Safra Group

markas besar: Brazil

Top 5 Forest-Risk Clients

Credit & underwriting (2016-2022)

-

Brazil Agriculture Finance Program

1790.82 (USD Million) -

Royal Golden Eagle Group

215.15 (USD Million) -

Small-scale Agricultural Operators Brazil

69.78 (USD Million) -

Marfrig

54.6 (USD Million) -

Cooperativa Agroindustrial Alfa

24.59 (USD Million)

5 investasi teratas

Share & bond holdings (latest, 2022)

-

Suzano

255.67 (USD Million) -

CMPC

6.18 (USD Million) -

Minerva

4.99 (USD Million) -

SLC Agricola

3.39 (USD Million) -

Sampoerna Group

2.64 (USD Million)

Note: Red flags are give to companies for which big social and environmental impacts have been documented

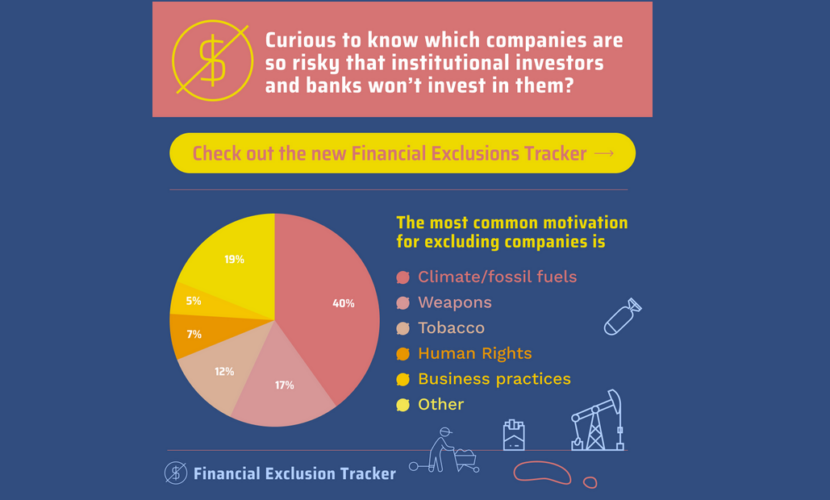

penilaian kebijakan

Weighted Total Score

Environment Total Score

Social Total Score

Governance Total Score

Scores by Sector

| The total scores are calculated based on the weighted average of the sector scores, according to the exposure of the financial institution to each sector. | |||||||

|---|---|---|---|---|---|---|---|

| X.X | X.X | X.X | X.X | X.X | X.X | X.X |

detail penilaian

| The total scores are calculated based on the weighted average of the sector scores, according to the exposure of the financial institution to each sector. | ||||||||

|---|---|---|---|---|---|---|---|---|

| X.X | X.X | X.X | X.X | X.X | X.X | X.X |