Notícias

Asian banks increase financing of rogue palm oil company Indofood, filling void left by Citi, Rabobank and Standard Chartered loan cancellations

Banks and investors are under increasing scrutiny for their financing of commodities driving tropical deforestation, and rightly so. The environmental, social, and governance (ESG) risks associated with these controversial sectors — illegality, land grabbing, peatland and rainforest destruction, fires and labor abuses, to name a few — can carry significant reputational and financial risks for financiers. Our analysis of recent financing to rogue palm oil company PT Indofood Sukses Makmur Tbk (“Indofood”) (INDF:IJ) shows a clear divide between Western and Asian banks in how they address applicable ESG risks. The main takeaway? Financing by Asian banks, most notably Indonesian, Japanese, Malaysian and Singaporean banks, is fueling tropical deforestation and related human rights abuses, and their practices must improve if we are to solve the deforestation crisis..

Indofood – a rogue company in disguise

A flagship company of the Salim Group, Indofood has a market cap of nearly 5 billion USD and is Indonesia’s largest food company as well as the world’s largest instant noodle manufacturer. It also has the second largest oil palm land bank in Indonesia through its subsidiary Indofood Agri Resources. But the company is not without controversies.

In October 2016, Rainforest Action Network (RAN), International Labor Rights Forum (ILRF) and Indonesian labor rights organization OPPUK filed a complaint against Indofood’s palm oil subsidiaries for violating the certification standards under the Roundtable on Sustainable Palm Oil (RSPO). Multiple investigations by RAN, OPPUK and ILRF, as well as the RSPO and its accreditation body, confirmed the presence of exploitative labor practices in Indofood’s palm oil operations –– including cases of child labor, unpaid workers, precarious employment, gender discrimination, and toxic working conditions. In affirmation of these findings, the RSPO issued a decision in November 2018 that required Indofood to address worker exploitation in its subsidiary’s operations, including over 20 violations of the RSPO standard and 10 violations of Indonesian labor law. Indofood’s refusal to submit the required corrective action plan left the RSPO no choice but to terminate Indofood’s RSPO certificates and cancel its RSPO membership in March of this year, while leaving Indofood’s workers without remedy for the harms committed.

Indofood’s controversial palm oil practices have driven away 15 business partners over the past 2 years, including Nestlé, Wilmar, Musim Mas, Cargill, Fuji Oil, Hershey’s, Kellogg’s, General Mills, Unilever, and Mars. Indofood’s CEO, Anthoni Salim, has also received scrutiny for his other palm oil businesses that are operating in the shadows and illegally clearing substantial areas ofpeatlands in Borneo or embroiled in serious land conflicts in West Papua. Since 2017, the share price of Indofood’s palm oil subsidiary, Indofood Agri Resources, has dropped 37%, indicating that its unsustainable business model is hurting the company financially.

The Role of Banks

Given Indofood’s market share, it’s no surprise that multinational banks and investors are attracted to the company. In fact, banks have financed one third of Indofood’s palm oil expansion capital. But any amount of due diligence would reveal that this company’s operations are rife with illegalities, human rights abuses and environmental harms that should turn away any responsible bank or investor. So which banks have taken steps to mitigate these risks and which banks are continuing to facilitate Indofood’s Conflict Palm Oil practices?

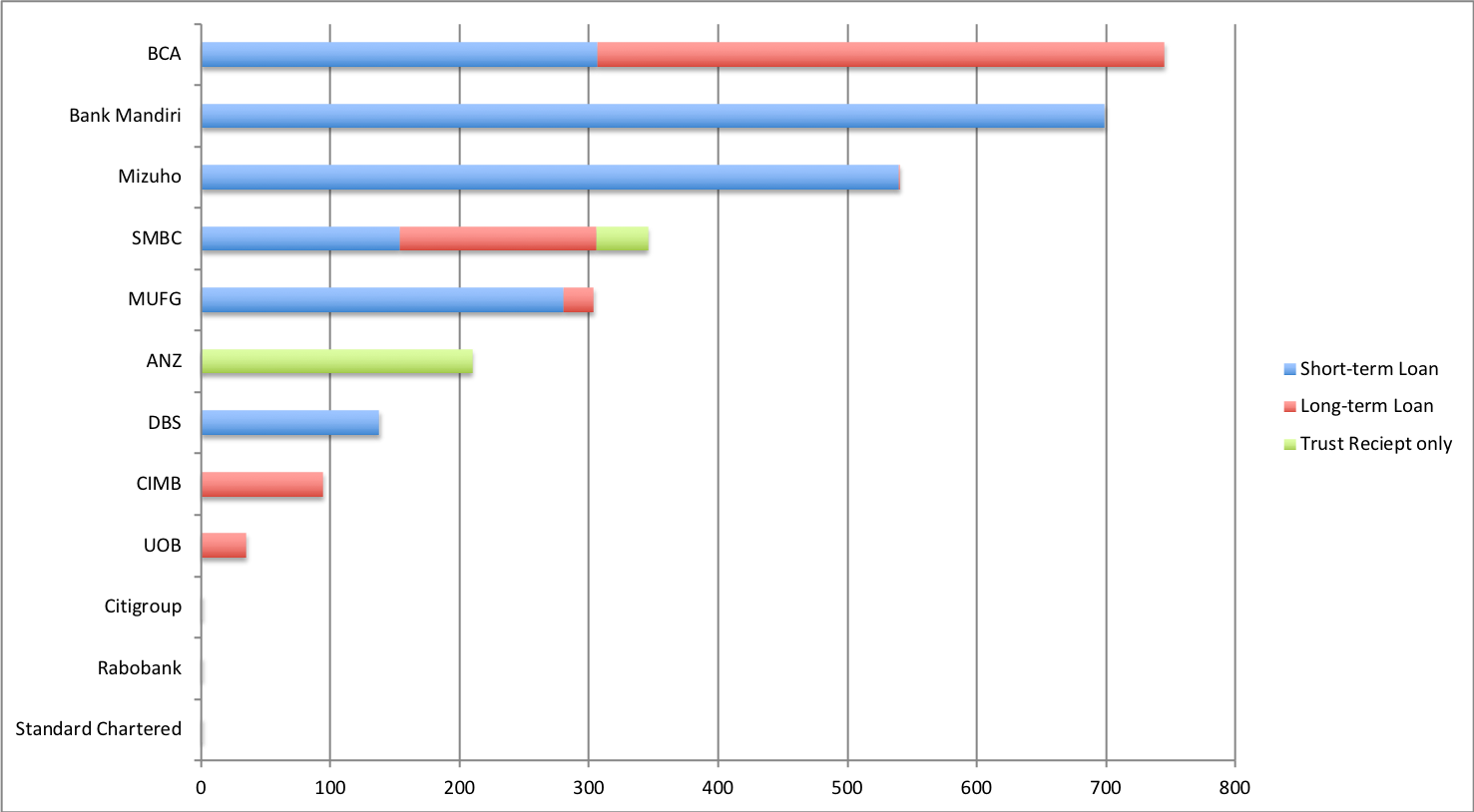

As of September 30th this year, Indofood’s largest financiers included Indonesian banks Bank Central Asia (BCA, formerly part of the Salim Group) and Bank Mandiri, followed by the three largest banks in Japan: Mizuho Financial Group, Sumitomo Mitsui Financial Group (SMBC Group), and Mitsubishi UFJ Financial Group (MUFG). Other bankers include Australian ANZ, Singaporean DBS and United Overseas Bank, and Malaysian CIMB. (See below) In recent months, loans from BCA, Mizuho and CIMB visibly increased.

Bank Loans and Trust Receipts to Indofood & Subsidiaries

(Maximum Credit Facility Limits, Unit: Million USD)

Source: Indofood Financial Statement September 30 2019

Following Indofood’s RSPO termination, several Western banks cut ties with Indofood, notably Standard Chartered, Rabobank and Citi. What distinguishes these banks from their Asian peers are clear financing policies that require clients to comply with host country laws and regulations, be RSPO members, and commit to a time-bound action plan to achieve RSPO certification. Indofood was clearly in noncompliance with these policies since March. Evidence of Indofood’s labor abuses had already prompted Citi to stop lending to Indofood’s palm oil operations in April 2018.

In stark contrast, the three Japanese megabanks as well as ANZ and DBS have continued to lend to Indofood with hundreds of millions of dollars in spite of clear evidence of noncompliance with their lending policies, raising significant doubts about their commitment and ability to ensure compliance. All three Japanese megabanks recently adopted policies that require palm oil clients to operate legally and, in varying degrees, sustainably. SMBC Group, for example,stipulates that they “will not provide financial support to Palm Oil plantation companies that are involved in … human rights violations such as child labor”; and they “will check that internationally accepted external certifications such as RSPO or other equivalent certifications are obtained or expected to be obtained.” Indofood is currently only certified with the Indonesian Sustainable Palm Oil certificate, which is far weaker than the RSPO. MUFG similarly prohibits financing of child labor and “request[s] clients to submit action plans to achieve [palm oil] certification” with a preference for the RSPO. Mizuho has the weakest policy among the three banks, but states that they will “take into consideration whether the client/project has received certification for the production of sustainable palm oil.” A reasonable interpretation of these commitments should rule out further financing of Indofood. Instead, all three banks have continued to make new loan commitments.

As for the remaining financiers, DBS and ANZ prohibit financing of clients engaged in labor exploitation in the palm oil sector, which should automatically exclude Indofood. Meanwhile, BCA, Bank Mandiri, CIMB and UOB lack explicit ESG criteria that would exclude Indofood financing.

The OECD Guidelines for Multinational Enterprises and the accompanying guidance for banks issued last month make clear that banks have a responsibility to prevent or mitigate actual or potential adverse impacts on issues such as labor exploitation that are directly linked to the bank’s clients. Where the harms are foreseeable, the Guidelines indicate that banks may even be implicated in contributing to the harms, in which case they are responsible for remediation. As OECD banks, ANZ and all three Japanese megabanks risk violating these Guidelines as well as damaging their global reputation. Indofood’s unsustainable business model and market risks should also worry banks on financial grounds.

The Role of Investors

While banks are the dominant source of capital for Indofood, institutional investors also play a role in facilitating Indofood’s Conflict Palm Oil by accounting for 10% of its palm oil expansion capital. According to the OECD Guidelines for Multinational Enterprises, investors also have a responsibility to mitigate the harms, even when they have a minority stake.

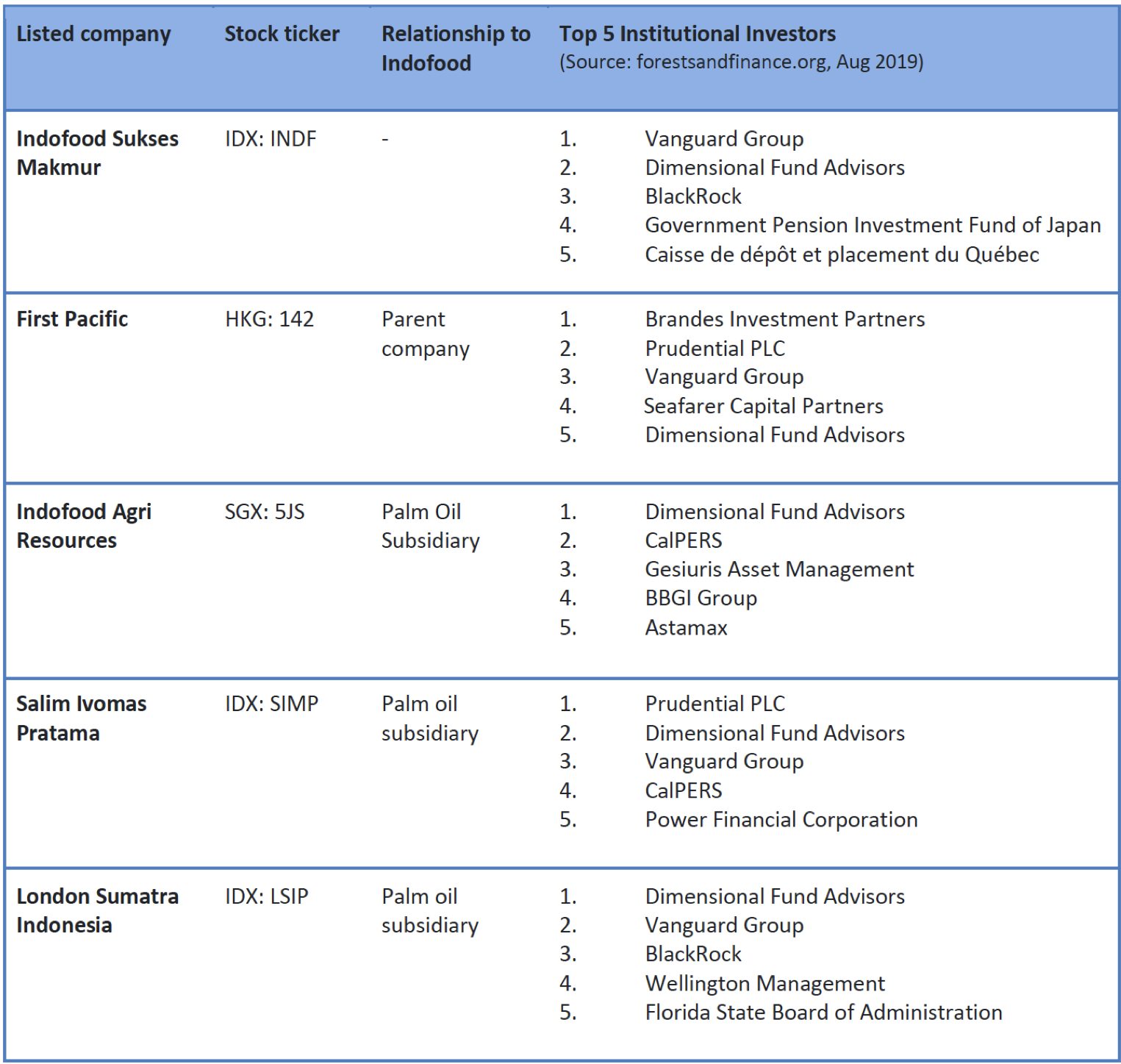

Investors have exposure to Indofood’s ESG risks through Indofood, its parent company First Pacific and several of its publicly listed palm oil companies. Below is a list of the top 5 institutional investors for each of these companies.

In general, the response by investors has been disappointing and contradictory. One of the first to publicly divest from Indofood was the Norwegian Government Pension Fund Global (Norges Bank), the world’s largest sovereign wealth fund. It withdrew its investments from Indofood Agri Resources and First Pacific because they “were considered to produce palm oil unsustainably.” However, they continue to be invested in Indofood CBP (Indofood’s food and beverage subsidiary), which relies on Indofood’s Conflict Palm Oil for production of packaged products. In 2016, Dimensional Fund Advisors removed all palm oil companies from two of its sustainability portfolios, which included a subsidiary of Indofood – Indofood Agri Resources (which recently went private). But Dimensional’s other funds continue to be heavily invested in Indofood. Meanwhile, BlackRock’s CEO has called on all of its investee companies to make “a positive contribution to society” and to “benefit all of their stakeholders.” That has led to engagement with Indofood, but not to noticeable improvements in Indofood’s operations.

In April of this year, 56 investors affiliated with the UN-supported Principles for Responsible Investment (PRI), with approximately $7.9 trillion in assets under management, highlighted their support for the RSPO and called for all companies across the palm oil value chain, including producers, refiners, traders, consumer goods manufacturers, retailers and banks, to adopt and implement a publicly available No Deforestation, No Peatland and No Exploitation (NDPE) policy and achieve full traceability of palm oil to the plantation. While none of these investors are among the top five investors of Indofood or its related companies, some are minority shareholders, and many hold shares in the banks mentioned above. Indofood’s policy falls short of the NDPE standard as it fails to apply at a corporate group level, and fails to require compliance with the full set of international human rights norms or grievance resolution in line with the UN Guiding Principles on Business and Human Rights. Among its bankers, only Standard Chartered, Rabobank, DBS, and ANZ have explicitly incorporated NDPE into their policies. Investors need to ensure responsible palm oil by demanding better policies and practices that are aligned with NDPE.

Recommendations for banks, investors, and regulators

Institutions providing financial services to Indofood and the wider Salim Group share a responsibility for the harmful environmental and human rights impacts resulting from its palm oil operations. Banks and investors can and should use their leverage to demand the following of Indofood and other Salim Group companies:

- A publicly available time-bound implementation plan that addresses the labor abuses identified by the RSPO;

- Establishment of a credible grievance mechanism that is aligned with the UN Guiding Principles on Business and Human Rights and independently verified corrective actions to remedy documented labor violations and existing land conflicts;

- A commitment to immediately cease all new plantation development until compliance with the requirements of the High Carbon Stock Approach is verified and investment is made in the restoration of the degraded peatlands; and

- Adoption of a comprehensive NDPE policy that applies to the entire Salim Group, including Anthoni Salim’s shadow companies, as well as all third party suppliers.

Banks and investors should ensure that their continued financing of Indofood is contingent on satisfaction of these demands, and where that’s not possible, to divest from the company as Citi, Rabobank and Standard Chartered have done. Regulators should ensure that banks and investors are properly disclosing these risks in their portfolios, rigorously addressing them, and reporting on progress to all relevant stakeholders. Indofood should be considered an important litmus test for the financial sector’s commitment to sustainability.