Notícias

Financiers’ risks in the Indonesian pulp & paper sector

A report by TuK Indonesia and Profundo found that financing in the pulp and paper sector exposes financiers to high ESG risk. Of the 8 researched pulp & paper companies, all were found to be implicated in some form of ESG issue. The identified issues include, among others:

- Environmental issues, such as deforestation, development on (deep) peat, development of HCV forests area, used of fire for land clearing, fire hotspots, and contamination of water sources.

- Social issues, such as land grabbing, land conflicts, and labour issues (e.g. unpaid wages).

- Governance issues, such as bribery, corporate structures potentially designed to facilitate BEPS, and nonconformance with government regulations. The company structures of a number of these companies are also potentially designed to facilitate base erosion and profit shifting (BEPS) and transfer mispricing (tax avoidance strategies).

In spite of these serious ESG issues, the eight researched companies received at least US$ 18 billion in pulp & paper attributable loans and underwriting services in the period 2013 to June 2018. Almost 80% of this credit came from financial institutions based in East Asia, and 15% came from Indonesian financial institutions.

Financial institutions can prevent exposure to the ESG risks of their financial companies with utilizing ESG risk mitigation frameworks. One of frameworks pillar is an ESG risk mitigation policy related general policy of human rights and environmental standards, which is the policy of financial institutions expected that each the companies as well as financing partnership conducted the ESG risk policy, specifically each sectors that their clients operation like forest commodities, mining or manufacturing.

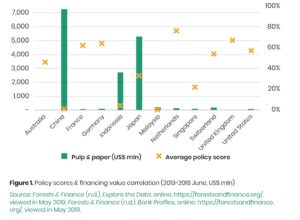

An analysis of assessments of forest commodity sector specific ESG risk mitigation policies found that financial institutions scored on average 28% in total for all categories of assessment.

They scored better in terms of the scope of their commitments and the social standards they expect of their clients, scoring on average 37% and 30% respectively for these categories.

The expected of the environmental and governance standards of their clients have scored comparatively lower, at 27% and 21% respectively. There were significant differences in the scores of financial institutions from different jurisdictions. Figure 1 shows that financial institutions with higher average policies scores provided comparatively little financing to the companies active in the pulp & paper sector in Indonesia. The financial institutions that provided the highest levels of finance – i.e. those from China, Japan and Indonesia – also had the poorest policies.

Notably, Indonesian and Chinese financial institutions scored 0% in the environmental and social

standards to they expect of their clients. This particularly disconcerting given the findings that the majority of ESG related issues the selected companies were implicated in relate to environmental and social issues.

Corporate practices of companies active in the pulp & paper sector in Indonesia can translate into financial risks for the financial institutions that supported by them. For example, if a company has land rights conflicts with communities in its concessions, it may violate the NDPE policies of its buyers, meaning that the buyers will terminate the relationships, resulting in lower revenues for the company, reducing free cash flow decreasing its ability to repay its loans, putting pressure on the solvency ratios of the banks that finance it, reducing their profitability.

Similarly, if a company engages in the development of pulp & paper timber plantations on peat land it will violate Indonesian government policy, meaning that those concessions become stranded assets, reducing the collateral value of the concessions which banks rely upon in their credit agreements, putting pressure on the solvency ratios of the banks that finance the company, ultimately reducing the profitability of those banks.

Therefore, financial institutions are encouraged to be urged to develop policies in managing and reducing ESG risks. Financial institutions must make these policies and be available to the public, so that they can carry out public oversight which will ultimately produce stronger and better and more complete policies in managing and reducing the ESG risk of the funded company.

The companies assesseds are:

• Alas Group;

• Asia Pulp & paper (APP);

• APRIL Group;

• Djarum Forestry;

• Kertas Nusantara;

• Korindo Group;

• Marubeni Corporation; and

• Oji Holdings Corporation.

Download Financiers’ risks in the Indonesian pulp & paper sector