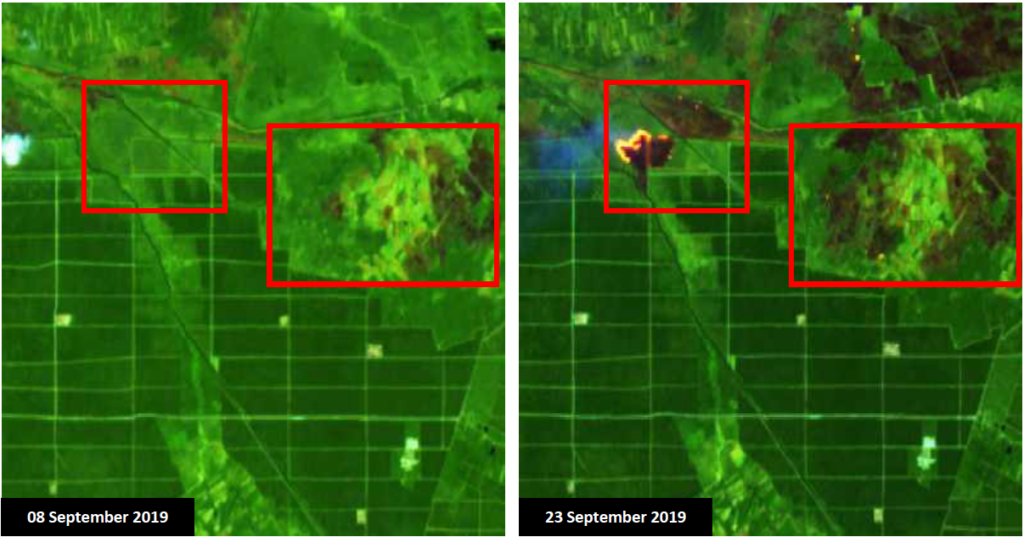

The partial lists of plantation companies sealed by the Indonesian government does not, however, reveal the full scale of culpability for Indonesia’s 2019 fire and haze crisis. Satellite imagery and hotspot data demonstrates that many other corporate actors had large fires in their concessions, yet are not reported to have had their plantations sealed. These include, for example, Astra Agro Lestari (IDX: AALI) and Golden Agri Resources (SGX: E5H), part of Jardine Matheson Group and Sinar Mas Group respectively. Four of Astra Agro Lestari’s palm oil concessions developed had fires in August-September 2019. Three of these had previously experienced fires 2016-2018. All four are being developed in peatland areas. The seeming inconsistency in enforcement action underlines the need for banks to exercise enhanced due diligence that is more robust than disclosures from law enforcement.

Fires and burn scar visible inside PT Persada Dinamika Lestari (AAL)

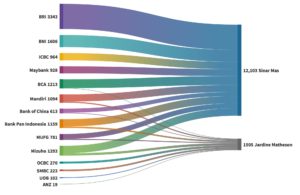

Some of the largest financiers of Astra Agro Lestari include the Japanese megabanks SMBC and Mizuho. Notably, the Director of AAL owner Jardine Matheson Holdings sits on the Global Advisory Board of MUFG, indicating a potential conflict of interest. MUFG has also been a major financier of GAR. We will cover GAR’s financing and fire links in Part 2 of this blog.

Top Creditors for Jardine Matheson and Sinar Mas Group 2015-20 (April) USD Millions

What should banks do?

Lack of effective sanction on the one hand, and huge lines of credit on the other means companies face no real incentive to alter their operations, and do not incur the multibillion dollar costs of the fires they cause.

Banks must play their part in addressing the climate crisis, biodiversity crisis and now the health crisis brought on by COVID-19, by immediately adopting effective incentives and deterrents to stop the fires. Such measures must include an explicit prohibition on clients using fire to clear land, as well as implementing a comprehensive ‘NDPE policy’, which requires clients to refrain from any involvement in deforestation, peatland development, or exploitation of local communities and workers.