News

New database names companies excluded by global investors and banks

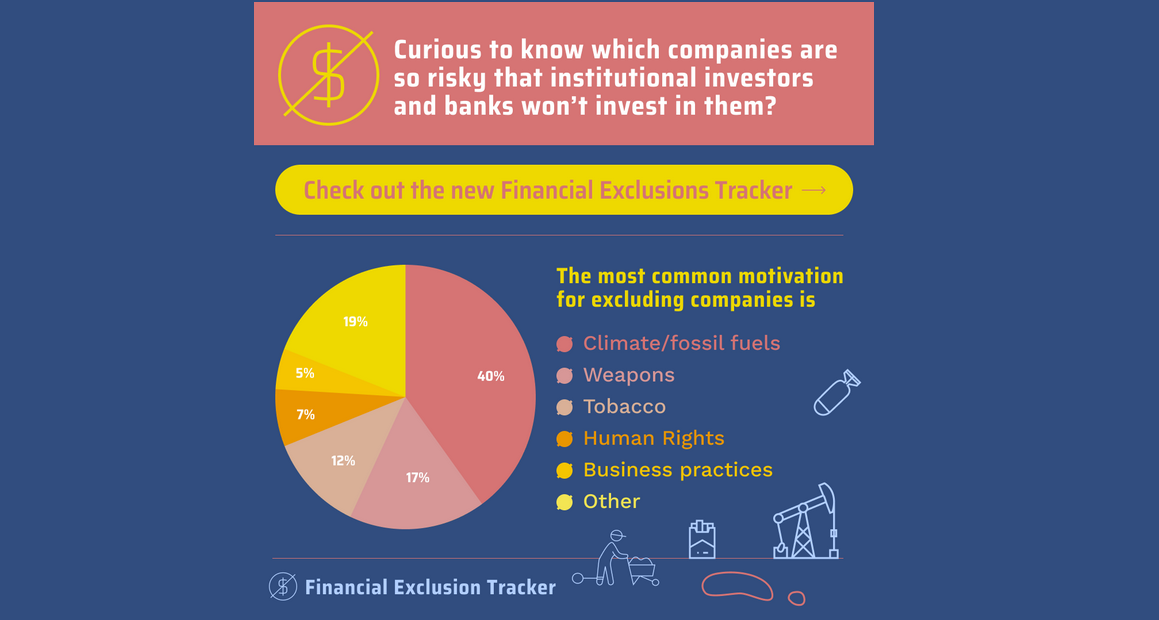

A coalition of NGOs today launched the Financial Exclusions Tracker http://financialexclusionstracker.org/ a new website that tracks which companies are being excluded by investors and banks for sustainability reasons. Most excluded corporations are barred due to links to fossil fuels, weapons or tobacco.

This public dataset is the first of its kind. It aims to inform investors and banks, civil society and media about which corporations are excluded by investors. The tracker lists a total of 4,532 companies that have been excluded by 87 financial institutions in 16 countries.

The coalition expects the list to put additional pressure on those identified companies to change their practices. Local communities, civil society, investors and governments can use the list to identify the companies with the largest Environmental, Social, and Governance (ESG) risks, as flagged by investors themselves.

Climate as most common reason for exclusion

The most common motivation for excluding companies is climate/fossil fuels (40%) This is followed by controversial weapons (17%) and tobacco accounting for 12% of exclusions. The fourth most prominent reason for exclusion is human rights (7%). Concerns around business practices are a fifth main motive for exclusion. The companies most excluded by investors and banks are:

- Climate change (mainly fossil fuel companies): 1 Cenovus Energy; 2 Suncor; 3 China Energy; 4 ExxonMobil; 5 Shandong Energy

- Controversial weapons (cluster munitions, nuclear etc.): 1 Poongsan; 2 Northrop Grumman; 3 General Dynamics; 4 Larsen & Toubro; 5 LigNex1

- Tobacco: 1 Philip Morris; 2 Altria Group; 3 British American Tobacco; 4 Imperial Brands; 5 Japan Tobacco

- Human Rights: 1 Energy Transfer; 2 Vale; 3 Walmart; 4 OCP Group; 5 ConocoPhillips

- Business practices (corruption, tax evasion, etc): 1 JBS; 2 Gazprom; 3 Elbit Systems; 4 China National Petroleum Corporation (CNPC); 5 Kangmei Pharmaceutical;

The company most excluded is Poongsan Corporation from South Korea, which is excluded by a total of 75 investors and banks due to its involvement in cluster munitions.

Fossil fuel companies do not only feature prominently in the climate category, but also in the categories relating to human rights violations and controversial business practices.

Website shows original motivation for exclusion

The Financial Exclusions Tracker comes with a downloadable full data set in Excel, wherein the original motivation for excluding each company by the financial institution can be found, if provided by the financial institution. It will be updated on a regular basis, as investors and banks regularly add and remove corporations from exclusion lists. The data set is searchable by company, by investor, by country of investor, by country of company, by category and by subcategory for exclusion.

The Financial Exclusions Tracker was originally scheduled to launch on Monday, October 2nd. However, a few hours before the launch, malicious code was injected into the database which brought the website down. Unfortunately, it is not possible to establish the origin or this unauthorised access nor any possible motive for the injection.”

Financial Exclusions Tracker is an initiative by:

BankTrack, Both ENDS, Fair Finance International, Forests & Finance, Health Funds for a Smokefree Netherlands, Milieudefensie (Friends of the Earth Netherlands), PAX, Profundo Research Foundation, Rainforest Action Network, and the Environmental Paper Network.