最新記事&分析

The Banks Fueling the Catastrophic Fires in Indonesia

Indonesia has yet again witnessed another year scarred by catastrophic fires that have caused immense damage and blanketed the country and its neighbours in a toxic haze. Once confined to drought years, fires are fast becoming the ‘new normal’ due to ongoing deforestation and degradation of peatlands. The fires are accelerating climate change, emitting an estimated 708 million tonnes of CO2 from January through November 2019, more than the annual output of global aviation industry.

This year’s fires blazed over 850,000 ha of land and forest, an area more than ten times the size of Singapore. Schools, airports and businesses closed, as six Indonesian provinces declared a State of Emergency. The haze has become a recurrent international environmental and public health crisis, described by President Jokowi as a “national embarrassment”. The United Nations warned that Indonesia was putting ten million children under five at risk from air pollution.

A recent study estimates that the fires in Riau, one of Indonesia’s worst hit provinces, have resulted in material losses of USD 3.6 billion (IDR 50 trillion). At a national level, the World Bank estimated that the fires in 2015 resulted in USD 16 billion (IDR 221 trillion) loss and damage nationwide.

The enforcement division of Indonesia’s Ministry of Environment and Forestry has sealed off and issued ‘stop-work’ orders for 83 palm oil, pulpwood and rubber plantations linked to this year’s fires. From this list, 17 corporate groups have been identified as parent companies, and includes major conglomerates with listed entities on the Jakarta, Kuala Lumpur and Singapore Stock Exchanges.

The names of the companies implicated in the fires include; Austindo, Batu Kawan, DSN, Cargill, Ganda, IOI group, Musim Mas, Provident Agro, Rajawali, Royal Golden Eagle, Salim, Sampoerna, Sinar Mas, Sime Darby and Tianjin Julong.

Financial data from forestandfinance.org shows that between January 2015 and August 2019, these 17 groups’ palm oil, pulp & paper, timber, and rubber divisions received at least USD 19.2 billion in corporate loans and underwriting facilities (likely a conservative estimate as the methodology does not capture all financing due to lack of transparency by financial sector). This figure illustrates the kind of leverage financial institutions could use to reform client operations, at a time where the Indonesian authorities are clearly struggling to prevent burning through enforcement and civil and/or criminal sanctions (a new report by RAN, TuK-Indonesia, Jikalahari, Walhi-Eknas and Profundo explores Indonesia’s existing efforts to promote sustainable finance in Indonesia).

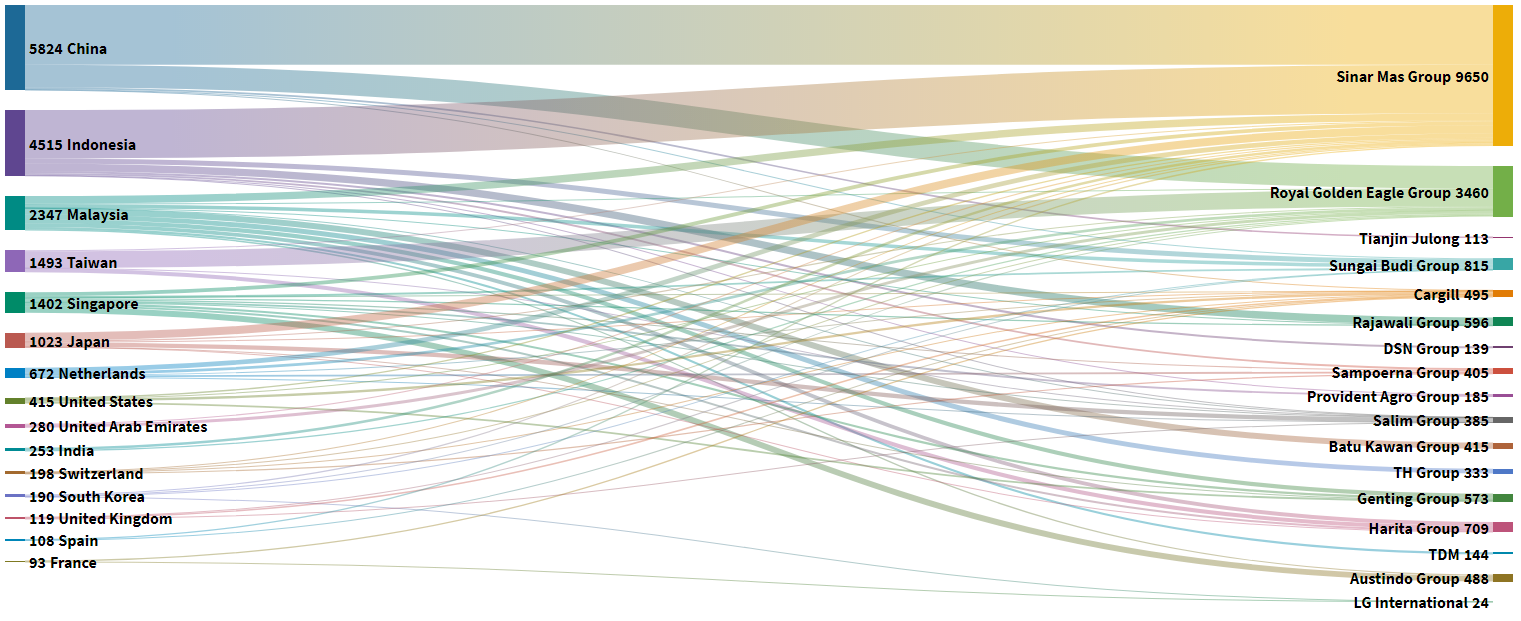

The data also reveals that, much like the haze itself, this is an international problem, with much of the finance coming from ASEAN and East Asian financial institutions. Banks from China represented the largest share of financing at USD 5.8 billion, followed by Indonesia at USD 4.5 billion, Malaysia at USD 2.3 billion, Taiwan at USD 1.5 billion, Singapore at USD 1.4 billion and Japan at USD 1.0 billion. Together these countries accounted for 86% of finance to fire-linked groups. Around 2% came from US banks and 6% from EU banks.

Recent investigations have shown that, while most plantation groups now talk the language of sustainability, and overtly have no-fire policies, several major groups are violating government regulations on peatland restoration, or have attempted to obscure their ownership and control of companies linked to fires.

Banks could use this leverage to ensure that clients are addressing fire and haze in their operations, by implementing robust ESG safeguards and building strong transparency and sustainability performance covenants into loans. Clients who fail to meet these standards should be denied the capital they need to operate and expand.

Below is some analysis of what the data indicates.

By country:

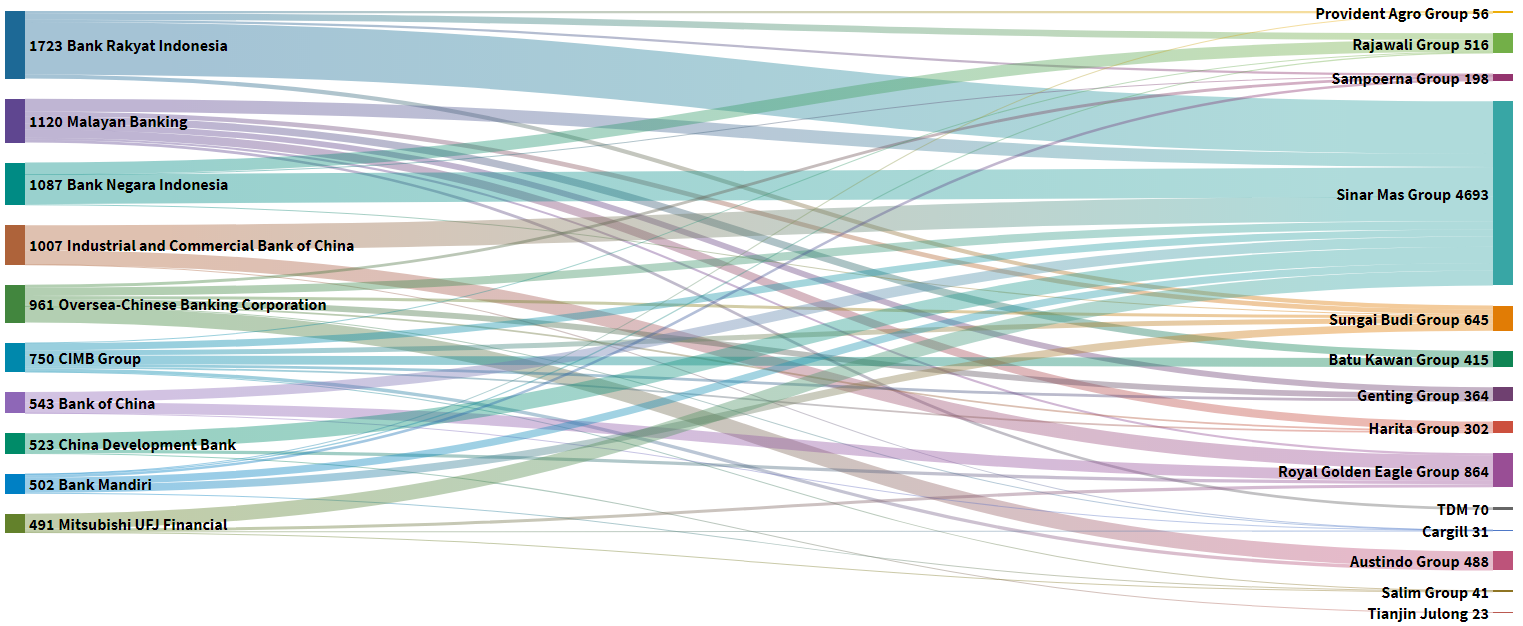

By bank:

By bank:

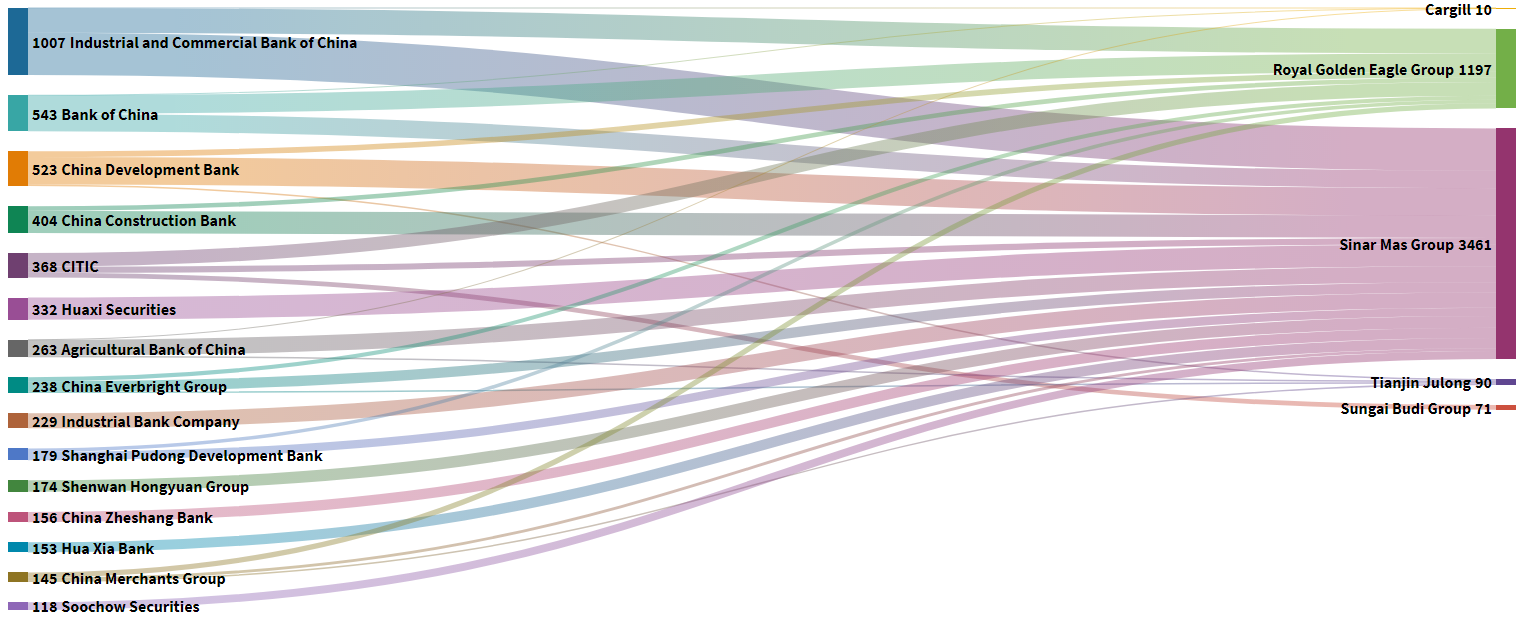

China

China

Chinese banks have provided more loans and underwriting services than Indonesian banks since the last devastating fires in 2015. The largest Chinese financiers overall are Industrial and Commercial Bank of China (ICBC) with USD 1 billion, Bank of China with USD 539 million and China Development Bank with USD 523 million. It is noteworthy that ICBC recently endorsed the Principles for Responsible Banking (PRB), thereby committing to align financing with the Paris Climate Agreement and Sustainable Development Goals. ICBC’s current financing is not aligned with the PRB.

China’s banks should be implementing standards set out in the Green Credit Guidelines, released by China’s Banking Regulator in 2012, requiring ESG integration into lending practices. These standards require enhanced due diligence measures to address risks and promote “climate-friendly” financing. As they apply to Chinese bank portfolios domestically and overseas, China’s leading role in financing the forest-risk clients implicated in the fires, raises serious questions over the implementation of these guidelines.

Chinese financing is largely directed to the pulp and paper divisions of Sinar Mas Group (SMG), known as Asia Pulp & Paper (APP), and Royal Golden Eagle (RGE) group, known as APRIL. Of the total Chinese financing of fire-implicated groups, approximately 70% went to SMG and 26% to RGE. Much of their pulp plantations have been developed by draining peatlands, and recent analysis by Greenpeace revealed that both groups’ concession land has burned every year since 2014. Field investigations in Riau Province have also revealed how both groups have failed to restore peat ecosystems after the devastating fires of 2015, and had in fact continued to replant the areas with industrial acacia, in violation of government regulation and increasing the risk of new peat fires.

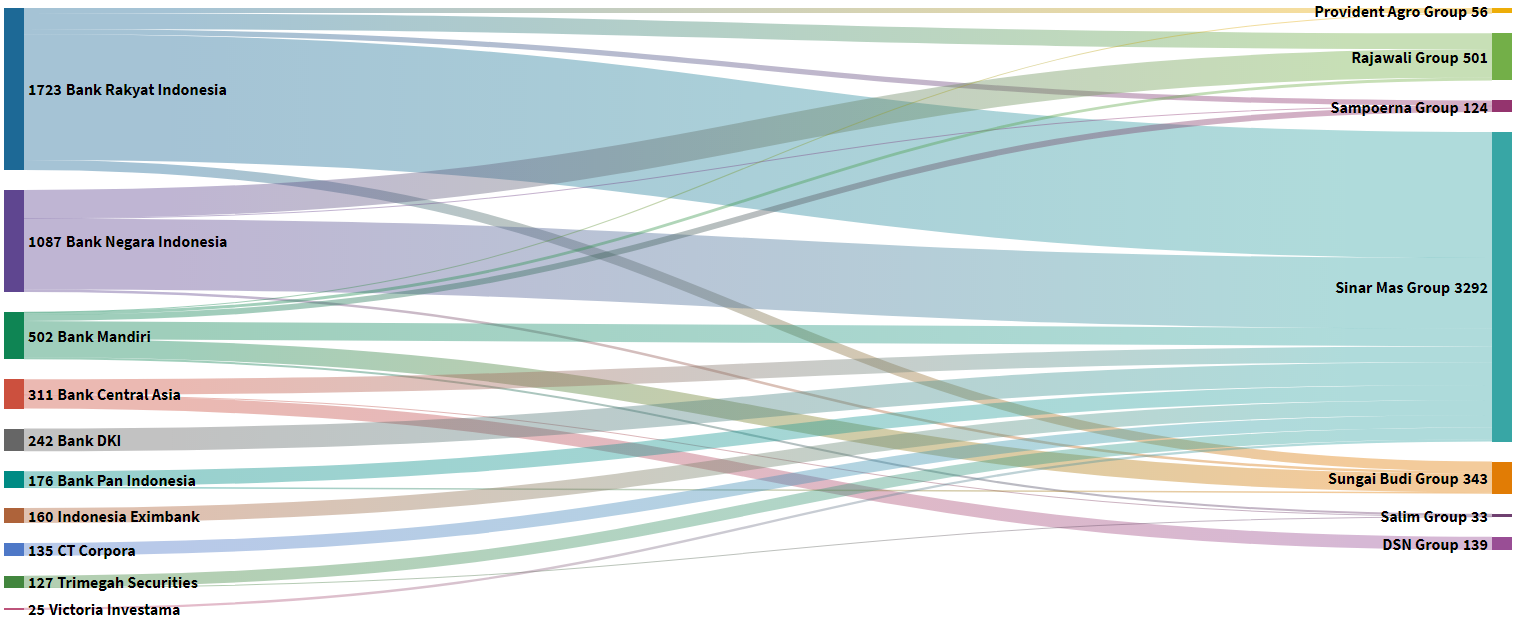

Indonesia

For Indonesian financial institutions, most financing to the fire-linked plantation groups has come from banks majority owned by the Indonesian state, Bank Rakyat Indonesia (IDX:BBRI), Bank Negara Indonesia (IDX:BBNI) and Bank Mandiri (IDX:BMRI). The three banks between them have provided USD 3.31 billion in financing. Indonesia’s financial regulator, OJK, introduced a landmark Sustainable Finance regulation in 2016, aimed at getting banks to identify and address Environmental, Social and Governance (ESG) risks in their lending portfolio. The fires and haze are a dramatic illustration of the huge risks prevalent in the lending practices of even majority state owned financial institutions.

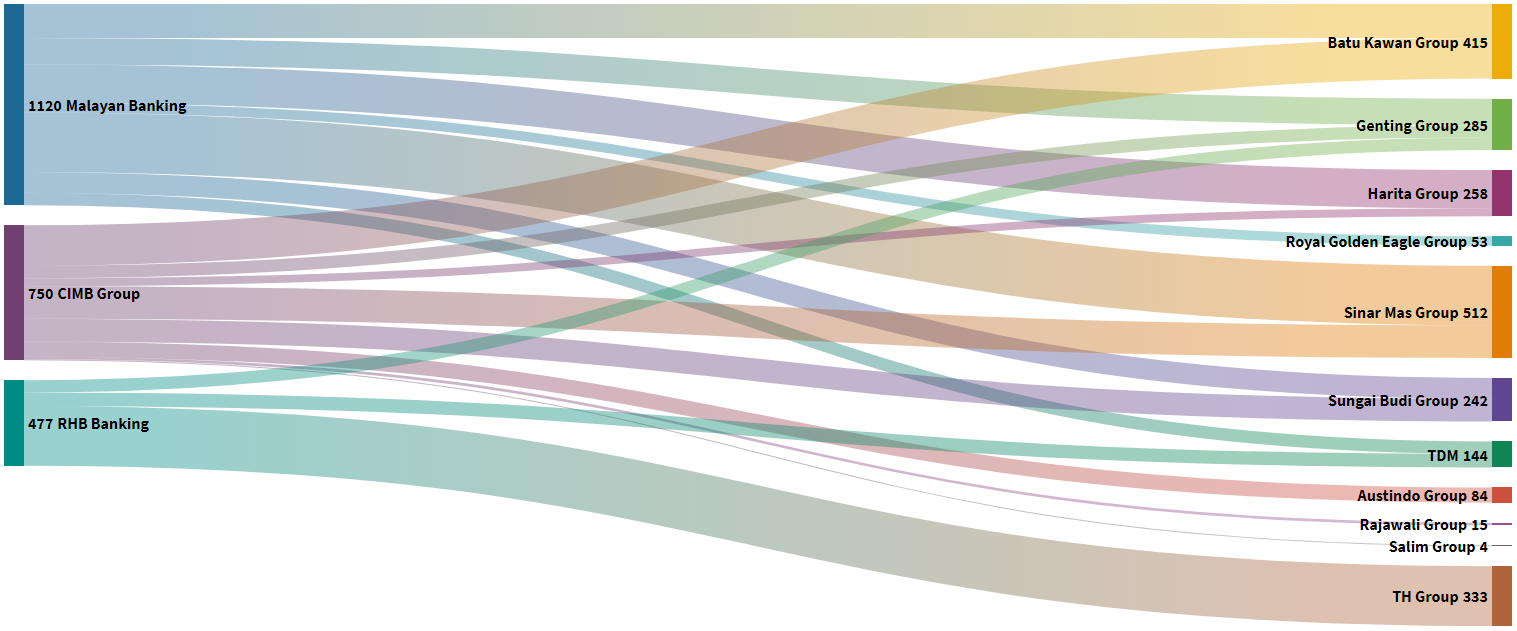

Malaysia

Malaysia’s Prime Minister Mahathir Mohammad recently lamented the limited recourse of the current international system to force Indonesia to act on fires. In response to the crisis, he also stated that the government will introduce a dedicated law to penalize Malaysian companies for burning plantations abroad.

KLHK data shows that subsidiaries of major Malaysian groups Genting (KLSE: GENTING), IOI Corporation (KLSE: IOICORP), TDM (KLSE:TDM) and Batu Kawan (KLSE:BKAWAN) are implicated in the fires.

However, new research reveals how Malaysia’s financial sector is perpetuating the crisis, and highlights the critical leverage it has to transform the behavior of errant companies. Malayan Banking (Maybank) is Malaysia’s largest bank with listed entities in Malaysia (KLSE:MAYBANK) and Indonesia (JSX:BBNI.JK). It the largest single global lender to the palm oil industry, and scores amongst the worst for its financing safeguards. Since 2015, Maybank has provided USD 1.12 billion in finance to the groups implicated in the 2019 fires. CIMB Group (KLSE:CIMB) provided almost USD 750 million finance to the fire-linked groups, despite also being a recent signatory to the PRB.

Taiwan

Major lenders from Taiwan include Fubon Financial Group with USD 321m, Tashin Financial Group with USD 163m and Cathay Financial with USD 148m. By far the largest recipient of finance from Taiwanese banks is Royal Golden Eagle with 1.2 billion, or around 77% of the identified Taiwanese financing to the fire-linked groups.

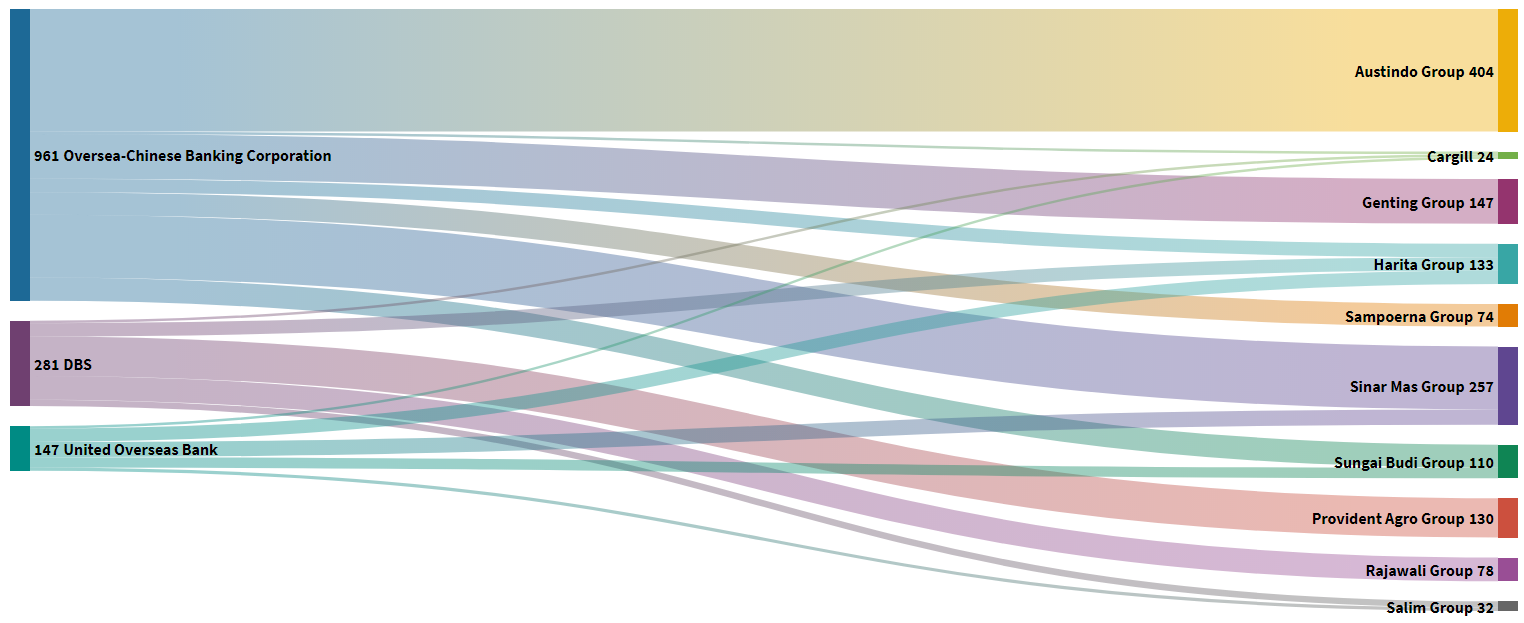

Singapore

The haze has become a major issue in Singapore, with prevailing winds from Sumatra blowing the haze to the city state, causing a widespread public health concern due to air quality. Many of the groups implicated in the fires -and the tycoon families that control them- have enormous assets in Singapore or have listed companies on the SGX stock exchange. This includes Sinar Mas, Salim, Royal Golden Eagle, Sampoerna and Genting.

In 2014, Singapore parliament passed the Transboundary Haze Pollution Act which imposes civil and criminal liability on companies domiciled or operating overseas but which cause or contribute to haze pollution in Singapore. While the government has repeatedly threatened to use the act against errant companies, it has not yet brought any such prosecutions or civil suits.

OCBC (SGX:039) is the fifth largest overall financier of the 17 groups linked to the 2019 fires, providing US 960 million in finance nearly all of which was for palm oil operations of Sinar Mas, Austindo Group, DSN Group and Sampoerna Group. While DBS (SGX:MU7) – whose largest shareholder is government fund Temasek Holdings – provided USD 281 million to palm oil groups Harita Group, LG International and Rajawali Group.

In 2017, The Association of Banks in Singapore (ABS) requires all members to manage haze and fire risks using ‘Haze Diagnostic Toolkit’ which sets out indicators of best practice. The strong links between Singapore financiers and fire-implicated companies calls into question whether this toolkit is effective in identifying and mitigating fire-risks.

Japan

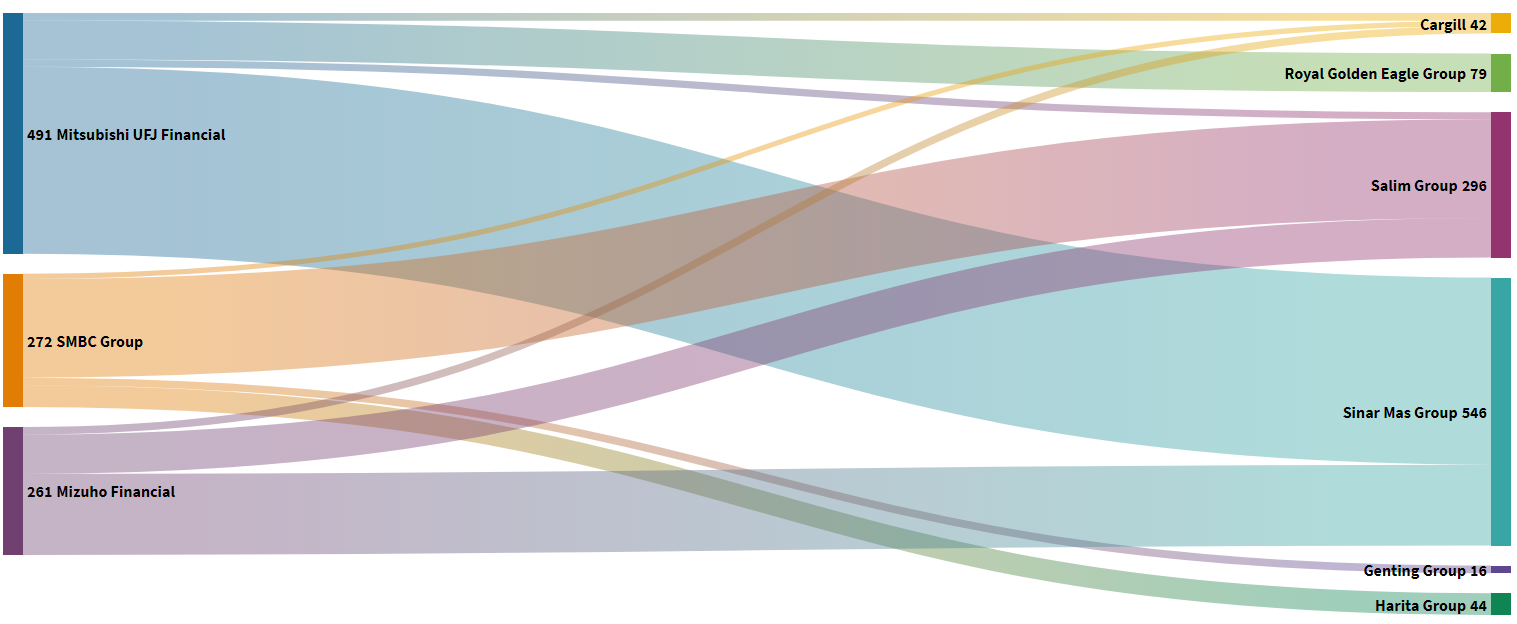

Japan’s megabank Mitsubishi UFJ Financial Group (MUFG, TYO:8306) is the tenth largest financier of the fire-linked companies with USD 491m, followed by SMBC Group (TYO:8316) with USD 272m and Mizuho Financial Group (TYO:8411) USD 261m.

Of particular note are the strong financial links between Japan’s three megabanks and high risk groups Sinar Mas, Salim and Royal Golden Eagle. All three banks recently adopted financing policies for palm oil and forestry sectors and have endorsed the PRB. However, their continued financing of high risk forest sector clients indicates significant shortcomings in both the strength and implementation of these policies. In particular, MUFG’s recent substantial financing of Sinar Mas and Royal Golden Eagle, despite both companies’ egregious ESG track record, suggest poor monitoring of their client’s ESG performance.