最新記事&分析

Investors Increase Pressure on Japanese Companies to Take Urgent Climate Action

Market Forces

Kiko Network

FoE Japan

Rainforest Action Network

Japan’s largest banks and power companies have faced a record number of shareholders backing proposals calling for greater action and transparency on meeting net-zero carbon emissions targets.

Mitsubishi Corporation, two utilities Tokyo Electric Power Company Holdings (TEPCO) and Chubu Electric Power Co who jointly own JERA, the largest thermal power generator in Japan, and three mega-banks, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group and Mizuho Financial Group, are all feeling the heat from shareholders calling for disclosure on how their investments are aligned with achieving global climate goals.

The shareholders from a range of civil society organizations or their representatives, include, Friends of the Earth Japan, Kiko Network, Market Forces, and Rainforest Action Network.

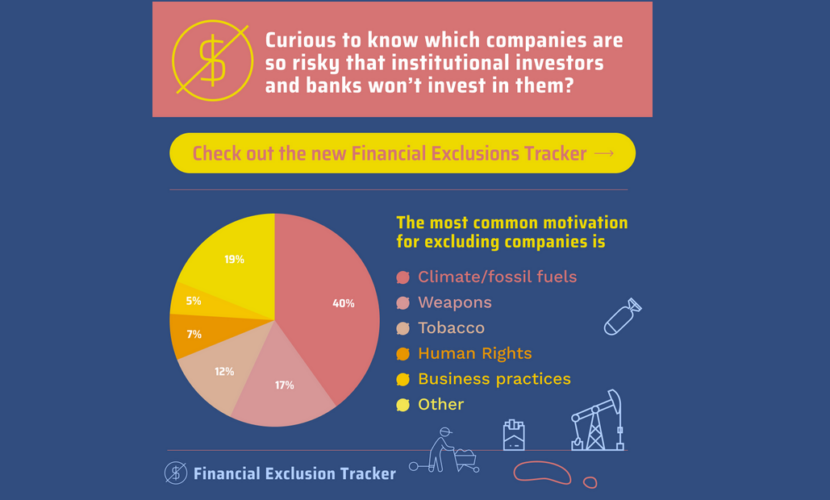

The results demonstrate that the tide has turned for companies failing to align their business practices with the growing risks due to the climate crisis. There is a strong global momentum of institutional investors and shareholders who are demanding action to counter these grave threats.

| Company (Ticker) | Shareholder Proposal | Shareholder’s support (%) |

|---|---|---|

| Mitsubishi Corporation (JP: 8058) | Proposal 5: Partial amendment to the Articles of Incorporation (adoption and disclosure of short-term and mid-term greenhouse gas emission reduction targets aligned with the goals of the Paris Agreement) | 19.84% |

| Mitsubishi Corporation (JP: 8058) | Proposal 6: Partial amendment to the Articles of Incorporation (disclosure of how the company evaluates the consistency of each new material capital expenditure with a net zero greenhouse gas emissions by 2050 scenario) | 12.42% |

| TEPCo (JP: 9501) | Proposal 2: Partial amendment to the Articles of Incorporation (Alignment of capital allocation with a net zero by 2050 pathway) | 9.86% |

| Chubu (JP: 9502) | Proposal 10: Partial amendment to the Articles of Incorporation (Alignment of capital allocation with a net zero by 2050 pathway) | To be disclosed in a few days |

| Mitsubishi UFJ FG (8306) | Proposal 3: Partial amendment to the Articles of Incorporation (issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050) | To be disclosed in a few days |

| Sumitomo Mitsui FG (JP: 8316) | Proposal 3: Partial amendment to the Articles of Incorporation (issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050) | To be disclosed in a few days |

| Mizuho FG (JP: 8411) | Proposal 2: Partial amendment to the Articles of Incorporation (issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050) | 19.85% |

Mitsubishi Corporation

Meg Fukuzawa, Energy Finance Campaigner, Market Forces said:

“Investors representing close to 2 trillion yen ($US14 billion) have sent a strong message to Mitsubishi. Nearly 20 per cent of shareholders have voted in favour of a proposal requesting the company disclose its short and mid-term emission reduction targets aligned with global climate goals. Investors are unsatisfied with the progress Mitsubishi has made on climate-related disclosures and are demanding greater action to achieve net zero emissions by 2050.”

Ayumi Fukakusa, Campaigner, Friends of the Earth Japan said:

“While Mitsubishi has made some progress in their climate-related disclosures since our shareholder proposal in 2022, the company has not yet set sufficient reduction targets or other targets to stem the climate crisis. Furthermore, the recent energy crisis has shown that deepening our dependence on fossil fuels will not only exacerbate climate change, but would bring bigger concerns to our energy security. Although our proposal was rejected, we will continue our engagement with Mitsubishi to update the policies of the company.”

Chubu Electric

Yasuko Suzuki, Program Coordinator, Kiko Network said:

“Chubu Electric Power’s roadmap to 2050 lacks feasibility and specificity. The company insists that it can achieve its goals by fading out low-efficient coal-fired power plants and co-firing ammonia at high-efficiency coal-fired power plants, but specific reduction measures are not clear yet. The involvement of JERA, a subsidiary of TEPCO and Chubu, in new fossil fuel projects both in Japan and abroad and in the expansion of ammonia co-firing as a decarbonization measure under GX is another issue. We continue to call for Chubu Electric Power and JERA to fulfill their responsibilities to achieve the 2050 Net Zero goal.”

TEPCO

Takako Momoi, Manager of Tokyo Office, Kiko Network said:

“TEPCO has set a net zero 2050 target, but its roadmap lacks specificity and it has not disclosed the information on which it is based to achieve zero emissions by 2050. Particularly, TEPCO’s subsidiary JERA, which is the largest CO2 emitter in Japan, plans to start commercial operation of new unabated coal power plants, with Taketoyo last year and Yokosuka this year (Unit 1) and next year (Unit 2). As a result, emissions are expected to increase, but TEPCO has not been held accountable for this expected increase in emissions. Although our shareholder proposal was rejected, we will continue to request the disclosure of information regarding the pathway to net zero by 2050 .”

MUFG, SMFG, and Mizuho FG

Toyoyuki Kawakami, Japan Representative, Rainforest Action Network said:

“At the MUFG shareholders’ meeting, the company said the materiality of the woody biomass power generation is relatively less than financing fossil fuels such as coal, but stated that ‘If materiality of the woody biomass power generation increases, we will consider taking action’. This can be called a step forward. Although the three megabanks as a whole are gradually gaining a better understanding of the issues of woody biomass power generation, they have yet to calculate greenhouse gas emissions and formulate a strict regulation policy. In the future, if more woody fuels are co-fired with coal-fired power generation, emissions will certainly increase and lead to life extensions of coal-fired power generation and it would be impossible to realize proper energy transition and decarbonization. ”

Eri Watanabe, Japan Energy Finance Campaigner, Market Forces said:

“One in five Mizuho shareholders have supported our proposal showing strong investor concern that the bank’s investment and financing of fossil fuels and its reduction targets are inconsistent with its 2050 net-zero commitment. Shareholders of MUFG and SMFG including ANIMA, Italy’s largest asset manager, and other institutional investors with assets worth €187 billion (MUFG) and €278 billion (SMFG) have supported the shareholder proposals. Any financing of new gas development and LNG facilities contradicts climate science and poses significant unacceptable financial risk to investors. Investors are demanding appropriate financial and ESG risk assessments. It’s vital that Mizuho and the megabanks urgently adopt policies that limit investment in new oil and gas aligned with the global climate agreement, rather than relying on government policies, which are inconsistent with climate science.”

Yasuko Suzuki, Program Coordinator, Kiko Network said:

“All three megabanks have updated or strengthened their policies in these years; however, listening to the board members’ explanations and answers to the questions at AGMs, I am compelled to feel that there are still gaps in their sense of urgency regarding the climate change and meaning for funding fossil fuel related businesses, which are the primary cause of climate change. As long as they follow the Japanese government’s policy, they will be left behind in the global movements toward net zero. I hope the private companies including banks will become the driving force of Japanese decarbonization measures. ”

Background for editors:

Record numbers of climate-related shareholder proposals in 2023

Various investors voiced serious concerns to global companies in 2023. Shareholders of financial institutions have been calling for a comprehensive transition from lendings to and investment in carbon-intensive businesses to low-emitting sectors. Proposals calling for credible climate transition plans received high levels of support at JPMorgan (35%), Wells Fargo (31%), Goldman Sachs (30%), and Bank of America (29%). This global sense of urgency with fossil fuel financiers explains the reasons why all 3 mega-banks, who are among the top fossil fuel financiers in the world, faced shareholder resolutions at the same time in 2023.

In Japan, shareholders of Toyota Motors voted for the first time on a climate-related resolution this month, focused on its lobbying activities filed by 3 European investors. The investor pressure followed research from InfluenceMap ranking Toyota as the 3rd-worst anti-climate policy lobbyist in 2021. Also, J-Power faced climate resolutions from Amundi, HSBC Asset Management, and ACCR (Australasian Centre for Corporate Responsibility) two years in a row. The coalition of climate groups (Market Forces, Kiko Network as organizations and individuals from FoE Japan, and Rainforest Action Network) have lodged seven shareholder proposals in total to six Japanese companies.

Effects of shareholder proposals

Investor engagement, triggered by shareholder proposals, has played a key role in these efforts.

Market Forces filed a shareholder proposal with Sumitomo Corporation in 2021. The proposal achieved a 20 per cent vote in favour. Following the result, Sumitomo Corporation made improvements to their coal policy and announced their withdrawal from the Matarbari 2 coal power station in Bangladesh in February 2022. The government of Japan halted financial support to related projects in the country in June 2022.

In 2022, 350.org Japan, RAN, Kiko Network and Market Forces filed two climate-related shareholder proposals to Sumitomo Mitsui Financial Group (SMFG). After the resolution was filed, the company strengthened the coal mining sector policy to restrict both new and expansion of existing projects as well as related infrastructure development. Plus, in May 2023, the company announced that they are no longer involved with EACOP (The East African Crude Oil Pipeline Project), where its banking arm was playing a key role as a financial advisor to the key project proponent, Total Energy.

In 2021, 350.org Japan, RAN, Kiko Network and Market Forces filed a shareholder proposal to Mitsubishi UFJ Financial Group (MUFG). After the resolution was filed, MUFG announced a portfolio-wide net-zero goal by 2050 and became the first Japanese bank to join the Net Zero Banking Alliance. Mizuho Financial Group and SMBC Group followed suit.

In 2020, Kiko Network filed a shareholder proposal to Mizuho FG and Mizuho became the first bank in Japan to set a coal phase-out target by 2050 (later changed to 2040). The other two megabanks, MUFG and SMBC Group followed this move.

The companies subject to shareholder proposals have also made improvements in disclosure and the expectation is that more will be made once their integrated reports are released later this year.

For further information, including investor briefings and media releases,

please access: Asia Shareholder Action (https://shareholderaction.asia/)