News

Top asset managers resist biodiversity resolutions this year despite growing investor interest in nature

Article originally published here by Global Witness

Investors filed a record number of biodiversity resolutions in 2024 – yet none that of the resolutions we analysed that went to a vote passed, and all received low levels of support overall.

- Despite increasing investor awareness and interest in nature, leading asset managers including BlackRock, Vanguard, and State Street Global Advisors (SSGA) largely opposed biodiversity and deforestation shareholder resolutions this year.

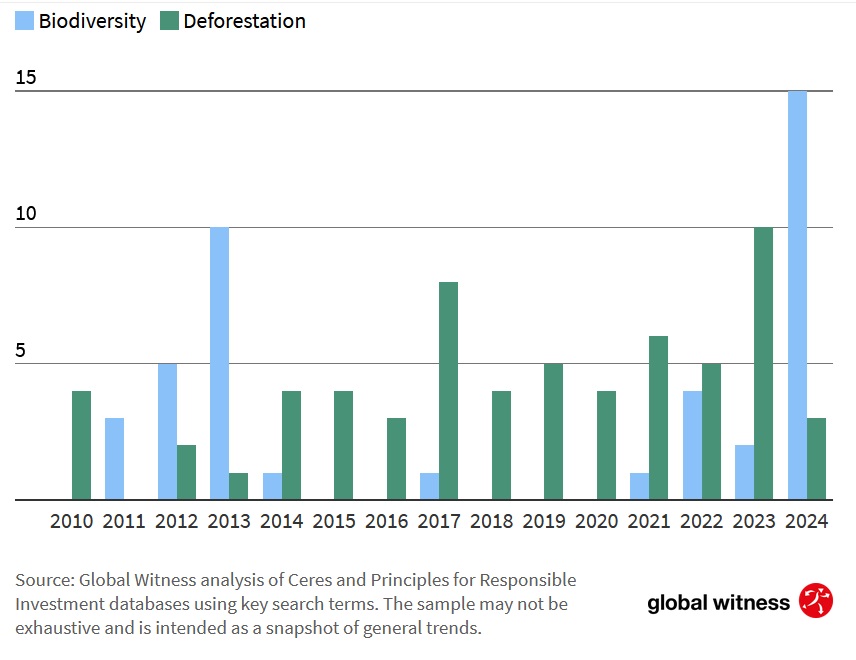

- Investors filed a record number of shareholder resolutions relating to biodiversity. However, our analysis also reveals a decline in the number of resolutions filed specifically relating to deforestation last year.

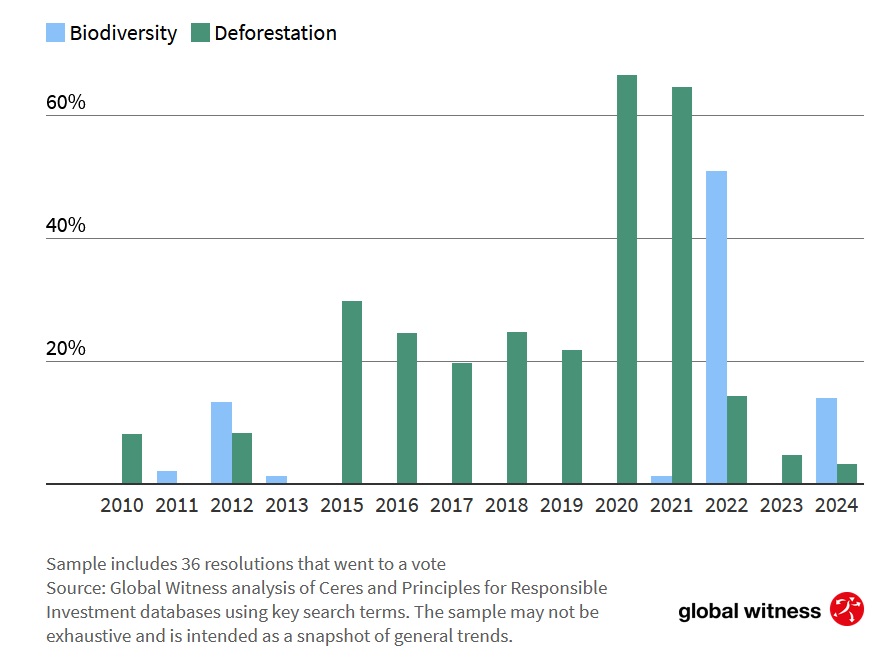

- Average support for deforestation and biodiversity focused resolutions in our analysis has plummeted in recent years, averaging just 13% support in 2024, down from 59% in 2022 and 50% in 2021. This reflects a wider trend of asset managers turning their backs on environmental, social and governance (ESG) resolutions.

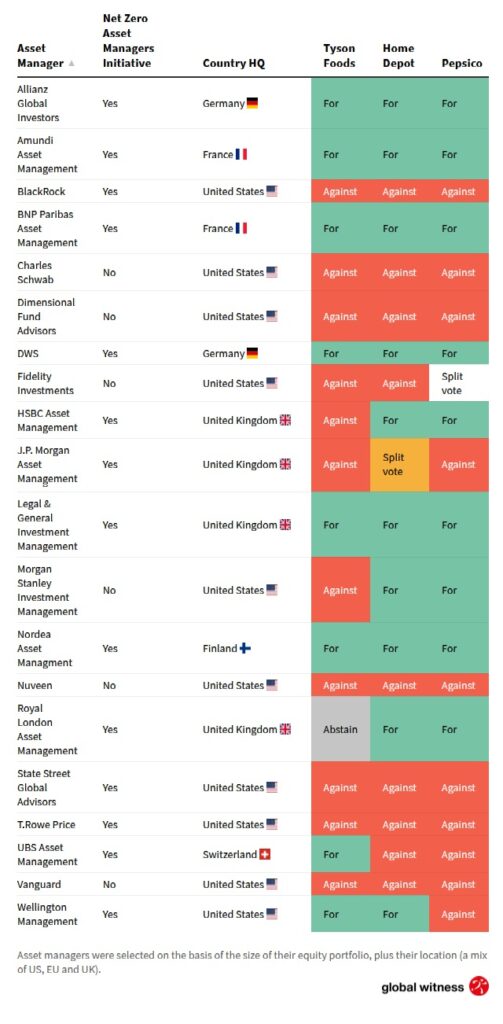

- US asset managers, including BlackRock, Vanguard and SSGA, have voted against three key biodiversity resolutions at higher rates than their European or UK counterparts.

Limited success of biodiversity resolutions

Investors filed a record number of biodiversity resolutions in 2024 – yet none that of the resolutions we analysed that went to a vote passed, and all received low levels of support overall.

Shareholder resolutions occur when a stakeholder in a listed company files a proposal for an action they would like that company to take, for example, electing a new director, or changing its policy on employee pay.

In recent years, ESG resolutions have emerged as a powerful tool shareholders can wield to influence corporate sustainability practices.

Global Witness analysed public filings logged in databases provided by the Principles for Responsible Investment and Ceres, using relevant search terms. Most companies included are based in North America; the sample may not be exhaustive and is intended as a snapshot of general trends.

There was a marked increase in biodiversity-related shareholder resolutions filed in 2024, which focused on issues such as supply chain deforestation; deep sea mining; water use; and the use of pesticides in agricultural supply chains.

However, these resolutions received low levels of support from key investors, including some financiers that have made public commitments on biodiversity.

Biodiversity resolutions are on the rise, while deforestation-specific resolutions decline in 2024

Number of shareholder resolutions filed publicly per AGM season by category (includes those that either go to vote, are omitted or are withdrawn).

Once a resolution has been filed at a company, there are several options going forward, including: the company’s board can agree to its demands, or agree to engage with certain aspects of the resolution leading it to be “withdrawn”; if the company is US-based, its board can ask the SEC to reject the resolution, forcing it to be “omitted” from the proxy statement; or it can go to a vote by shareholders, usually at the company’s Annual General Meeting (AGM).

In the US, if a resolution receives more than 50% of the vote, the company must adopt its demands.

Of the 18 biodiversity or deforestation resolutions filed this year and tracked by Global Witness, eight went to a vote, while six were withdrawn and four omitted.

Despite the small sample size, it’s clear that average support for deforestation and biodiversity-focused resolutions going to vote has fallen in recent years, averaging just 13% support in 2024 and 10% in 2023, down from 59% and 50% in 2022 and 2021 respectively.

This reflects a wider trend of declining support for ESG resolutions that has been observed elsewhere: average support for ESG resolutions in the US market has dropped from 43% in 2022 to 36% in 2023 and to 30% in 2024, according to financial services provider Morningstar.

Around 1 million animal and plant species are currently facing the threat of extinction – and the rate at which nature is declining globally is unprecedented in human history. Lalo de Almeida / Panos / Global Witness

Not a single biodiversity-related shareholder resolution we analysed passed in 2024.

By contrast, between 2021 and 2022, three shareholder resolutions relating to biodiversity and deforestation passed with significant backing, including two relating to deforestation – one that required US agribusiness Bunge to adopt a supply chain deforestation policy (99% of the vote) and one demanding US retailer Home Depot report on its deforestation risks (65%).

The latter resolution argued that Home Depot’s global sourcing operations, in particular its wood and timber sourcing, may be linked to illegal logging, and contribute to deforestation.

Green Century Capital Management, an impact investor behind two of these successful resolutions, has continued its efforts in 2024, filling a handful of resolutions relating to biodiversity and deforestation.

These resolutions tend to be more focused in their demands than those filed in previous years, asking companies to develop actionable targets or conduct biodiversity risk assessments, rather than just reporting on impacts.

They include a proposal filed at Tyson Foods, which is the world’s second largest food processor, and part of the “Big Four” meat processors companies that control 80% of the US beef market and include the notorious Brazilian meatpacker JBS.

The resolution asked the company to accelerate efforts to “eliminate deforestation” from its supply chains by 2025. Tysons’ shareholders, however, offered a mere 3% total support (and 11.6% of independent shareholders).

This may be due in part to the ESG backlash in the US as well as to what has been perceived by some asset managers as more specific, ambitious asks for companies to address ESG-related risks, Annie Sanders, director of shareholder advocacy at Green Century Management told Global Witness.

Another proposal led by Green Century Management, which asked US-consumer goods company PepsiCo to conduct a biodiversity impact assessment, received only 18% support from shareholders.

In 2024, investors filed nine resolutions demanding companies conduct biodiversity impact assessments; another almost identical resolution at Home Depot, from Domini Impact Investments, received 16% backing.

Average support for deforestation and biodiversity-focused resolutions has fallen sharply

Average support for biodiversity and deforestation-focused resolutions

Not all votes are created equal: The outsized influence of the US “Big Three”

Votes from major asset managers significantly influence the outcome of ESG proposals.

BlackRock, Vanguard and SSGA, known as the “Big Three”, collectively hold substantial stakes in major companies that operate in sectors at high-risk of causing deforestation, like agriculture, mining and fossil fuel extraction, among others.

They often wield enough voting power to tip the scales on shareholder resolutions.

For instance, together, these companies own a combined 22% of Tyson Foods; 18% in PepsiCo and 18% in Home Depot. Their opposition often effectively blocks these resolutions from passing.

This year, the Big Three rejected all three of the key biodiversity resolutions that we analysed.

Global Witness contacted several investors filing ESG resolutions and heard that their experience engaging with large asset managers can be frustrating.

For example, one investor with experience of all three asset managers, who asked not to be named, said that, in their experience, Vanguard and SSGA are often receptive to their outreach, but BlackRock is less willing to connect with them.

In its rationale for why it voted against these resolutions, BlackRock said most ESG resolutions “sought outcomes that were unlikely to promote long-term shareholder value” and expressed satisfaction with how the companies are already reporting on these issues.

By contrast, asset managers who voted in favour of these resolutions tended to cite their general support for proposals that seek to promote greater disclosure and transparency, noting that they believe this to be in the interest of shareholders.

While these firms have occasionally supported deforestation-related resolutions in past years, they have shown declining interest in biodiversity resolutions in 2024.

According to a recent assessment from the World Resources Institute, deforestation slowed last year in some parts of the world like Colombia and Brazil.

However, this progress was counteracted by “sharp increases in forest loss” in other regions like Bolivia, Laos, and Nicaragua.

Meanwhile, US-based asset managers are notably more reluctant to support biodiversity initiatives compared to those in the EU and UK.

Aerial shot of agricultural land in Pará, Brazil. Global Witness

Divergence despite climate commitments

Global Witness’ analysis found some inconsistencies.

Members of the Financial Sector Deforestation Action (FSDA), who have committed to make “best efforts” to eliminate deforestation caused by “high-risk commodities” from their investment and lending portfolios by 2025, generally show more support for biodiversity resolutions.

Yet, some members still vote against these measures.

For example, Swiss banking group Lombard Odier Investment Managers gave a “split vote” on biodiversity resolutions at PepsiCo and Home Depot in 2024, while GAM Investments rejected the proposal at Home Depot, signalling a disconnect between their pledged goals and voting actions.

Sue Reid, who works as Climate Finance Advisor to Christiana Figueres at Global Optimism, and helps to coordinate the FSDA, believes members are ahead of the curve in recognising that collaborative efforts are essential for meaning full change in corporate deforestation policies, as no single investor can influence a multinational company alone.

However, the slow rate of support for biodiversity resolutions suggests many investors fail to recognize the financial and regulatory risks tied to biodiversity issues.

This gap may become more problematic with the impending EU Deforestation Regulation (EUDR), which is due to be implemented in December 2025, and will impose new demands on companies to prevent the sale in the EU of goods grown on deforested land.

US asset managers are dropping the ball on key biodiversity resolutions

Asset manager votes on key biodiversity resolutions in 2024: resolution at Tyson Foods called on company to accelerate efforts to combat deforestation (received 3.3% support); resolutions at Home Depot & PepsiCo called on company to conduct biodiversity impact assessments (in line with TNFD requirements – 16.1% and 18.4% support, respectively).

Methodology

Global Witness used Ceres’ and the Principles for Responsible Investment’s (PRI) shareholder resolution databases to identify biodiversity and deforestation-related resolutions, filtering for terms such as “biodiversity” and “deforestation”.

We also used filters provided by the PRI to select resolutions relating to “land use, including deforestation”, and “biodiversity and nature”.

We excluded resolutions at fossil fuel companies relating to Arctic drilling.

We reviewed asset managers’ holdings using Refinitiv Eikon, selecting the largest global equity investors with available voting data and including prominent US, UK, EU-based asset managers for comparison.

BlackRock, Vanguard, SSGA, GAM Investments and Lombard Odier Investment Managers (LOIM) were all approached for comment. Vanguard and SSGA did not provide a response to our request.

BlackRock declined to comment on our analysis, however, a representative for the firm pointed us to relevant sections of its 2024 Global Voting Spotlight Report, which provides additional rationales for its votes and highlighted the BlackRock Voting Choice program, which in some cases allows clients to engage in the proxy voting process.

A spokesperson from LOIM said that the firm is convinced that nature-related risks remain “underappreciated”, adding that the firm’s recommended voting policy was to vote “for” both of the biodiversity resolutions highlighted above, resulting in more than 80% of its votes being cast in favour of the above resolutions.

However, they told us that “a minority share of their votes linked to a specific client that opted to follow a different voting policy” led to a split vote.

A spokesperson for GAM Investments detailed the firm’s satisfaction with Home Depot’s existing disclosures, and noted the “positive steps” the company has taken in recent years to address biodiversity concerns and increase their disclosure, leading them to conclude that a vote in favour of the above resolution “wasn’t appropriate.”

In addition, they re-affirmed GAM Investment’s commitment to the FSDA, and its goal to eliminate forest-risk agricultural commodity-driven deforestation activities from its financing activities by 2025.