News

New Report Exposes How Global Banks and Investors Are Still “Banking on Biodiversity Collapse” — Coalition Calls for Financial Regulation to Halt Deforestation

FOR IMMEDIATE RELEASE (00:00 ET / 02:00 BRT / 06:00 CET)

November 5, 2025

São Paulo, Brazil – As world leaders will soon convene in Brazil for COP30, a new report from the Forests & Finance Coalition reveals that finance for sectors driving tropical deforestation has surged since the Paris Agreement. Global banks have poured USD 72 billion into the forest-risk sectors in the last 18 months while investors held USD 42 billion in bonds and shares.

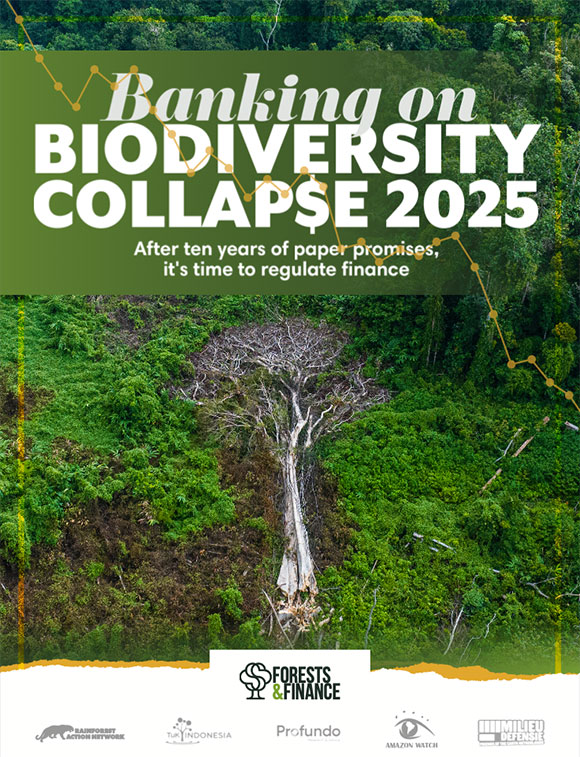

Titled Banking on Biodiversity Collapse 2025: After Ten Years of Paper Promises, It’s Time to Regulate Finance, the report launches today at the Principles for Responsible Investment (PRI) event in São Paulo. It provides the most comprehensive assessment yet of the financial institutions fueling biodiversity loss and Indigenous rights violations linked to forest-risk commodities such as palm oil, soy, beef, and pulp and paper.

The findings show that despite a decade of voluntary pledges and net-zero alliances, harmful financing has continued to surge — with half of the world’s top 30 banks increasing their financing to deforestation-linked sectors and investors increasing their exposure to deforestation by USD 8 billion since Paris.

Key findings include:

- Investors hold USD 42 billion in shares and bonds across 191 forest-risk companies — led by Permodalan Nasional Berhad (USD 3.8 billion), the Employees Provident Fund (USD 3.5 billion) and Vanguard (USD 3.4 billion).

- Institutional investors have increased their investments in forest-risk companies by almost US$ 8 billion since Paris, with investments in palm oil and pulp & paper making up the majority of that increase.

- North American, East Asian and Southeast Asian investors in particular have increased their exposure to forest-risk commodities. Only investments from European investors have decreased since Paris.

- Since 2016, banks have provided USD 429 billion in credit to forest-risk commodity companies, a 35 percent increase.

- Five financial centers dominate this financing: the United States, Malaysia, Brazil, Japan and the UK.

- Some banks have exponentially increased their forest-risk lending — including Canadian Scotiabank (+717%) and Banco do Nordeste do Brasil (+295%).

The coalition calls on governments to close the “accountability gap” by making biodiversity and human rights protection core to financial regulation. Recommendations include: mandatory due diligence on deforestation risk, capital penalties for high-risk lending, transparent disclosure of portfolios, and legal liability for environmental and social harms.

“This decade of self-regulation has been a political choice — not a technical failure,” the report concludes. “If we want to deliver on the Paris Agreement and the Global Biodiversity Framework, governments must move from paper promises to enforceable rules.”

Quotes from author organizations:

Steph Dowlen, Forest Campaigner with Rainforest Action Network: “After ten years of rising finance and investment in commodities driving tropical deforestation, governments must step in with binding rules that make it unlawful to profit from deforestation and rights abuses. Our analysis shows that voluntary promises have failed and the only real world impact was to delay meaningful climate action.”

Marcel Gomes, Executive Director, Repórter Brasil: “In Brazil, the introduction of new instruments to finance agribusiness has attracted a new range of investors, who find tax-exempt securities with higher interest rates. However, the legislation has fallen behind and is no longer able to ensure that investments respect the environment and human rights.”

Katharine Lu, Senior Manager, Friends of the Earth US: “Deforestation will not stop unless governments do their job and make deforestation illegal. The past ten years prove that financiers are fundamentally unable, if not uninterested, in ensuring their financing does not drive and accelerate deforestation. Only real regulation with real consequences can compel the financial sector to stop deforestation in this global moment of twin biodiversity and climate crises.”