最新記事&分析

Report: Major Indonesian palm oil supplier linked to illegal deforestation, land rights violations

Exposé from Friends of the Earth U.S. implicates many US consumer brands and investors in ongoing environmental and human rights abuses

A new report released today by Friends of the Earth U.S. and Friends of the Earth Indonesia (WALHI) found that Indonesia’s second largest palm oil company, Astra Agro Lestari (AAL), is responsible for longstanding land rights abuses and environmental destruction in operations undertaken without proper legal permits.

The investigation affirms the claims of local farmers, whose complaints trace back to 2005, that some 16,000 acres of their lands have been illegally occupied by three subsidiaries of Astra Agro Lestari. Local communities accuse the companies of violent land-grabbing abetted by Indonesian security forces, encroachment on legally protected forest areas, destruction of waterways and other abuses. None of the three companies have received the Free, Prior and Informed Consent (FPIC) of local communities to operate – a key requirement called for by the sustainability policies of many global consumer brands.

AAL, which supplies palm oil to leading consumer brands including Procter & Gamble, PepsiCo, Unilever and Danone and to major palm oil traders such as Archer Daniels Midland, Bunge and Cargill, has faced scrutiny over ongoing conflicts with local farmers in the provinces of Central and West Sulawesi, Indonesia. Friends of the Earth U.S. has raised allegations against AAL with Procter & Gamble repeatedly since 2020, but the company has yet to take clear steps to resolve the deep-seated land conflict.

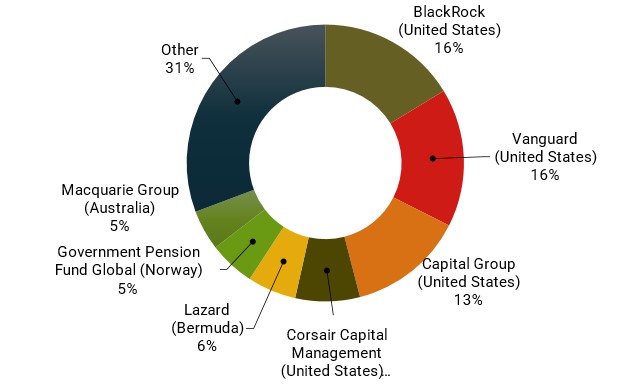

Astra Agro Lestari (IDX:AALI) is owned through complex financial structures by Astra International (IDX:ASII), which in turn is majority-owned by Jardine Matheson (LSEG:JARB, SGX:J36, BSX:JMHBD), a British conglomerate headquartered in Hong Kong and incorporated in Bermuda. After the majority holdings, AAL’s top three shareholders are US asset managers BlackRock, Vanguard and Capital Group.

Investors and financiers

The largest shareholders in AAL and its parent companies (Astra International, Jardine Matheson, Jardine Cycle & Carriage, and Jardine Strategic of the Jardine Matheson group) are U.S. asset managers BlackRock, Vanguard, and Capital Group.[i] As of November 2021, BlackRock and Vanguard each owned around $42 million (or 16%) of shares in the group of companies. Notably, while the Norwegian Government Pension Fund Global fund divested from AAL in 2011, it remains invested in AAL’s parent companies. At the time of publication, the Norwegian Government Pension Fund Global fund has Astra International “under observation because of the risk of the company being responsible for severe environmental damage.”[ii]

Forest-risk shareholdings in AAL and Jardine Matheson group companies (November 2021)

| Investor | Value (US$ mln) |

| BlackRock (United States) | 42.3 |

| Vanguard (United States) | 41.9 |

| Capital Group (United States) | 35.1 |

| Corsair Capital Management (United States) | 19.5 |

| Lazard (Bermuda) | 14.8 |

| Government Pension Fund Global (Norway) | 13.9 |

| Macquarie Group (Australia) | 12.2 |

| Other | 79.7 |

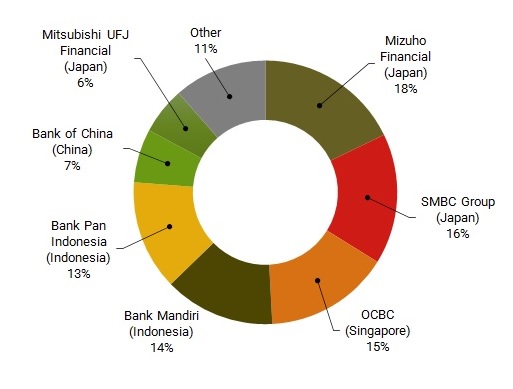

Forest-risk loans and underwriting services to AAL and Jardine Matheson group companies (September 2016-2021)

Banks providing loans and underwriting services to AAL and its parent companies include Japanese banks Mizuho Financial ($198.2 million) and SMBC Group ($178.3 million), Singaporean bank OCBC ($170.5 million), and Indonesian banks Bank Mandiri ($151 million) and Bank Pan Indonesia ($150 million). The Bank of China ($73.2 million) also provides substantial financial support to AAL and its parent companies.

| Creditor | Value (US$ mln.) |

| Mizuho Financial (Japan) | 198.2 |

| SMBC Group (Japan) | 178.3 |

| OCBC (Singapore) | 170.5 |

| Bank Mandiri (Indonesia) | 151.0 |

| Bank Pan Indonesia (Indonesia) | 150.0 |

| Bank of China (China) | 73.2 |

| Mitsubishi UFJ Financial (Japan) | 64.3 |

| Other | 127.0 |

“The abuses exposed in this report are business as usual for an industry predicated on violent land grabbing and fueled by illegal deforestation,” said Jeff Conant, Senior International Forests Program Manager with Friends of the Earth, one of the report’s authors. “The question is, what will brands like Procter & Gamble and investors like BlackRock do to remediate the damage caused by doing business with Astra Agro Lestari? When will they learn to disassociate themselves from companies that flout the law and systematically dispossess people of their lands and their rights?”

Local farmers have faced intense repression and human rights abuses resulting in numerous community members being criminalized for practicing their livelihoods on lands claimed by these companies. One especially vocal farmer has received death threats and been imprisoned on three separate occasions for his advocacy.

“For many years, Astra Group has been robbing people in Central and West Sulawesi of their livelihoods and generating structural poverty in the affected communities,” said Khairul Syahputra, Director of Advocacy, WALHI Central Sulawesi. “Today’s massive land conflicts between communities and Astra are the result of a cascade of business effects that began with land grabbing. Astra has used criminalization and intimidation as weapons to subdue the struggle of communities, which now seek the restoration of their rights. We demand that Astra return confiscated community lands, re-evaluate all the permits of its plantation subsidiaries, and stop criminalizing and threatening communities.”

[i] Shareholdings are adjusted to account for exposure to percentage of companies directly engaged in trade and production of forest-risk commodities.

[ii] https://lcbackerblog.blogspot.com/2015/10/indonesian-company-pt-astra.html