News

Companies accused of biodiversity or human rights harms ‘adopt’ TNFD reporting

Last week – at the World Economic Forum, also known as ‘Davos’ – the Taskforce on Nature-related Financial Disclosures (TNFD) announced a list of 320 companies that would formally ‘adopt’ the TNFD. Companies committed to starting reporting under TNFD in 2024 or 2025.

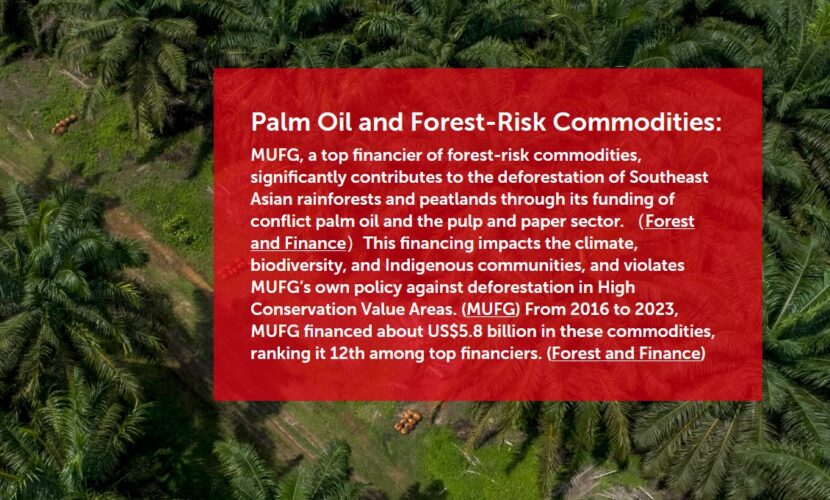

“The list of companies adopting the TNFD includes some of the worst companies linked to environmental destruction. While not every company adopting TNFD is linked to environmental abuse or human rights violations, the adoption list clearly signals that companies see TNFD reporting as compatible with the status quo,” said Shona Hawkes, an advisor on finance at Rainforest Action Network. “The list includes coal miner Anglo American, chemical company Dow Inc as well as companies like Suzano and Drax that have long-faced allegations of being linked to deforestation. Bunge also stands accused of sourcing from farms linked to threats to environmental human rights defenders. Shockingly, the list also includes Vale – whose mine tailings dam collapse in 2019 killed hundreds of people and has seen it placed on the exclusion lists of investors in nine countries. The list also includes Bank of America and MUFG – some of the world’s largest bankers of fossil fuels.”

“If companies that have persistently failed to clean up their act on environmental and human rights issues like Drax and Suzano are signing up we can assume it’s because they don’t see TNFD as challenging their current environmental or human rights practices. This is prima facie evidence that TNFD falls short of requiring sound action on biodiversity and human rights – which entails full transparency, accountability and exiting high-risk activities – not just high-level aggregate self-reporting that can’t even be verified against realities on the ground,” added Karen Vermeer, coordinator of the Finance Working Groups of the Environmental Paper Network.

“So-called ‘Nature-related disclosures’ are only a preliminary step before launching biodiversity offset/credit markets, whose goal is to avoid curbing our destruction by claiming to compensate for it. It is thus not surprising that TNFD reporting is seen as compatible with the status quo.” said Frédéric Hache, director Green Finance Observatory

“We’re particularly concerned that TNFD now appears to be promoting this corporate-written framework as future law, with its appointment of a Head of Regulatory Engagement. Essentially, acting as a back-door for corporations to write future laws,” stated Meena Raman, President of Sahabat Alam Malaysia.

‘Governments must not use the TNFD as an excuse to wriggle out of adopting new laws to stop biodiversity loss on the ground. Years of Global Witness investigations have shed light on the deforesting companies driving our planet to the brink, prove that data alone does not fix the market,’ said Alexandria Reid, Senior Global Policy Adviser, Global Witness.

A list of civil society and Indigenous People’s statements, open letters and submissions on TNFD can be found on the Forests & Finance coalition website here.