Notícias

MUFG Falls Behind Peers in New ESG Finance Policy Announcement

MUFG’s policy revisions “disappointing,” says Rainforest Action Network

Japan’s largest bank, Mitsubishi UFJ Financial Group (MUFG), released a revised Environmental, Social and Governance (ESG) financing policy today, but fell short of its global and domestic peers –– most notably Mizuho Financial Group (Mizuho) and Sumitomo Mitsui Financial Group (SMBC Group).

Rainforest Action Network (RAN), which has been calling out MUFG for years over its financing of destructive palm oil operations and global fossil fuel expansion, denounced the policy revision:

“Amid the current deforestation-linked pandemic, when the UN Environment Programme (UNEP) has said that the need to address threats to ecosystems and wildlife has never been greater, this policy represents a failure of leadership. We are deeply disappointed,” said Hana Heineken, Senior Campaigner on Responsible Finance at Rainforest Action Network (RAN). “With this policy, MUFG has made the decision to prioritize its profits over a stable climate and the world’s last remaining rainforests, both of which are critical to preventing future pandemics.”

Unlike Mizuho, MUFG has failed to commit to incorporate international best practice on forest sector financing, represented by No Deforestation, No Peatland, No Exploitation (NDPE) policies and enshrining local communities’ right to Free, Prior and Informed Consent (FPIC). And unlike SMBC, MUFG has made no commitment to protect forests and biodiversity or prohibit the use of fire to clear land, relying instead on weak certification mechanisms.

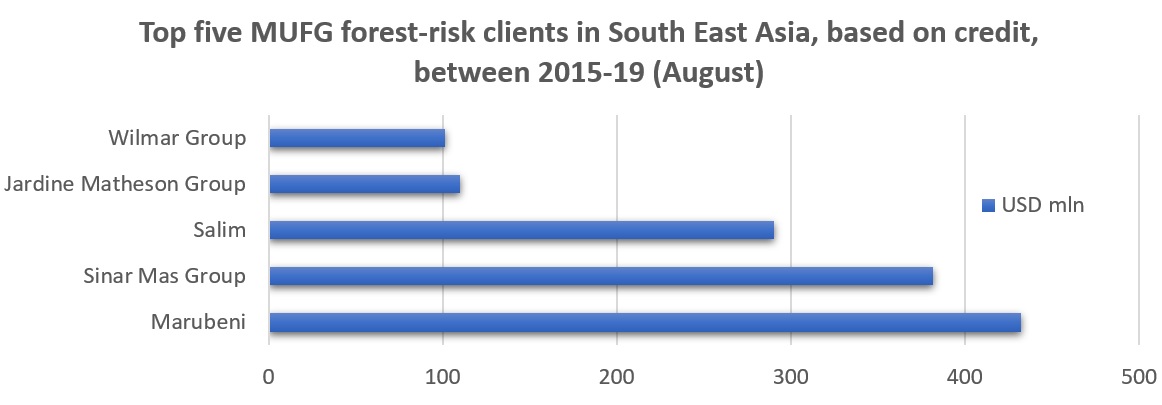

MUFG has been one of the largest global financiers of Conflict Palm Oil and helped finance the climate-destructive forest fires in Indonesia last year. Its top forest-risk clients in South East Asia include Marubeni, Sinar Mar Group, Salim, Jardine Matheson Group and Wilmar.

“MUFG’s policy represents a textbook case of corporate doublespeak. MUFG’s new policy recognizes tar sands and Arctic oil and gas as high-risk sectors, but red line restrictions and a clear phase-out plan are needed if MUFG wants to align with the Paris Agreement. As one of the largest global financiers of rainforest destruction and fossil fuel development, MUFG must commit to strengthening their standards or risk significant damage to its reputation,” said Heineken