最新記事&分析

Why are banks and investors still funding Indofood?

Palm oil workers resist ongoing labor abuses from Indonesian noodle giant

This month, 10 banks committed another $2.1 billion in loans to Indonesian noodle giant Indofood CBP Sukses Makmur – whose instant noodles rely on Conflict Palm Oil produced by its palm oil subsidiary London Sumatra (Lonsum). The syndicated loan was used to acquire 100% of noodle maker Pine Hill, and was led by Bank of China, BNP Paribas, Mizuho Financial Group, Natixis, OCBC Bank and Sumitomo Mitsui Banking Corp (SMBC).

Indofood CBP is the food & beverage manufacturing arm of Indofood Sukses Makmur (Indofood), the largest food company in Indonesia and the 2nd largest palm oil company in Indonesia based on the amount of land area it controls. Both companies are part of the Salim Group that’s headed by Anthoni Salim, the notorious Indonesian tycoon who concurrently serves as the President Director of Indofood CBP, CEO of Indofood, and Chairman of Indofood’s parent company First Pacific.

Unfortunately, this recent loan to Indofood CBP is just one of many loans and other financing that’s greasing Indofood’s wheels while the company is being investigated for multiple allegations of labor exploitation in Indofood’s palm oil operations, a number of which have persisted for years.

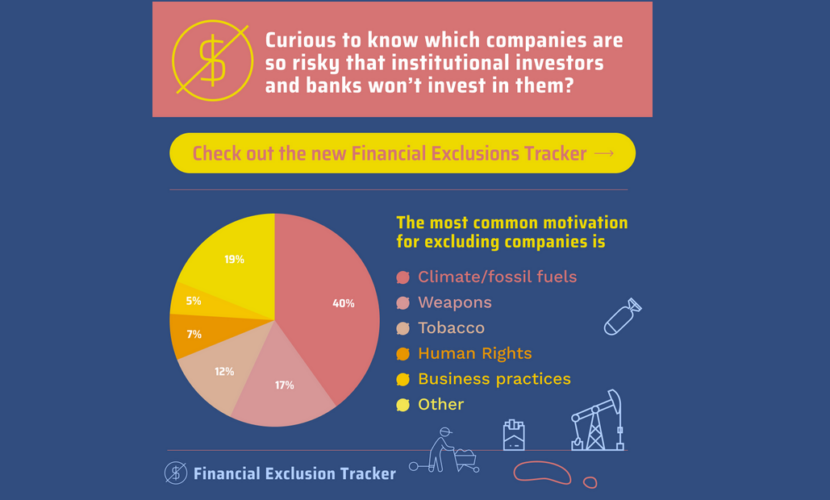

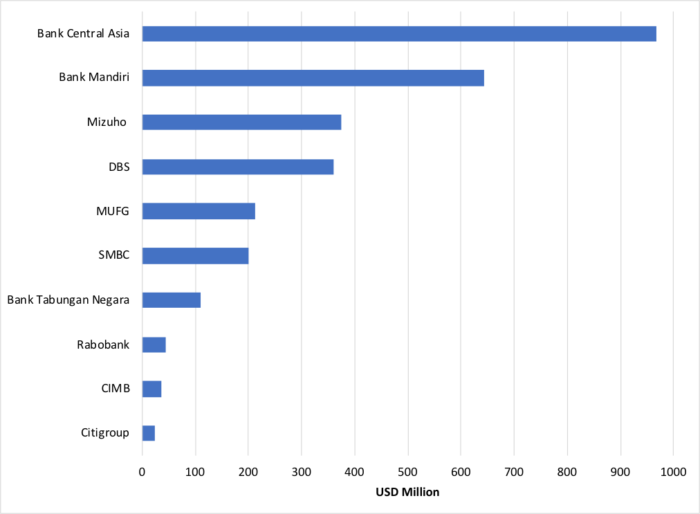

Some banks, like Citigroup, Rabobank and Standard Chartered, made a conscious decision last year to sever their ties with Indofood, when the company got ousted from the Roundtable on Sustainable Palm Oil (RSPO) certification scheme over violations of over 20 RSPO standards, including 10 violations of Indonesian labor laws.

But Indofood’s 2020 financial statements shows that Indofood is still receiving billions of dollars in loans, led by Indonesian banks Bank Central Asia (BCA – previously owned by Anthoni Salim) and Bank Mandiri, Japanese banks SMBC, Mizuho, and Mitsubishi UFJ Financial Group (MUFG), Singaporean bank DBS, and Malaysian bank CIMB. Among these, BCA, Bank Mandiri, SMBC, and DBS have been among the largest direct financiers of Indofood’s palm oil subsidiaries, with commitments in the hundreds of millions of dollars. (See our analysis below)

Banks aren’t alone. Brands continue to source from and maintain business relationships with the Salim Group. Public mill lists of Colgate-Palmolive, Mondelez, and Kao continue to list some Salim Group mills, while PepsiCo has taken public action to end direct and indirect sourcing from the Salim Group but maintains a joint venture partnership with Indofood for some of its products in Indonesia.

Ongoing abuses on Indofood’s palm oil operations

Our partners OPPUK and independent workers’ union SERBUNDO have been carefully documenting the continued allegations of exploitation of workers by Lonsum, and taking measures to protect their rights, by bringing lawsuits and appealing to the local Government over claims of intimidation, union busting, arbitrary dismissal of hundreds of workers, temporary employment and other labor abuses.

Instead of meaningfully engaging with the workers over these grievances, Lonsum fired 19 of SERBUNDO’s local branch officers. This prompted allegations of union busting, a criminal offence that police are investigating. Lonsum also attempted to compel at least two SERBUNDO union officers to retire below the retirement age, which is being litigated in Court. These dismissals are critically cutting the union’s capacity to defend and advocate for their members.

The workers aren’t giving up, and fortunately the courts are beginning to give them the justice they deserve. SERBUNDO filed six lawsuits against Lonsum in February 2020, involving twelve workers, over claims of arbitrary dismissal, unpaid severance pay and unlawful employment terms. On November 4th, the court partially ruled in favor of the workers, stating that by law their temporary work agreements should have been considered permanent and ordered Lonsum to pay the workers their severance pay accordingly, totaling over IDR 500 million (USD 30,000). It wasn’t a full victory, but the court’s acknowledgement that the workers were being deprived of the benefits they deserved was a significant win for SERBUNDO and its members.

Holding banks, investors, and brands accountable

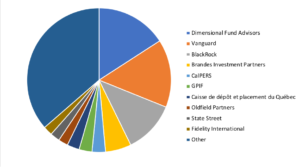

RAN recently sent a letter to more than two dozen banks and investors that are still financing Indofood and other companies within the Salim Group. The letter detailed multiple allegations of the ongoing labor exploitation by Indofood and why the continued financing and investment in Indofood and its related companies are unsustainable and inexcusable.

With recent passage of the controversial Omnibus Law on Job Creation in Indonesia, which drastically weakened labor laws in Indonesia, the risk of labor exploitation for palm oil workers is now worse.

That’s why we’re calling on banks, investors, and brands to exit any current financing and sourcing relationships with Indofood and the other Salim group companies, and steer clear of any future financing or sourcing until these problems are addressed. We owe that to the workers.