News

JBS: Climate chaos and exploitation in the Amazon

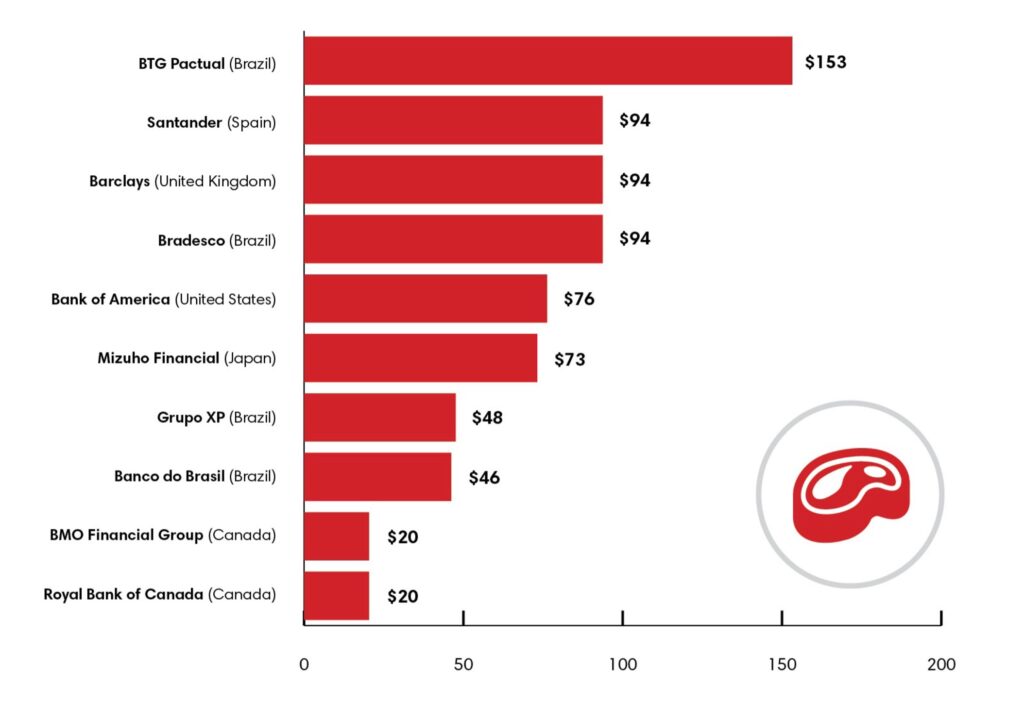

JBS is financed by major banks from Brazil, the US, Europe, and Japan. Since 2019, these banks have enabled JBS’s unacceptable business practices in Brazil by providing over US$ 718 million in forest-risk beef credit. As of September 2023, investors held US$ 667 million in bonds and shares. The largest institutional shareholders are Brazilian BNDES and BTG Pactual with shares of US$ 412 million.

Largest 10 creditors to JBS’ forest-risk beef operations (2019-2023 September, US$ millions)

The Brazilian meat giant JBS is the largest animal protein company in the world. Its supply chain has devastating impacts on forests and communities in the Brazilian Amazon. As one of Brazil’s largest Amazon deforesters, JBS plays a major role in the climate and biodiversity crises. The company’s harmful and sometimes illegal business practices have been documented repeatedly over the last 15 years. These practices include bribery and corruption, price-fixing, forest destruction, forced labor and labor abuses, invasion and land grabbing of Indigenous and traditional territories, and excessive greenhouse gas (GHG) emissions.

In July 2023, JBS renewed its decade-long efforts to list its shares on the New York Stock Exchange through a dual listing (also in São Paulo) which, if it proceeds, will open up major opportunities for JBS to attract further investment. This process was thwarted in 2017 when the majority shareholders, the Batista brothers, were embroiled in a corruption scandal which concluded with a record-breaking fine of US$ 3.2 billion and their admission of bribing thousands of politicians. Now these men are seeking to consolidate their control of the company through a major restructure which would see the family’s voting power increase from 48.8% to 85%. CSOs have alerted investors to the risks related to this dual listing, and several groups, including Rainforest Action Network (RAN) and Indigenous associations APIB, COIAB, and Tato’a, have petitioned the SEC to investigate.

Exploiting people and forests in the Amazon

It is estimated that between 2008 and 2020, JBS’s total deforestation footprint was as high as 200,000 hectares in its direct supply chain and 1.5 million hectares in its indirect supply chain. Various organizations including Greenpeace, Repórter Brasil, Global Witness, and Amnesty International have documented cases of large-scale deforestation and human rights abuses linked to JBS between 2009 and 2022. This pattern of systemic unacceptable business practices by JBS should raise alarm among banks and investors.

JBS drives land grabs and invasion of Indigenous Peoples’ territories in the Brazilian Amazon by continuing to source cattle illegally grazed on Indigenous lands (TIs). In the last few years, investigations have found that JBS has purchased cattle that were illegally grazed in the Uru-Eu-Wau-Wau TI in 2019, the Naruvôtu Pequizal TI in 2020, and the Apyterewa TI in 2022. The Laboratório InfoAmazonia de Geojornalismo and Center for Climate Crime Analysis revealed JBS has continued sourcing from the Uru-Eu-Wau-Wau TI after 2021, indicating a failure by JBS to address such violations.

Following a landmark report and campaign in 2009 by Greenpeace, JBS signed agreements with the Brazilian public prosecutor and Greenpeace to clean up its supply chain. This requires JBS to ensure its products are free from deforestation after October 2009 and free from the use of forced labor or the invasion of Indigenous lands. A critical element of these agreements was the implementation of a transparent traceability system to enable monitoring and verification across the full supply chain. Yet 14 years on, despite JBS claiming to have eliminated deforestation and forced labor from its supply chain, it has still not delivered on these critical commitments.

Investigations by civil society and official audits have found large-scale deforestation in 2019-2020, contradicting JBS’s claims to have met its deforestation commitments. In the Amazon state of Pará, JBS’s cattle purchases of more than one in six cows – around 94,000 cattle – were found to be non-compliant, primarily due to illegal deforestation by their direct suppliers. Although there are other companies operating in the region, JBS was responsible for almost 69% of irregular cattle purchases.

Greenwashing alert

Following on from the 2009 commitments, JBS has made a high-profile pledge to achieve net-zero emissions by 2040. These types of claims offer material benefits to companies, as they can facilitate access to finance with favorable conditions. Many financiers are looking to boost their green credentials and align their client portfolio with their own net-zero claims. However, independent research found that JBS lacks any credible decarbonization plan, and in 2023, the US National Advertising Division (NAD) recommended JBS USA Holdings discontinue its net-zero claims because they were misleading.

Recent analysis estimates the company has increased its GHG emissions by 51% in five years. Estimates of JBS’s methane emissions also far outpace all other livestock companies, setting them apart from their peers yet again. Despite these allegations of greenwashing, in 2021, JBS sold US$3.2 billion worth of “green bonds” linked to their net-zero pledge, and in 2023, their bonds were oversubscribed. Notably for the recent bonds, 9 out of 11 underwriting banks – including Bank of America and Citigroup – have net-zero commitments under the Net Zero Banking Alliance (NZBA) but are actively enabling a company whose business model is incompatible with a climate-safe transition.

JBS did not respond to Rainforest Action Network in relation to allegations of misleading investors as part of its dual listing. JBS states that it is committed to be net zero by 2040 and to be deforestation-free in its Brazilian supply chains by 2025.

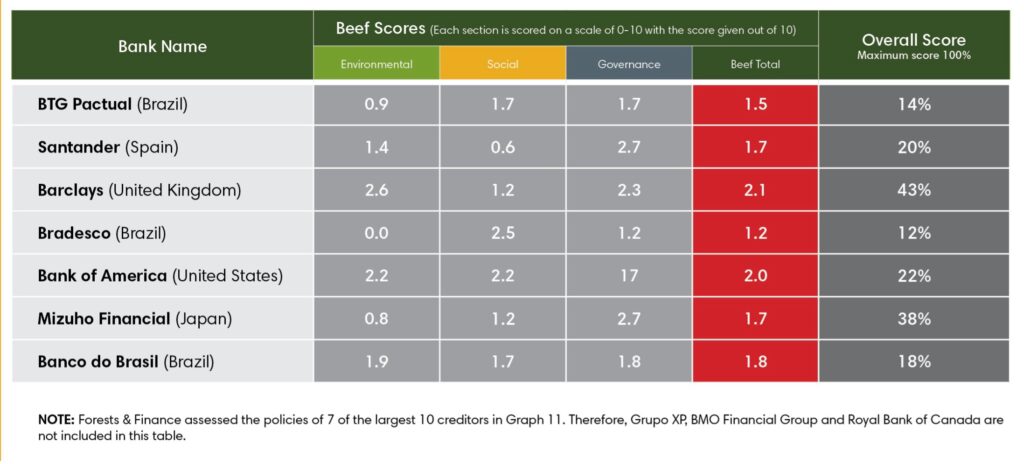

How do the policies of JBS’ bankers and investors stack up?

The bank with the highest overall score out of JBS’s creditors was Barclays at 43%. However, Barclays has been exposed for its major role in enabling JBS’s destructive business practices, and its beef sector score is much lower, at just 2.1 out of 10. The sector scores for beef are all abysmal, with Bradesco and BTG Pactual scoring the lowest at just 1.2 and 1.5 out of 10 respectively. These two Brazilian banks, along with Japanese Mizuho, all scored below 1.0 out of 10 for environmental criteria for the beef sector, which shows that their policies do nothing to prevent environmental harm.

Given that the beef sector is well known to be a key driver of deforestation and climate change in Brazil, the exceptionally weak requirements on these issues by JBS’s creditors is particularly concerning. Many of the banks also have weak social policies, including on requirements to ensure clients and their suppliers do not perpetrate labor abuses or violate FPIC for Indigenous Peoples or local communities. A standout bank lagging behind on social policies for beef is Santander, which scored just 0.6 out of 10.

These weak demands by JBS’s main financiers enable it to continue its unacceptable business practices with impunity. Banks should adopt, disclose, and consistently implement a process to end relationships with clients such as JBS which continue to be complicit in deforestation and human rights abuses.

Policy scores of JBS’ largest beef creditors