発行物

森林と金融_2020

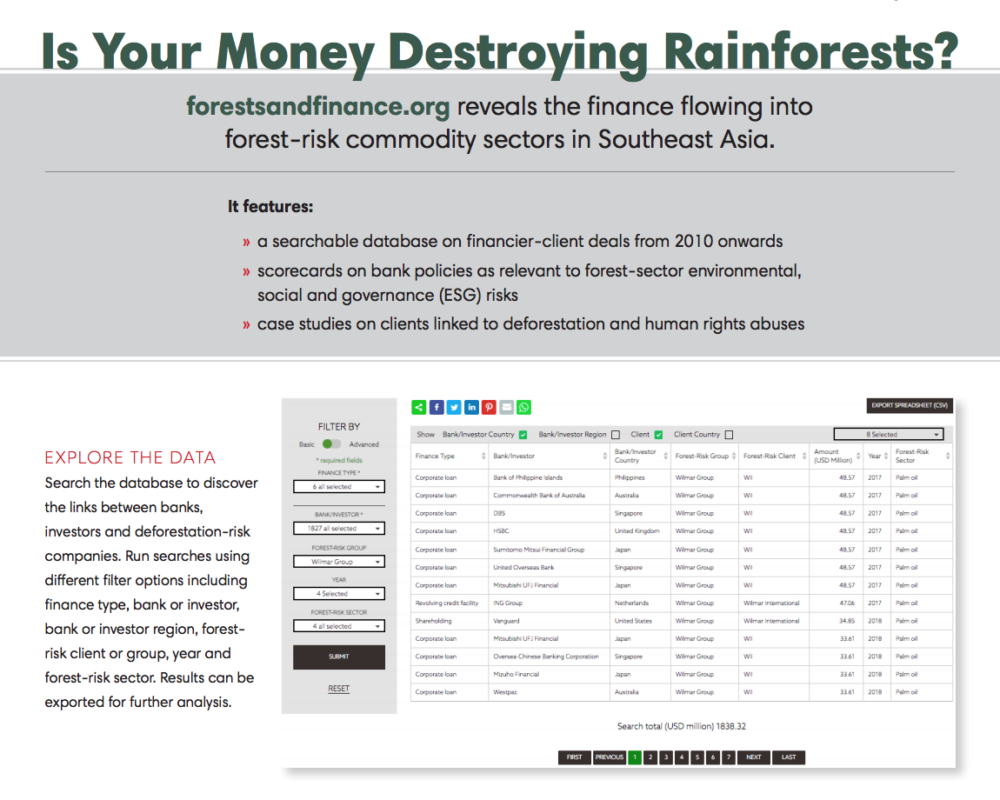

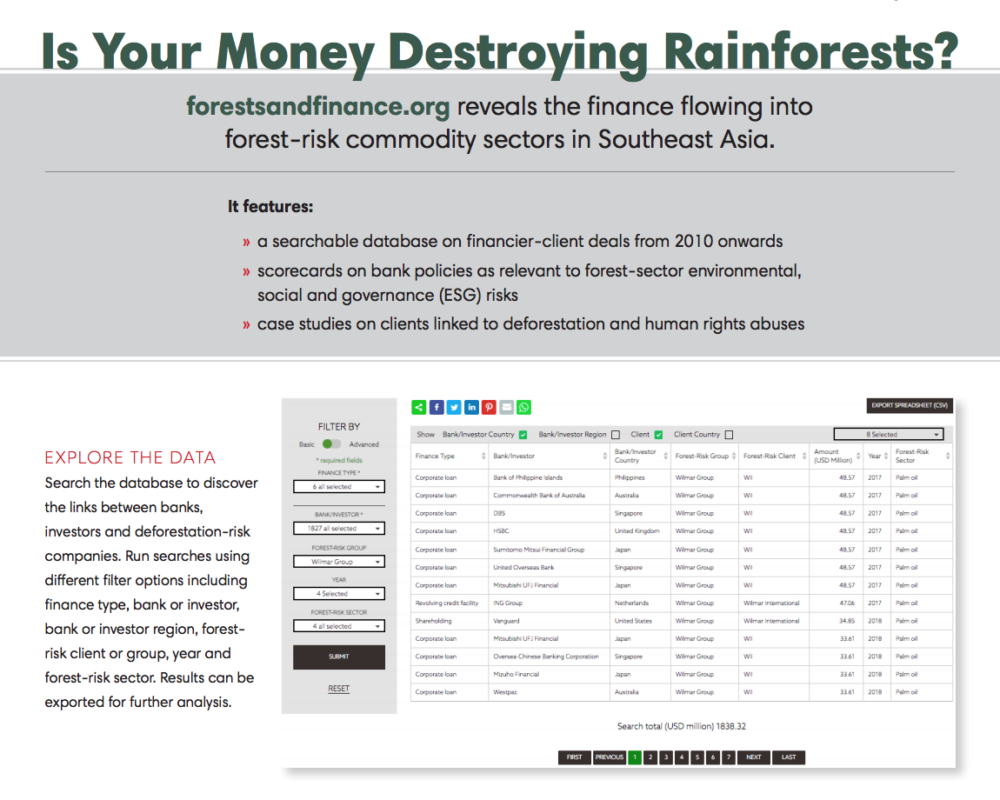

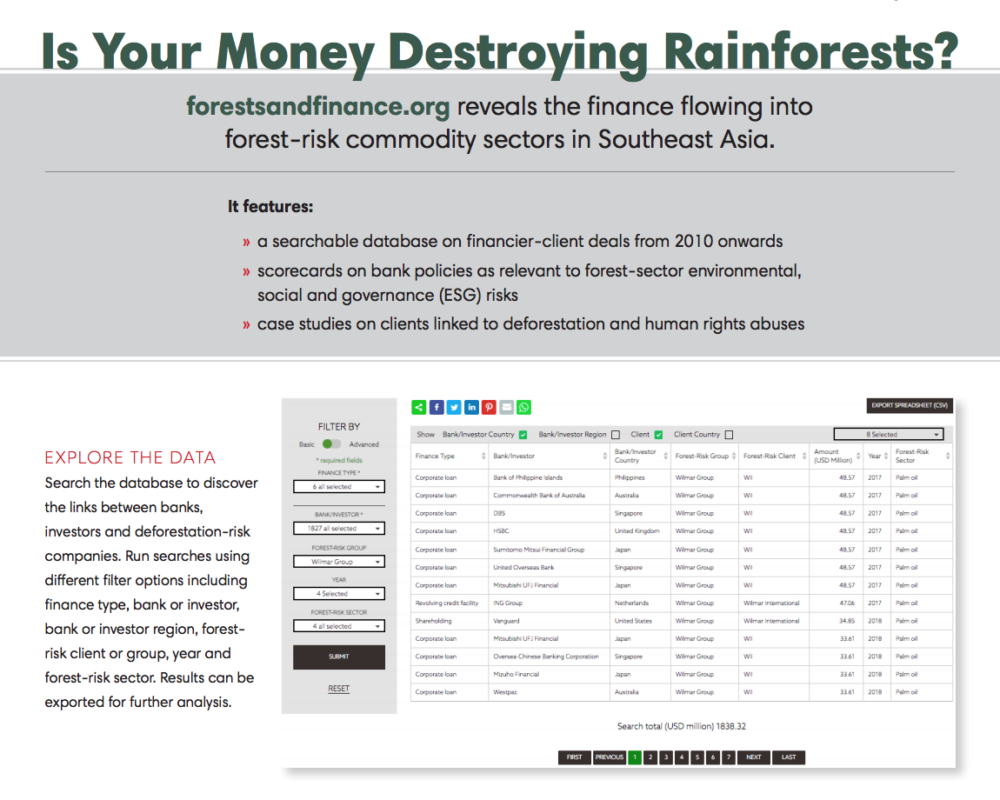

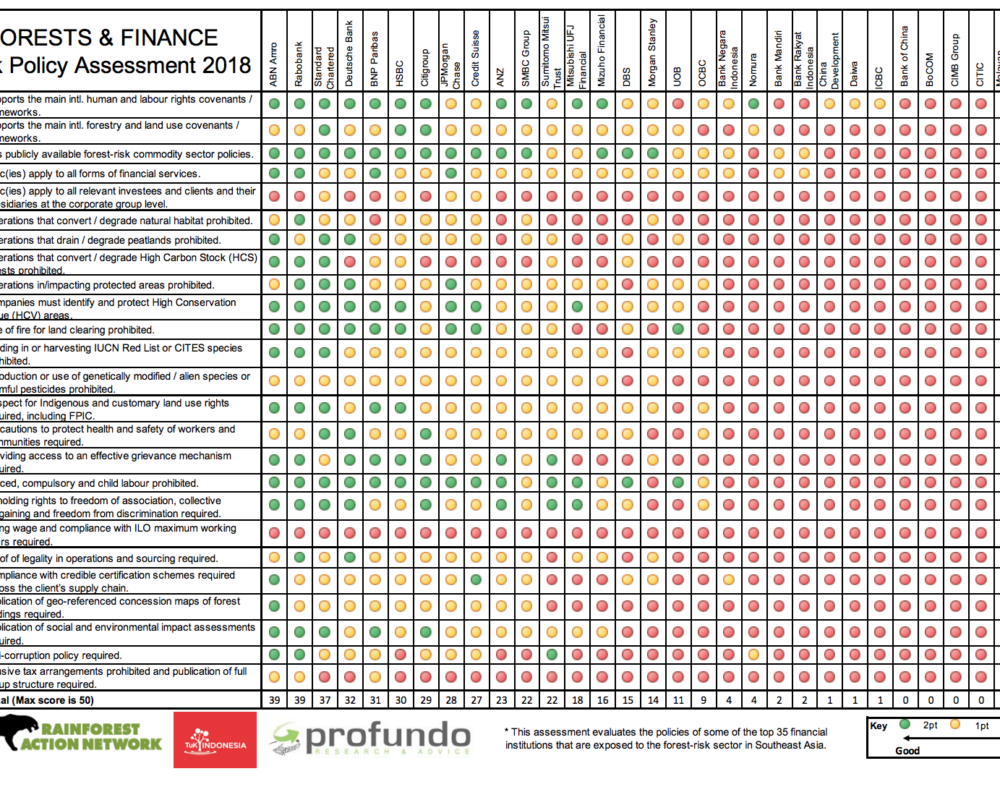

「森林と金融」データベース(forestsandfinance.org)は東南アジアの森林リスク産品セクターに流入する資金を明らかにするオンラインツールです。このブリーフィングペーパーは森林リスク産品セクターに存在するESGリスクと森林破壊に関与している金融・投資機関を紹介しています。(発行:2 0 2 0 年1月)

Explore Archives

発行物

「森林と金融」データベース(forestsandfinance.org)は東南アジアの森林リスク産品セクターに流入する資金を明らかにするオンラインツールです。このブリーフィングペーパーは森林リスク産品セクターに存在するESGリスクと森林破壊に関与している金融・投資機関を紹介しています。(発行:2 0 2 0 年1月)

発行物

A new report released by Rainforest Action Network, TuK Indonesia, WAHLI, Jikalahari and Profundo reviews the progress of Indonesia’s Sustainable Finance reforms over the past… Read More

発行物

Summary report released by Rainforest Action Network, TuK Indonesia, WAHLI, Jikalahari and Profundo reviews the progress of Indonesia’s Sustainable Finance reforms over the past 5… Read More

発行物

NGOから金融規制当局への手紙:東南アジアでの森林火災拡大について、2016年の煙害(ヘイズ)を引き起こした森林セクターの顧客企業への資金提供を銀行が中止するよう規制を求めた緊急制裁要請

発行物

「森林と金融」データベース(forestsandfinance.org)は東南アジアの森林リスク産品セクターに流入する資金を明らかにするオンラインツールです。このブリーフィングペーパーは森林リスク産品セクターに存在するESGリスクと森林破壊に関与している金融・投資機関を紹介しています。(発行:2019年)

発行物

発行物

発行物

Maybank is the world’s single largest financier of the palm oil sector – it provided 11% of all loans and underwriting to selected palm oil… Read More

発行物

One of the largest trading houses in Japan, Itochu is exposed to widespread social conflict and deforestation risks through its investments in rubber processing as well as trade with companies involved in illegal and unsustainable pulp & paper, timber, palm oil, and natural rubber productions. Itochu makes no commitment to no deforestation for its procurement of pulp & paper, timber, or rubber, and it lacks transparency on supply chain ESG risks and due diligence measures. Read More

発行物