Actualités

Japan’s Largest Bank Targeted by Climate Resolution: Mitsubishi UFJ Financial Group told to align with Paris

Just a few days ago, Japanese NGO Kiko Network, with the support of Rainforest Action Network (RAN), 350.org Japan, and Market Forces, filed Japan’s second-ever climate resolution on a Japanese financial institution. Kiko Network targeted Mizuho Financial Group in 2020 and received 34% of shareholder support. This time, the target is Japan’s largest bank, Mitsubishi UFJ Financial Group (MUFG). The resolution was filed on March 26th and received by MUFG today.

As the 5th largest bank in the world by assets, MUFG has its financial tentacles all over the world, with major subsidiaries in multiple countries, including the US (Union Bank), Indonesia (PT Bank Danamon Tbk), and Thailand (Bank of Ayudhya). The problem is that MUFG is not using its money responsibly.

RAN’s Japan Representative Toyo Kawakami co-filed the resolution in his individual capacity, but RAN is fully backing this resolution given the significant role MUFG plays in fueling the climate crisis through both its financing of fossil fuels and deforestation (more details below). That’s why the resolution calls on MUFG to adopt and disclose a plan to align its financing and investments with the Paris Climate Agreement. One of the reasons given for the proposal is that “[MUFG] continues to provide significant finance to fossil fuel expansion and deforestation, which falls far short of aligning with the Paris Agreement goals.” This is likely the very first shareholder resolution on a bank that takes aim at both fossil fuel AND deforestation financing as a climate issue.

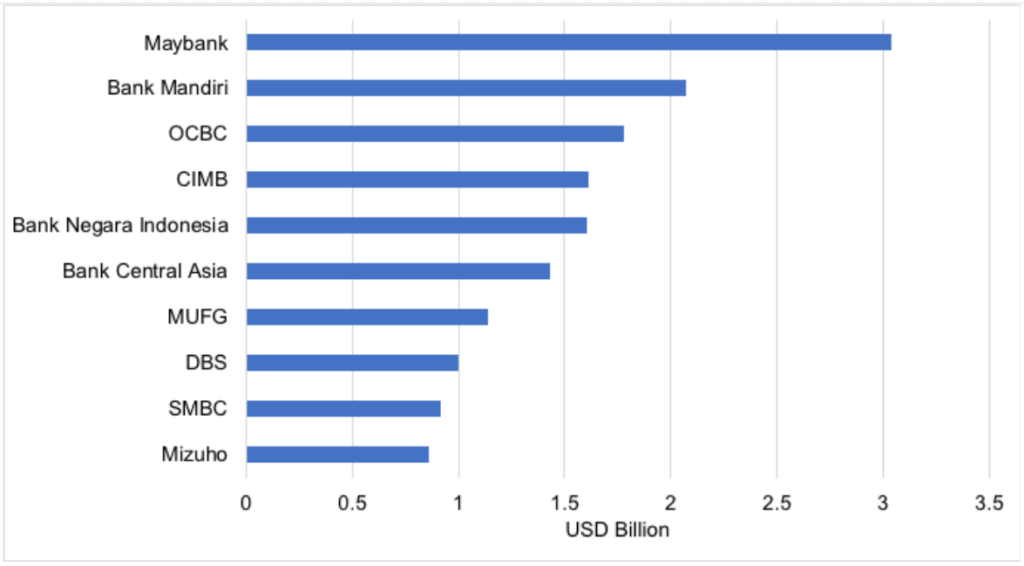

MUFG is a major funder of deforestation-linked companies

Based on Forests & Finance data, MUFG is one of the world’s leading bankers of companies driving rainforest destruction through the production and trade of commodities such as palm oil and pulp & paper. Between 2016 and April 2020, MUFG provided nearly US $3 billion in forest-risk financing to the production and trade of deforestation-linked commodities in Southeast Asia, Brazil, and parts of Africa. Over 60% of this went to Southeast Asia, with nearly US $1.2 billion to the palm oil sector alone between 2016-2019. In fact, MUFG is the largest financier of the palm oil sector headquartered outside Southeast Asia, ranking seventh globally.

Largest 10 Creditors of Palm Oil in Southeast Asia (Loans & Underwriting, 2016-2020 April)

Through this financing, MUFG is exposed to well documented ESG risks that include widespread deforestation, bribery, labor abuses and land rights violations. Several of MUFG’s clients, most notably Sinar Mas Group, have, over several years, been implicated in Indonesia’s catastrophic fires, which have made Indonesia one of the world’s largest greenhouse gas emitters.

Unfortunately, MUFG lacks the policies to properly deal with these risks, relying instead on weak certification mechanisms which have repeatedly proven to be ineffective. Not only that, MUFG excludes its Indonesian subsidiary Bank Danamon from its global financing policies, so-called Environmental and Social Policy Framework, despite Bank Danamon being one of the sources of finance to the Sinar Mas Group’s palm oil division led by Golden Agri-Resources. (Learn more by reading this White Paper)

Taking Action

To amplify the filing of this historic resolution, over 30 Indonesian civil society organisations are sending a letter to Indonesia’s financial regulator OJK on Friday, questioning MUFG’s decision to exclude its Indonesian subsidiary, Bank Danamon, from its global ESG policies. They are questioning whether MUFG is a responsible investor in Indonesia’s banking sector and flagging its highly concerning set of double standards that undermine the country’s aim to transition to a more sustainable, low carbon economy.

This resolution will be put to a vote in late June of this year, at MUFG’s annual shareholder meeting in Tokyo. By calling out MUFG’s deforestation financing and asking MUFG to “outline its business strategy, including metrics and short-, medium- and long-term targets, to align its financing and investments with the goals of the Paris Agreement,” the co-filers hope MUFG will strengthen its forest sector policies and adopt a No Deforestation, No Peat, No Exploitation (NDPE) policy for all forest-risk commodities. MUFG needs to then ensure it has the systems in place to ensure compliance across its entire financial group, including Bank Danamon.

Additional Resources:

Shareholder resolution filed with Mitsubishi UFJ Financial Group (Japanese PDF) (English PDF)

Investor Briefing: Shareholder resolution filed with MUFG (Japanese PDF) (English PDF)