News

Major risks of self-reporting under Science Based Targets initiative highlighted by pulp giant APRIL’s dubious Greenhouse Gas emissions numbers

APRIL’s removal from SBTi highlights the risks and loopholes associated with SBTIs target setting initiative. This initiative must focus on transparency and accountability to ensure its commitment to scientific integrity is realized.

Forests & Finance and our partners have written in detail about serious risks for climate, forests and human rights linked to Indonesian pulp producer Asia Pacific Resources International (APRIL)’s plans to dramatically expand its processing capacity. Our briefing details how APRIL’s glossy sustainability claims, which include achieving Net Zero Greenhouse Gas (GHG) emissions from Land Use Change by 2030, are incompatible with its expansion plans. Put simply, investing in new processing infrastructure will require scaling up the supply of wood fiber which will likely result in much higher GHG emissions from land use. This is due to intensifying production pressures on existing plantations, while also increasing the risk that new wood suppliers will engage in deforestation. APRIL denies that these risks are accurate.

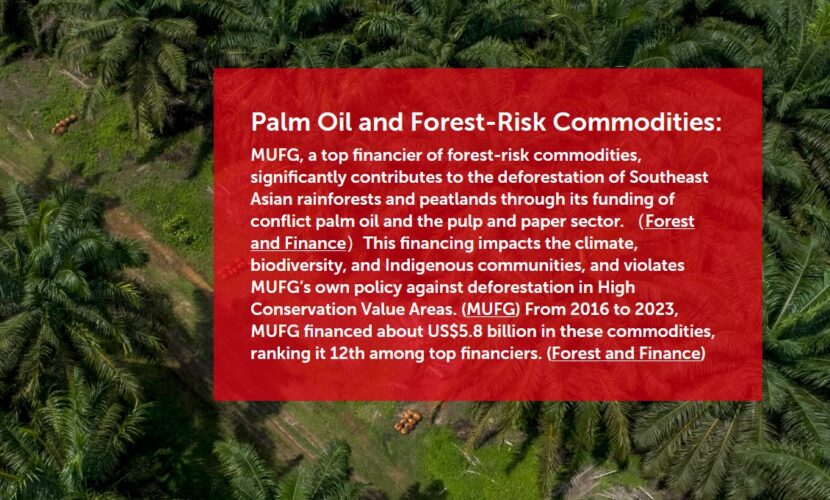

APRIL committed to the Science Based Targets initiative (SBTi) – a voluntary body for corporate decarbonization targets – in 2020. Having an SBTi stamp of approval is important, with validated targets linked to market benefits such as investor confidence, brand reputation and reduced regulatory uncertainty. Since launching, companies have flocked to adopt SBTi targets with companies representing around a third of the global economy (a cumulative market cap of $38 trillion) having signed up.

These market signals are likely to be attractive to companies like APRIL that are exposed to climate risks, and who may be looking to reassure financiers and customers of their sustainability and potential for long term viability and/or growth. APRIL is not the only forest-risk commodity company capitalizing on their SBTi commitment, Brazilian meatpacker JBS cite their SBTi targets in their green bond framework several times despite not having validated targets.

A considerable percentage, 21%, of APRIL’s creditors are SBTi signatories, and will likely be looking to finance companies with science based targets.1 However, APRIL has a long track record of expanding pulping capacity beyond its ability to sustainably source wood fiber. The resultant supply gap has historically driven deforestation and land rights violations. As such, APRIL’s claims must be approached with a high degree of scrutiny and skepticism.

APRIL’s Dubious GHG Numbers

Satellite image shows burned area with smoke still rising in PT Sumatera Riang Lestari concession in 2019 (turquoise boundary). It is estimated that over 1,000 ha burned inside this concession alone. Nusantara Atlas

SBTi requires companies to submit a GHG inventory for a baseline year, and to develop decarbonization targets to reduce and/or remove emissions against this baseline. Through correspondence with APRIL, we asked for details of this GHG inventory for its baseline year- 2019. While APRIL declined to provide many details, it did disclose a key number from its GHG inventory – the total area that burned inside its supplier concessions that year: 27 hectares.

While they later revised this number to 139 ha when the FT contacted them, both numbers seemed implausibly small. Spatial data from the Indonesian Ministry of Environment and Forestry (KLHK) indicates that around 7,800 ha burnt across APRIL’s supplier concessions in 2019. APRIL disputes that some of these third party suppliers were supplying them in 2019. However, even if APRIL are given the benefit of the doubt and these disputed sources are discounted, the burned area is still estimated to be over 3,000 ha (see FT article). This indicates a 99% discrepancy in the reported burned area- one of APRIL’s main sources of emissions.

We reported this discrepancy to SBTi in June 2022, only receiving a response from SBTi in October 2022 to confirm that APRIL had been removed for failing to submit information on time, and have recently been removed from the list of companies taking action.

[1] Based on Forests & Finance credit data to Royal Golden Eagle’s pulp and paper operations between 2016 and 2022 (September), 11 of the 53 banks are SBTi signatories. The signatory banks are: ABN Amro; Banco do Brasil; Cathay Financial; Credit Suisse; E.SUN Financial; Intesa Sanpaolo; Industrial Bank of Korea; Safra Group; Taishin Financial Group; Yuanta Financial and Woori Financial.