Berita

Banks investing billions in Southeast Asian forest-risk sector despite ESG risks

Key findings

- Banks have provided USD 62B in corporate loans and underwriting services to forest-risk sector operations in Southeast Asia between 2013 and 2018.

- Companies receiving the largest amounts of finance include; Sinar Mas Group, Sinochem Group, Royal Golden Eagle Group, Oji Group and Wilmar Group.

- Forest-risk sector companies were supported by an additional USD 31B worth of bond and shareholdings as of July 2018 with the biggest investors from Malaysia, Japan, Singapore, USA, and the UK.

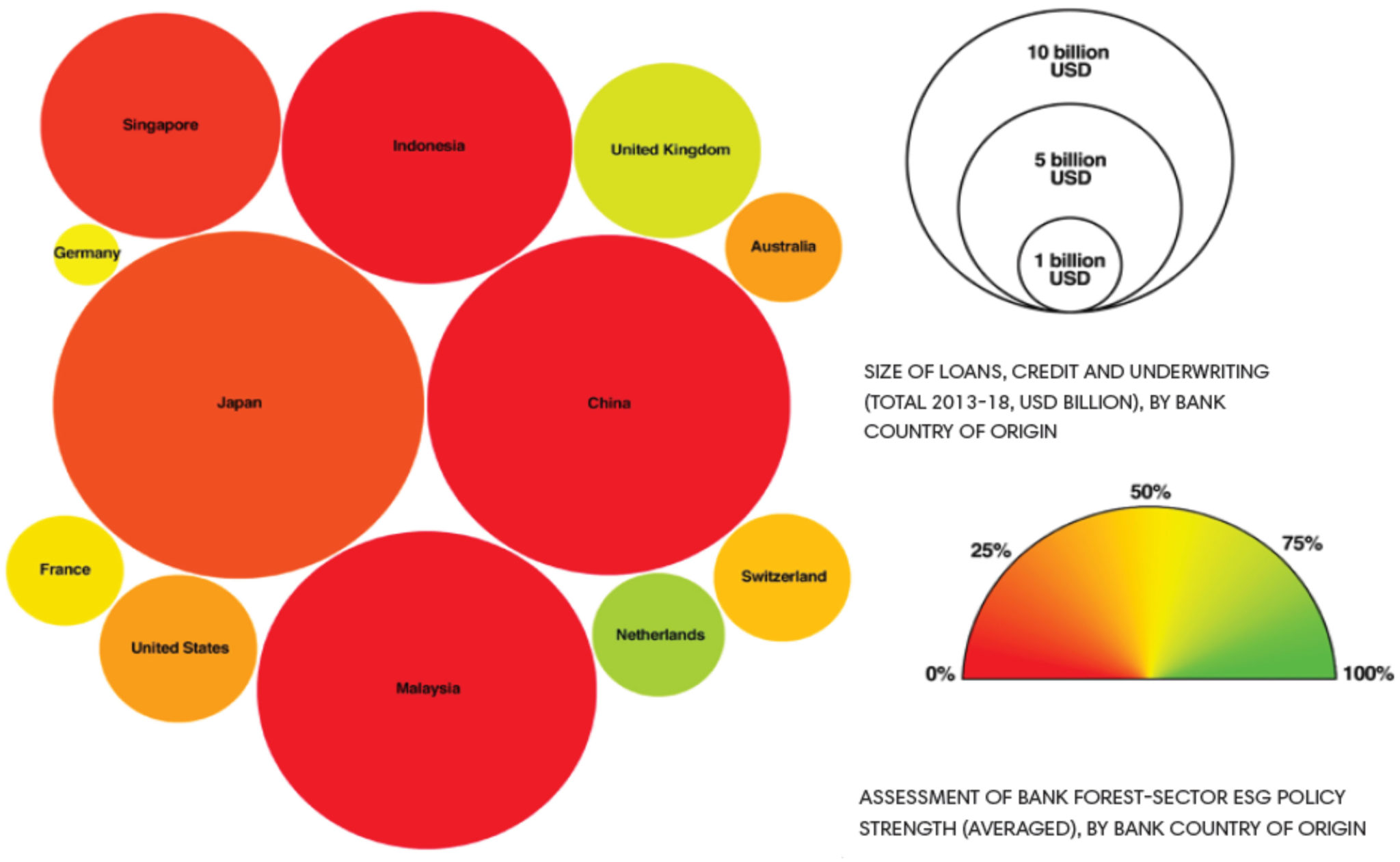

- Policy assessments of the top 30 financially exposed banks shows that ESG due diligence measures are noticeably absent in the banks with greatest exposure to forest-risk sector companies.

- The banks with the most financial exposure (2013-2018 June) and the lowest policy scores were headquartered in Malaysia, China, Japan and Indonesia.

Summary

Originally launched in September 2016, forestsandfinance.org provides an unrivalled transparency platform and searchable database revealing the banks and investors that are financing over a 100 companies impacting Southeast Asia’s tropical forests. The site has been updated to include financing amounts inclusive of 2018 and a detailed assessment of existing bank policy standards across a range of environmental, social and governance indicators, providing a comparison between forest-risk sector policies for over 30 of the largest banks.

forestsandfinance.org carried out a comprehensive assessment of the publicly available financing policies for the top 30 most financially exposed banks in order to determine their ability to manage Environmental, Social and Governance (ESG) risks in the forest-risk sector. Banks were scored against 25 criteria for a maximum score of 50 points; here the scores have been compiled into a useful comparative table.

The OECD Guidelines for Multinational Enterprises and the recent proposal for Principles for Responsible Banking, reinforce the fact that banks which provide financial services to companies with serious environmental and social sustainability concerns have a responsibility to identify and address adverse impacts related to their financing. The adoption of strong ESG financing policies is a critical component.

Our research reveals that such due diligence measures are noticeably absent in the banks with greatest exposure to forest risks from 2013-2018 June – Malaysian (USD 10B, average policy score 0%), Chinese (USD 11B, average policy score 1%), Japanese (USD 12B, average policy score 28%) and Indonesian (USD 8B, average policy score 4%). In contrast, the highest scoring banks include ABN Amro and Rabobank from the Netherlands and Standard Chartered from the U.K.

Since our last policy assessment in September 2016, some notable changes include the largest banks from Japan as well as DBS of Singapore. In particular, Japanese banks SMBC Group and Mizuho Financial Group adopted their first ever policies on the forest-risk sector, while Mitsubishi UFJ Financial Group, the largest bank in Japan, established clear prohibitions and restrictions to their financing which include mitigating impacts on Indigenous Peoples and High Conservation Value areas. This is significant given all three banks’ intentions to expand their business in Indonesia.

Forest-risk sector company spotlight

Below are three companies with business operations linked to devastating environmental and social impacts which are commonplace in the forest-risk commodity sector:

Wilmar Group

As the world’s biggest buyer and trader of palm oil products, Wilmar controls 43% of the global palm oil trade. Wilmar continues to face significant risk exposure to labor rights violations, unresolved land conflicts, illegal palm oil plantations, deforestation and high GHG emissions through its own operations, joint ventures, subsidiaries, associates and its extensive supply chain reach.

Despite Wilmar adopting a No Deforestation, No Peat, No Exploitation (NDPE) policy for all of its operations and third party suppliers in 2013, a recent report by Greenpeace exposed widespread noncompliance, especially in relation to its third party palm oil suppliers. Between 2015 and 2018 Wilmar received over USD 1.57B in corporate loans and underwriting, with DBS, Mitsubishi UFJ Financial, UOB, HSBC and SMBC Group most heavily financing.

In order to ascertain clients’ implementation of their own policies, banks should require their clients to publish mill location data and concession maps for their supply chain to prove their producers are compliant with all aspects of its NDPE policy.

Sumitomo Forestry

A major timber and building materials trading company in Japan, with forestry operations in Indonesia, Sumitomo Forestry has prominent creditors and underwriters, including Daiwa Securities, SMBC Group, Mizuho Financial Group, and Nomura Holdings, receiving almost USD 432M in the last three years. Its largest investor is the Government Pension Investment Fund of Japan (GPIF). Sumitomo Forestry is one of the largest buyers of tropical plywood from Indonesia and was recently exposed for purchasing substantial volumes of timber derived from rainforest conversion and likely illegal logging by notorious timber giant Korindo Group.

Bintulu Lumber Development (BLD)

In the first 9 months of 2018, Malaysian palm oil company BLD cleared 1,702 ha of peat and 1,307 ha of peat forest on its plantation in Sarawak, Malaysia according to a Chain Reaction Research briefing in October. Despite many of BLD’s downstream customers having (NDPE) policies, BLD products continue to appear in the supply chains of multiple traders and consumer goods companies, including AAK, ADM, Nestlé, Olam, IOI, Cargill, Louis Dreyfus Company, Lipsa and Reckitt Benckiser.

Since 2010 BLD has been financed predominantly by Malaysian financial institutions. RHB Banking and Maybank are its main financiers providing loans and underwriting of USD 69M in the past three years. Both these financial institutions scored 0 pt in the policy assessments which means they have no forest-risk sector policy and lack any ESG safeguards to adequately identify and address adverse impacts related to financing destructive companies like BLD.

For more information about forestsandfinance.org research, see our Methodology.