Notícias

MUFG Finances a Carbon Bomb in Indonesia’s Peatlands

Key Findings

- Mitsubishi UFJ Financial Group (MUFG) is an important foreign investor in Indonesia’s banking sector, acquiring one of Indonesia’s largest banks, Bank Danamon in 2019. In 2021, MUFG adopted a No Deforestation, No Peatland, No Exploitation (NDPE) policy for its palm oil financing.

- Bank Danamon continues to finance clients in clear breach of MUFG’s policies. In 2020, 2021 and 2022, Bank Danamon issued credit lines totalling $281 million to oil palm company Tunas Baru Lampung (IDX:TBLA), a company with an egregious environmental record related to destruction of peatlands and recurring fires and haze. TBLA clearly did not align with MUFG’s oil palm policy that aligned with the international No Deforestation, No Peatland, No Exploitation (NDPE) standard.

- From 2020-2023, TBLA, financed by MUFG, went on to convert close to 7,800 hectares (19,274 acres) of peatlands in just two neighbouring concessions – one oil palm and one sugarcane – in South Sumatra, driving vast greenhouse gas emissions and fire risk.

- Subsequently, in 2023, these two neighbouring concessions saw huge peatland fires spread over 14,500 hectares (35,830 acres) of land. In 2024, the Indonesian government sued TBLA’s subsidiary for US$ 41.5 million of ecological damage and economic losses.

- TBLA remains a client of Bank Danamon/MUFG, with outstanding loans to the bank until 2026.

- Bank Danamon is not adhering to MUFG’s group-wide Social and Environmental Policies, nor is Bank Danamon complying with its own published NDPE requirement. This represents a serious compliance breach.

Fires caused by the expansion of industrial plantations in peatlands remain one of the largest contributors to Indonesia’s greenhouse gas emissions. They also cause public health crises and cause billions of dollars of economic loss and damage.

Tunas Baru Lampung (IDX: TBLA), a publicly listed oil palm and sugarcane plantation company with plantations in South Sumatra’s peatlands, has been repeatedly linked to widespread fires and breaches of environmental regulations by the Indonesian government, and civil society groups. In October 2024, the Indonesian Ministry of Environment and Forestry (KLHK) filed a civil lawsuit against PT. Dinamika Graha Sarana (PT.DGS), a TBLA subsidiary, alleging ecological and economic damages amounting to IDR 671 billion (around US $42 million) for fires that spread across over 6,303 hectares (15,575 acres) between September and November 2023. However, this subsidiary was not the only TBLA operation to see widespread fires in 2023. A neighbouring concession, PT. Samora Usaha Jaya also saw fires spread across over 5,688 hectares (14.055 acres). RAN wrote to TBLA providing an opportunity to comment on the allegations contained in this post, but the company did not respond.

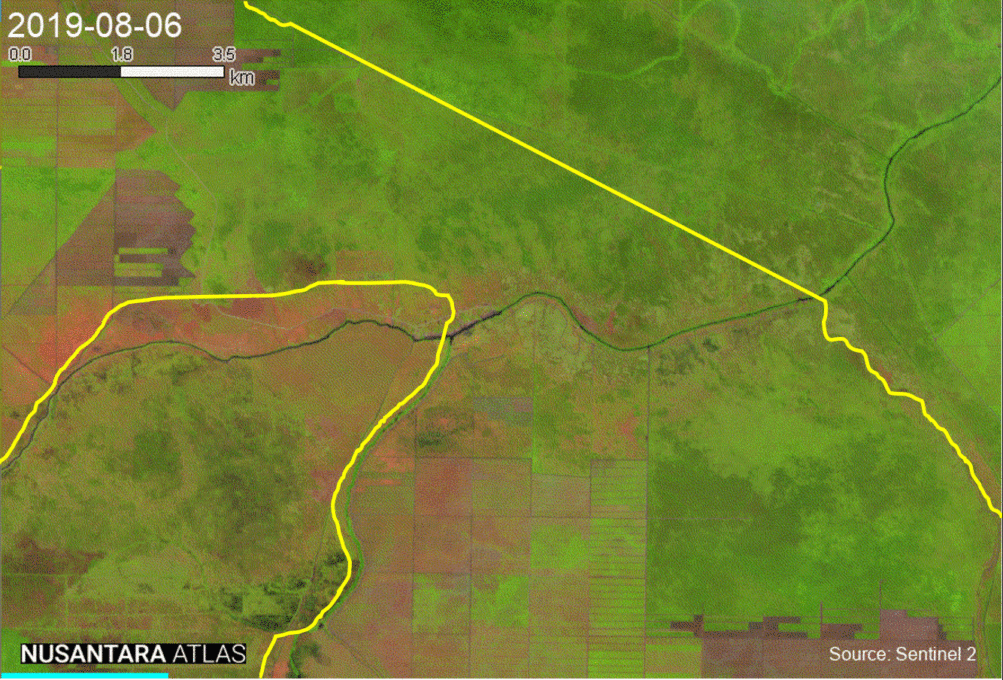

The timelapses below, developed on Nusantara Atlas/TreeMap show a time series of satellite images taken between August 30th – November 13th 2023. Using infrared color, fires and burned areas (dark brown) are clearly visible spreading across the plantation boundaries (yellow).

PT. Dinamika Graha Sarana

PT. Samora Usaha Jaya

Fires are linked to the draining and conversion of flammable peatlands for plantations.

Satellite analysis by RAN estimates that in the three years preceding the 2023 fires (2020-2022), TBLA converted close to 7,800 hectares (19,274 acres) of peatlands across just two of its neighbouring subsidiary concessions in South Sumatra: PT. Samora Usaha Jaya and PT. Dinamika Graha Sarana. Draining peatlands creates fire-prone conditions.

During this period of large scale peatland conversion (2020-2022), TBLA was provided with lines of credit totaling US $281 million by Japanese megabank Mitsubishi UFJ Financial Group (MUFG) – making TBLA third largest client of MUFG in the palm oil sector. This lending occurred despite MUFG moving to a policy in 2021 that required its clients to publicly commit to no conversion of peatlands – part of the international best practice standard of ‘No Deforestation, No Peatland, No Exploitation’ (NDPE).

The financing in question of TBLA came through Bank Danamon Tbk, MUFG’s banking subsidiary in Indonesia that it acquired in 2019. Since then, Bank Danamon’s Sustainability Reports have publicly reflected MUFG’s policy on NDPE. However, Danamon’s lending to TBLA indicates that this NDPE commitment is not being implemented. This compliance breach raises wider concerns in relation to bank controls to address human rights impacts routinely associated with forest-risk sector lending. MUFG’s 2024 Human Rights Report presents its Environmental and Social Policy Framework, as well as its wider Human Rights policies, as applicable to all MUFG Group businesses. Bank Danamon’s failure to follow MUFG group policies on NDPE raises serious questions as to whether its Indonesian subsidiary is also ignoring MUFG Group’s wider Human Rights commitments.

TBLA has a track record of fires and peatland conversion that long preceded the operations above. Satellite analysis allows us to estimate that these two TBLA concessions converted 8,600 hectares (21,251 acres) of peatlands in the years 2015-2019, and saw burned areas of 12,103 hectares (29,907 acres) in 2015 and 15,873 hectares (39,223 acres) in 2019.

Ongoing Fire-Risk and Greenhouse Gas Emissions

To ground these satellite observations, a field team from a local NGO visited PT. Samora Usaha Jaya’s concession in December 2024, and documented multiple locations where carbon-rich peatland has been converted into oil palm plantations in 2020-2022, the period of MUFG financing. This includes areas where repeated fires have occurred.

Video 1 (area around -3.34631°,105.37663°) young oil palms growing in drained peatland. Satellite images from the Sentinel2 (in false color to accentuate burn scar) show this area was badly burned in 2019. It was then converted in 2020-2021 into oil palm plantations.

Video 2 (area around −3.3118°,105.4185°) shows young oil palms growing in drained peatland. This area was converted in 2020-2021 and is an area that burned in 2019, and was subsequently converted to plantations. Satellite images from the Sentinel2 (in false color to accentuate burn scar) show the scale of burning at this location in 2019 and 2023.

Over 80% of palm oil refineries prohibit their suppliers from converting new areas of peatland, under their ‘NDPE’ commitments. While converting peatlands is not necessarily illegal in Indonesia, government regulations require companies operating on peatland to maintain high water table levels to prevent peatlands drying out and losing their hydrological and conservation functions.

The team measured water table depth at 17 different sample sites in three locations across PT. Samora Usaha Jaya. Despite taking the samples in the rainy season, not a single sample site complied with the government mandated depth requirements (of 40cm). The recurring fires, peat conversion and poor water table management indicates that TBLA’s operations continue to destroy the functions of South Sumatra’s peatlands, driving the release of vast greenhouse gas emissions and continued risk of fires and haze.

Timeline of Financing and Fires: MUFG, Bank Danamon and Tunas Baru Lampung

When MUFG acquired Bank Danamon and its clients in 2019, it should have undertaken compliance risk assessments of its clients. A basic level of environmental due diligence, including a review of TBLA’s stated policies would have revealed a company with no NDPE commitment, and a particularly egregious track record on fires and peatland conversion. Indicators of this included:

2015

June – Massive fires start and burn for months across concessions on Indonesia’s peatlands during El Niño period, causing US$16 billion in damages. Large scale fires burn across two TBLA concessions in 2015 (RAN estimates burned area of 12,103 hectares/29,907 acres)

2016

November – Regulatory violations by TBLA – Investigation by the Ministry of Environment and Forestry finds regulatory violations in TBLA subsidiary PT. DGS, including using heavy machinery to excavate peatlands that burned in 2015 for oil palm cultivation.

2018

December – TBLA placed on No Buy Lists – Major palm oil traders including Musim Mas and Wilmar, who cease sourcing from 2018.

2019

January – TBLAx continues to convert peatland areas – From January to December, TBLA converts an estimated 1,300 hectares (3,212 acres) of peatlands into plantations.

May – Japanese megabank MUFG buys Bank Danamon – It acquires 94% of shares in Bank Danamon Tbk, making it its Indonesian subsidiary bank

June – Fires again start and burn for months across Indonesia’s peatlands. An area of 1.64 million hectares burns across the country, causing an estimated US $5.2 billion economic loss and damage.

June – Fires burn for months across an estimated 15,873 hectares (39,223 acres) across TBLA concessions (PT. SUJ and PT. DGS). Click to see time lapse of satellite images showing fires (orange) and burned area (dark brown)Photo: Satellite image timelapse of fires spreading across TBLA concession in 2019

October – The Ministry of Environment and Forestry seal off one TBLA concession due to fires. Photo: InspirasiNews.com

2020

January – MUFG issues massive loans to TBLA – Across the year, MUFG, through Bank Danamon, issues US $58 million revolving credit facility to TBLA.

December – TBLA continues to convert peatland areas – By the end of 2020, TBLA has expanded its plantations into over 2,500 hectares (6,178 acres) of peatland, including areas that burned in 2019.

December- TBLA resigns from RSPO – TBLA resigns as a member of the Roundtable on Sustainable Palm Oil (RSPO).

October – TBLA publicly named as oil palm group with largest fire footprint – Analysis of burnscar data published by Greenpeace Indonesia (2020) alleged TBLA to have the largest burned area of any oil palm company in Indonesia between 2015-2019;

2021

January- MUFG provides more loans to TBLA – During the year, MUFG, through Bank Danamon, provides a further $105 million corporate loans to TBLA.

April – MUFG adopts a new palm oil financing policy. Bank requires clients to publicly commit to the ‘No Deforestation, No Peatland, No Exploitation’ standard. Bank Danamon Sustainability Report states that this is also its policy.

Photo: Protest outside of MUFG’s office in Jakarta in 2021, relating to its links to fires and haze in Indonesia- TuK-Indonesia

December- TBLA continues to convert new areas of peatlands – By the end of 2021, TBLA has converted a further 2,404 hectares (5,940 acres) of peatlands into plantations, including areas that burned in 2019.

2022

January – MUFG provides more loans to TBLA – During the year, MUFG, through Bank Danamon provides a further $103 million corporate loans to TBLA.

December – TBLA convert even more peatland areas – By the end of 2022, TBLA has converted a further 1,600 hectares (3,954 acres) of peatlands into plantations;

2023

June – Fires again burn for months across Indonesia’s peatlands during the dry season – Public health, schools and the economy severely affected by haze. An estimated 1.16 million hectares burned.

Public health, schools and the economy severely affected by haze. An estimated 1.16 million hectares burned.

June – Massive fires again burn across TBLA concessions – Fires burn across 14,544 hectares (35,939 acres) within TBLA concessions PT. DGS and PT. SUJ.

Photo: Satellite image captures fires burning inside TBLA concession in September 2023. Image from Sentinel2 using TreeMap/Nusantara Atlas

2024

October – Indonesian government sues TBLA subsidiary – The Ministry of Environment and Forestry sues TBLA subsidiary PT. DGS for US$ 41.5 million worth of ecological damage and economic losses linked to fires in 2023.

Photo: New areas of plantation on peatlands in PT.SUJ. December, 2024

2025

December – TBLA remains a client of Bank Danamon/MUFG – TBLA remains a client of MUFG, and continues to profit from corporate loans it provided to TBLA, the last of which – $32. 4 million – matures in 2026.

Originally published on Rainforest Action Network