News

Banks financing Royal Golden Eagle Group’s Sprawling Empire of Destruction

Read the full article on RAN/Forests Frontlines

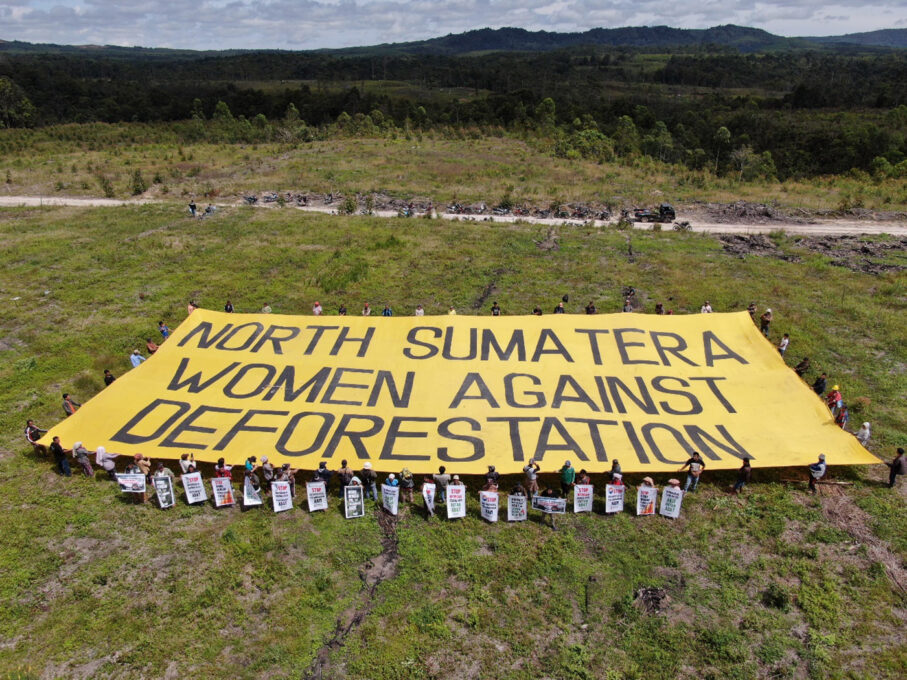

Despite corporate promises to stop driving deforestation, global household brands and banks are failing to ensure that they stop doing business with companies that are driving deforestation and rights abuses in their operations and supply chains in Indonesia.

RGE is a multi-billion dollar conglomerate owned and controlled by the notorious Indonesian tycoon Sukanto Tanoto. The company is Indonesia’s second largest pulp & paper producer and a major producer and trader of palm oil. RGE has been identified by RAN and many others as a prime example of bad corporate behavior through its well documented history of corruption, deception and for driving massive forest destruction and human rights violations. The sprawling business empire contained within RGE has been repeatedly exposed for over a decade for its impacts on Indigenous and traditional communities, tropical rainforests, biodiversity and its massive carbon footprint, and allegations of tax-evasion and the violation of laws prohibiting fires in pulpwood concession areas in Indonesia.

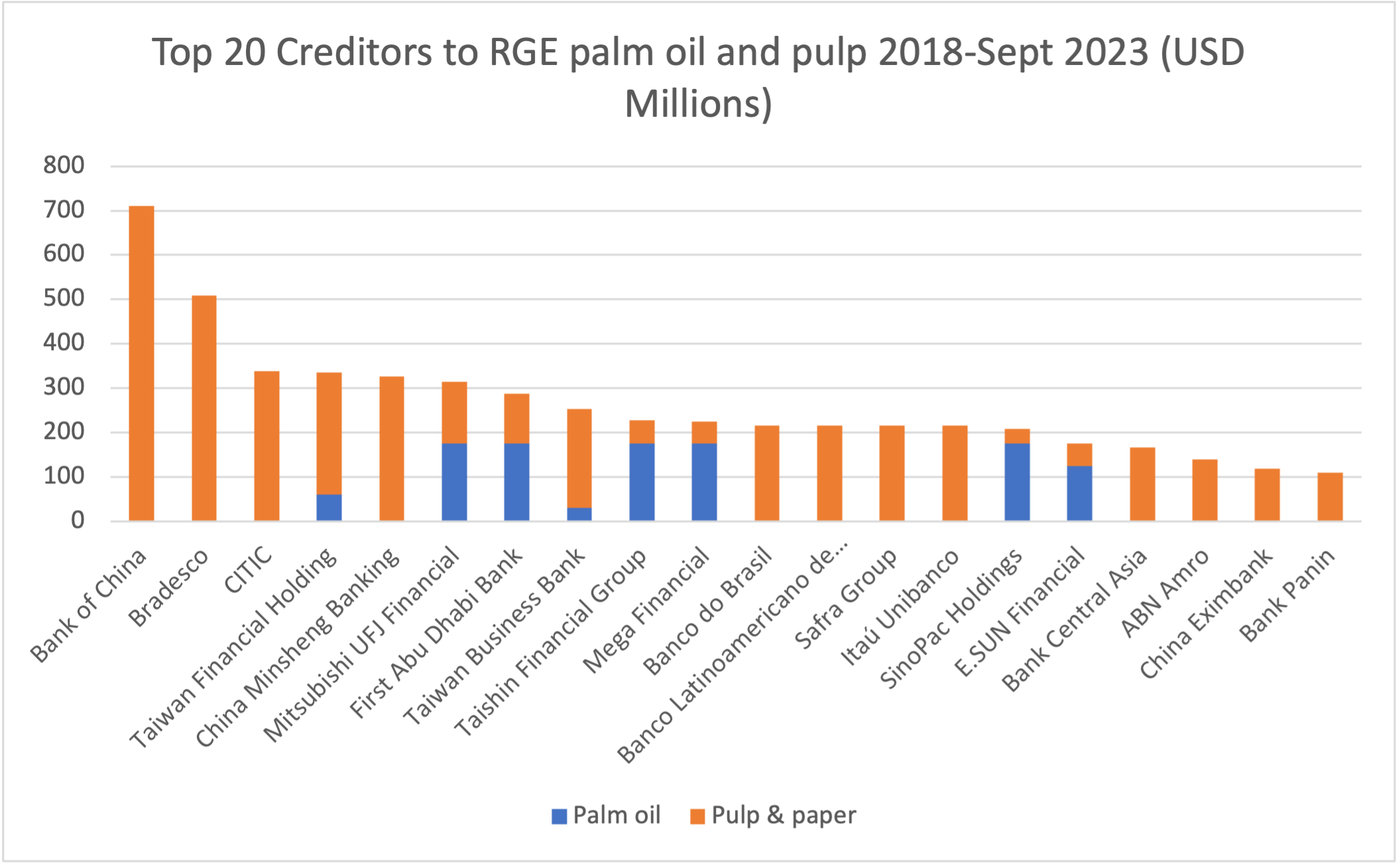

Data from Forests & Finance indicates that the Royal Golden Eagle (RGE) Group has received US $6.8 billion in credit from 2018 – September 2023, making it the second largest overall recipient of forest-risk financing in Indonesia. Around 80% of this is estimated to finance RGE’s worldwide pulp & paper operations and 20% to finance its palm oil production and trading business.

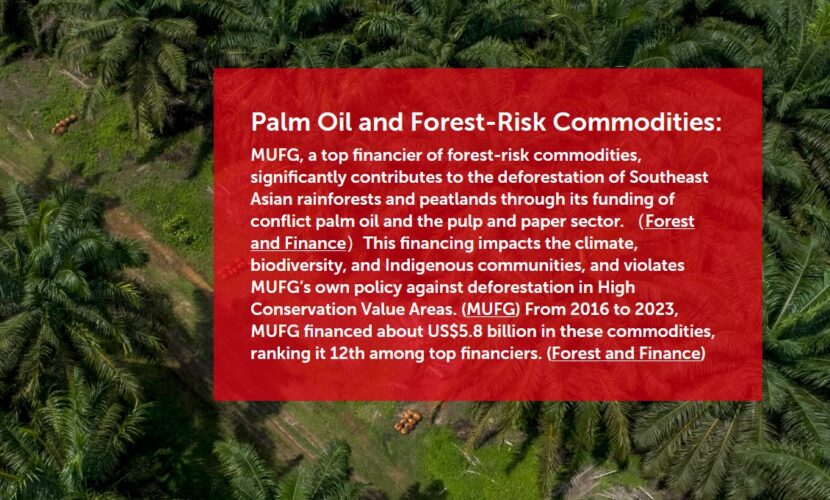

RGE group has increasingly sought to arrange credit as so-called Sustainability Linked Loans (SLLs) with syndicates of major international banks, including those with NDPE aligned policies like Japanese megabank Mitsubishi UFJ Financial Group (MUFG). MUFG has provided over $300 million in credit since 2018, and RGE has publicly championed MUFG’s role as its creditor and lead sustainable finance advisor for a new US $1 billion sustainability loan announced in 2024. These loans are set against environmental Key Performance Indicators, which reportedly align with “broad goals” that include “zero tolerance for deforestation” and “radical traceability and transparency.” As this report and others set out, RGE’s opaque relationship with PT. TPL, a company that continues to clear forest and violate customary rights, appears contradictory to the stated goals.

MUFG clearly plays an pivotal role in securing RGE’s huge new lines of credit. However, its NDPE policies do not currently apply to their clients’ entire corporate group. This provides the bank with a loophole to distance themselves from the impacts of PT. TPL and other RGE shadow company operations.

Read the full article with details on deforestation cases on RAN/Forests frontlines.