最新記事&分析

Fires, Haze and Finance – Riau connections

Runaway fires in July-August have prompted six Indonesian provinces to declare a State of Emergency.[1]The haze has become an international environmental and public health crisis, and has been described by President Joko Widodo as a national embarrassment.[2]The infernos are have become a recurring pattern in Indonesia’s biggest oil palm and wood fibre producing provinces, where deforestation and peat disturbance are rampant.

Riau Province is Indonesia’s largest grower of both palm oil[3]and wood fibre.[4]Decades of weak governance allowed these industries to rapidly expand without proper regulation, monitoring and enforcement, creating a permissive sector where companies routinely operate without necessary permits, trade in illegal commodities and flout environmental laws. This grey economy has been facilitated by corruption. Two of Riau’s former governors were convicted of corruption, having been bribed for illegally issuing permits to logging and palm oil interests.[5]

The environmental and social impacts of this boom are profound and well documented, but economic and public finance issues are also vital to note. Land fires triggered by plantation expansion in 2015 burned 140,000 ha of land in Riau, and cost the province at least USD 1.4 billion in losses and damage (part of a wider $16 billion bill for Indonesia).[6]Official data shows that January-May this year, wildfires have burned over 40,000 hectares in the province[7]– this figure is likely to jump considerably given the current scale of the crisis in July-August.

Peat drainage is not only fuelling fires but causing land subsidence and increasing flood-risk. Unless urgent mitigation measures are put in place, this is expected to lead to widespread land abandonment. [8]Across the country, the Indonesian government has pledged to restore 20,000 sq2 of damaged peatland, projected to cost USD 4.6 billion (although has so far only budgeted around 5% of this figure).[9]

The long-term costs of crisis management and ecosystem restoration are expected to be absorbed by the government. However, a 2015 investigation by a special committee of Riau Provincial Parliament (DPRD) revealed that Riau has only been taxing a fraction of the enormous profits companies have been earning from liquidating the province’s natural resources (many of these groups have relocated their ownership and financing operations to offshore financial centres to minimize tax contributions in Indonesia).

The findings of this committee were stark, and included:

- Only 35% of Riau’s oil palm plantations have legal land tenure (878,000 ha out of 2.6 million ha), while 65% (1.8 million ha) are plantations that have planted within forest areas, or without permits, or expanded beyond boundaries.

- Riau is collecting less than one third of the potential taxes from the forest and plantation sector due to widespread permit irregularities and manipulation of figures by downstream operators. They estimated annual tax losses of IDR 20 trillion (USD 1.4 billion) per year (equivalent to USD 875 per Riau household/year.[10])

- Routine violation of environmental laws, such as those protecting watersheds

While some media outlets are blaming deforestation and land fires on unsophisticated smallholder operations, committee findings and geospatial analysis draws connections to major wood fibre and palm oil corporations, financed by major domestic and international banks.

Who’s been financing this boom?

The financial sector has a crucial role to play in natural resource governance; conditioning the provision of finance on permit compliance and effective fire prevention, monitoring and reporting potential corruption and tax evasion. More broadly, banks in Indonesia have a requirement to direct more finance towards sustainable businesses and away from exploitative sectors that significantly harm the natural environment.

The findings of the special committee’s study beg the question: did the banks financing Riau’s plantation boom carry out basic legality and permit compliance checks on their clients?

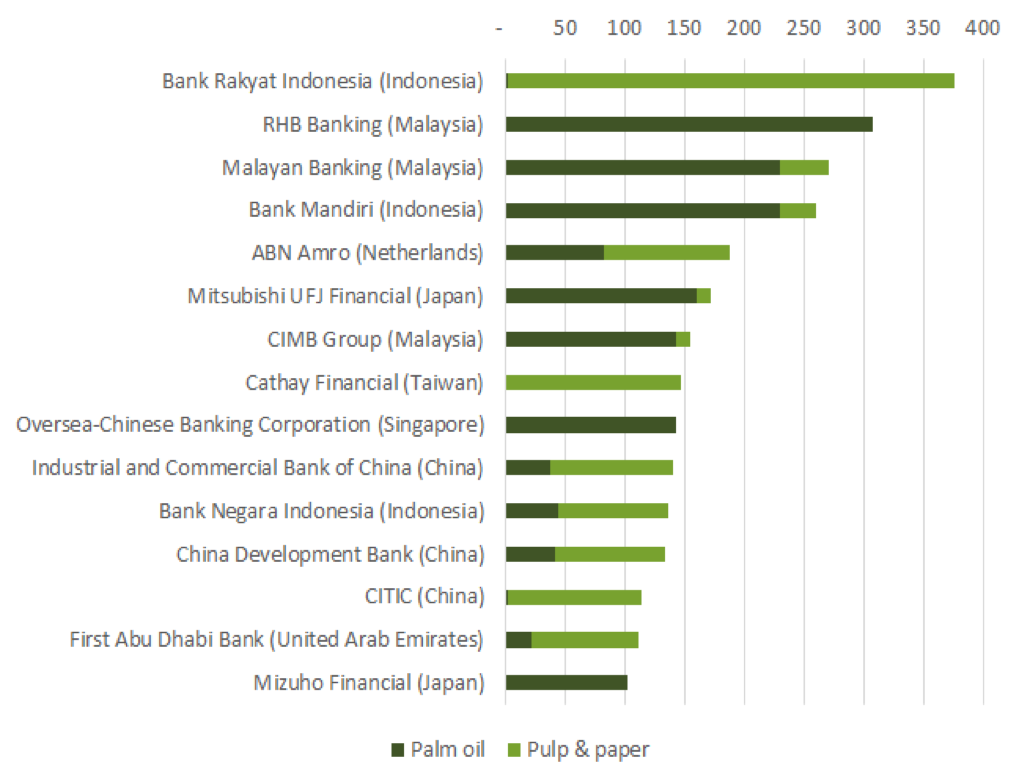

In the period 2010-2018, banks provided an estimated USD 5 billion dollars of loans and underwriting services to companies with oil palm plantations (52%) and industrial tree plantation (48%) operations in Riau.[11]Financial institutions invested USD 1.2 billion in bond- and shareholdings as of December 2018. This is a very conservative estimate as it excludes financing for companies who only have downstream operations like refineries, and also does not capture most financing for privately owned plantation groups.

There are positive signals that Riau’s provincial government is attempting to address the chronic governance problems of its plantation sector. In May, its new governor signed a Memorandum of Understanding with the Riau’s Land Agency, anti-corruption commission (KPK) and Director General of Taxation.[12]Following this, the governor convened a new task force to tackle the huge area of unlicensed plantations operating in Riau.[13]

Government and law enforcement of the sector are the most immediate and powerful tools to tackle the fires and associated illegality. Indonesia’s financial sector, however, has considerable power to incentivize legality and improved standards by suppressing credit and other services to companies acting illegally and unsustainably. Indonesia’s financial regulator the OJK has introduced new regulations requiring their banks to implement sustainable finance (POJK). While this framework is a positive development, the regulations lack teeth and do not yet even require banks to check their clients’ operations are legal.

Top 15 Creditors to palm oil and pulp & paper in Riau (2010-2018 June, US$ mln)

References:

[1]https://www.straitstimes.com/asia/indonesia-battles-fires-as-dry-season-peaks

[2]https://nasional.kompas.com/read/2019/08/06/12231891/jokowi-malu-mau-ke-malaysia-dan-singapura-gara-gara-asap

[3]TuK-Indonesia, (2019), ‘Tycoons in the Indonesian Palm Oil Sector,’ p10 https://www.tuk.or.id/wp-content/uploads/2019/03/Tycoons-in-the-Indonesian-palm-oil-sector_compressed.pdf

[4]Statistik Lingkungan Hidup dan Kehutanan Tahun 2017, pg 167

[5]In 2015, former governor Rusli Zainal was sentenced to 14 years in prison for illegally issuing logging permits to nine companies supplying major pulp and paper giants APRIL and APP (see https://bit.ly/2KtWY5t). In 2015, former governor Annas Maanum was sentenced to 6 years in prison for accepting bribes from the Chairman of Riau’s Oil Palm Growers Association in exchange for issuing forest conversion permits, see https://bit.ly/2YDPx4u

[6]World Bank (2015), ‘Cost of Fire’, p6

[7]https://www.thejakartapost.com/news/2019/08/12/thousands-of-pekanbaru-residents-perform-idul-adha-prayers-amid-thick-haze.html

[8]Deltares (2015), Commissioned by Wetlands International, ‘Assessment of impact of plantation drainage on the Kampar Peninsula, Riau’, p8,https://bit.ly/2ICpL8e

[9]Hansson. A, Dargusch. P, January 2018, ‘An estimate of the cost of peatland restoration in Indonesia’,https://bit.ly/2viCfJy

[10]The 2017 census records 1,598,800 households in Riau, and a population of 6,675,900. National Statistics, 2018, p85-88 https://bit.ly/2H3XrJA

[11]This figure is based on publicly available records of credit to 33 companies with upstream operationsin Riau, and refined by the proportion of their landbank that is in Riau as % of their total landbank.

[12]https://www.riau.go.id/home/content/2019/05/03/7877-gubri-harap-mou-bersama-kpk-dan-ditjen-pajak-dapat-perbaiki-persoalan

[13]https://www.cakaplah.com/berita/baca/2019/08/12/gubernur-bentuk-satgas-penertiban-perkebunan-ilegal-wagub-riau-ketuanya/